We’re excited to launch the Likelihood to Buy score, a new way to identify which companies are most likely to engage in the Voluntary Carbon Market (VCM) in the near future.

The score builds on AlliedOffsets’ unique dataset and modelling expertise, making the market more transparent and actionable for all stakeholders.

What is the Likelihood to Buy score?

The score covers -28,000 companies that have either been active in the VCM, are major publicly listed firms, or have been identified through our own research into large emitters. It reflects the probability of near-term buying activity, combining three key inputs:

-

Past market engagement

- Transacted in the past 12 months - Very High

- Transacted 12–24 months ago - High

- Transacted >24 months ago - Medium

-

Corporate commitments

- Near-term SBTi or CORSIA obligation - Very High

- SBTi/NZT commitment - High

- Other climate commitments feed into the model

-

Predictive modelling

- Built using XGBoost, incorporating company size, emissions, revenue, sector, HQ location, climate commitments, and more.

- Balanced training ensures fairness between buyers and non-buyers, with outputs adjusted using Bayes’ Rule to reflect real-world proportions.

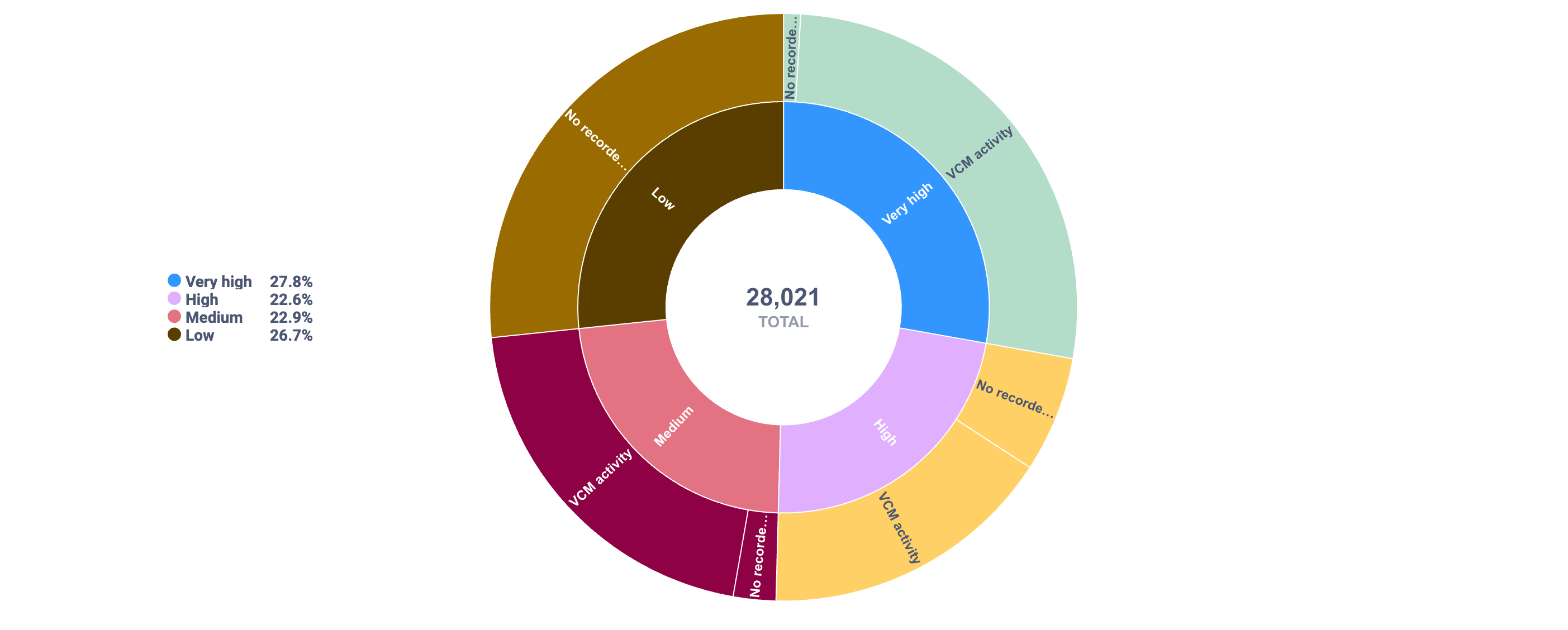

The result: every company is assigned a probability score, grouped into Very High, High, Medium, or Low likelihood to buy.

Distribution of Buyers by Likelihood to Engage in the Voluntary Carbon Market

How can you use the score?

The Likelihood to Buy score helps you:

-

Target effectively: Prioritise companies most likely to purchase credits soon.

-

Spot new opportunities: Identify firms that haven’t transacted yet but are highly likely to enter the market.

-

Benchmark markets: Compare buyer likelihood across regions and sectors.

For instance, we’ve identified 2,000+ companies with no previous transactions but a strong likelihood of entering the voluntary carbon markets.

Regional Breakdown of Likely New Buyers in the Voluntary Carbon Market

Sector Breakdown of Likely New Buyers in the Voluntary Carbon Market

Why it matters

The Likelihood to Buy score translates uncertainty into predictive insight, highlighting where future demand will come from. By combining commitments, past behavior, and predictive analytics, it helps stakeholders anticipate demand and make better decisions in a market that is steadily evolving and growing.

What’s next?

The score will evolve with the market. Each time we ingest new datasets into our Buyer Supplementary Data table, the model will be re-run to reflect the most up-to-date signals.

This ensures the market stays one step ahead, enabling smarter targeting, clearer benchmarking, and better visibility into the companies driving climate action.

If you’re curious to learn more, get in touch!