During our recent webinar on Investment, Risk, and Policy Insights in Carbon Markets Across the Global South, we received a range of thoughtful questions from participants. To continue the discussion and provide clarity on some of the key topics raised, we’ve compiled a summary of the Q&A below.

Didn't get the chance to join live? Watch the full webinar below:

Question:

"Could Fundi please further explain the weighted average price by continent?"

Answer:

The weighted average price reflects both the number of credits retired and their prices. For example, if 1,000 credits are retired at $2 and 10 at $50, the weighted average balances those to show a more accurate market price. We calculate this at different levels, methodology, sector, and continent, to represent real market activity. This approach also underpins our AlliedOffsets500 index, which tracks market sentiment across the 500 most active projects.

Question:

"Where do you see carbon prices for different types of projects? Avoidance projects seem to trade at low single dollar per ton Co2e, while removals can be 30-40 USD/Mt"

Answer:

Avoidance projects typically trade at the lower end, around $1-4 per ton, and in some countries even below $1. For example, Colombia’s carbon tax caps offset prices at roughly $6 per ton. In contrast, nature-based removals usually range from $25-45 per ton, while engineered removals like direct air capture (DAC) can exceed $100 per ton. We track these variations globally through our price agreements and data monitoring.

In our State of CDR Market Report 2025, we also recorded biochar on-registry issuances in the first half of 2025 at approximately 290 ktCO2e.

Question:

"Neelesh, in general how are the certifications of the MMV (CO2 storage verification) ensured with these offtake agreements?"

Answer:

Projects must be registered with reputable, market-accepted registries to ensure proper certification of monitoring, measurement, and verification (MMV). In addition, insurance providers factor in a project’s past performance, such as successful credit delivery, when pricing coverage for new projects, adding another layer of assurance for investors and offtakers.

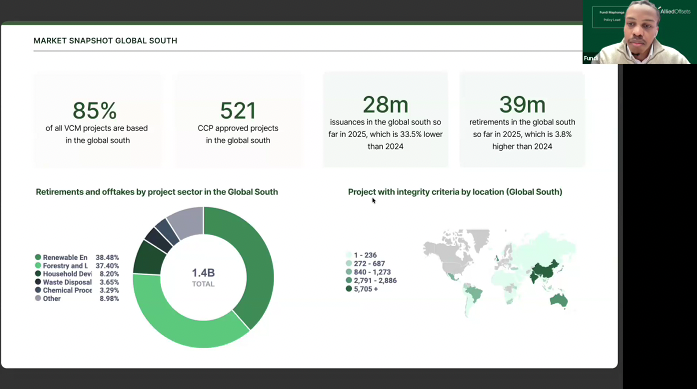

Carbon Market Snapshot Global South

Question:

"How is capacity building for local communities, smallholder farmers and/or IPs factored into such pre-financing agreements to ensure local people are truly project partners, beneficiaries, and co-implementers in such transactions?"

Answer:

We don’t handle project execution directly but focus on connecting credible projects with investors. Before marketing a project, we ensure key elements are in place, a draft PDD outlining design, an FPIC process confirming community engagement, a feasibility study estimating carbon outcomes, and ideally a small pilot. These steps help ensure local communities are genuinely involved and benefit from the project.

Question:

"What are the main barriers in terms of policy and regulation that would catalyse your ability to move finance at scale?"

Answer:

A key barrier is policy uncertainty, especially around project authorization, carbon rights, and credit ownership. Clear and consistent regulations, cooperative agreements between countries, and transparent rules on how credits are shared or applied toward national targets (NDCs) would give investors greater confidence and help unlock finance at scale.

If you’d like to dive deeper into the data and insights discussed during the session, you can download the full presentation slides below.