The carbon market has an important role to play in achieving global climate targets, but its trajectory depends on how supply and demand evolve over time. Understanding these dynamics is critical for market participants.

Forecasting helps buyers plan for when demand is likely to increase, supports developers in preparing future supply pipelines, and informs investors and policymakers about where capital and interventions are most needed.

By modelling supply and demand under different scenarios, AlliedOffsets forecasts provide clarity on how the market may develop.

When will the current oversupply end?

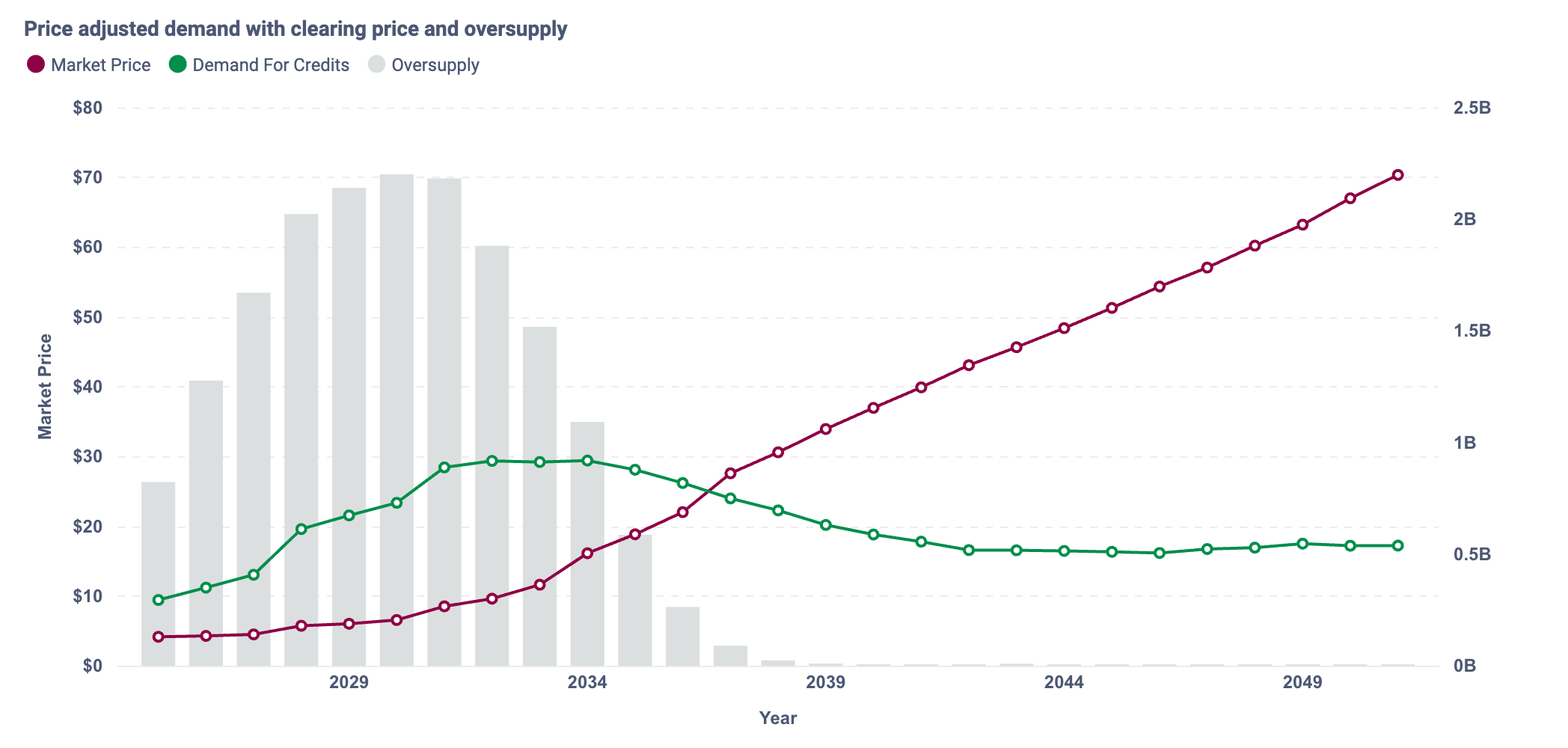

At present, the carbon market is characterised by a significant oversupply of older credits, particularly from lower quality projects. This surplus has held back demand growth.

This oversupply currently sits at over 1b tons - meaning that if projects issued no new credits, there would be enough supply in the market to meet demand for more than four years (AlliedOffsets Forecast report, 2025). The dampened demand and the high number of issued but not retired credits in the market today keep prices low, which only reach double digits in the late 2030s.

In our forecast report, we explore this oversupply problem in more detail and present some options to reduce it, either by increasing demand, retiring the oversupplied credits, or taking the credits out of the market. In the report, we also go into detail on how we factor in the oversupply issue in our forecast modelling, to ensure more accurate outputs in our scenarios.

Forecast: When Oversupply Ends and Prices Begin to Rise

How does supply meet demand over time?

AlliedOffsets' forecast shows that as older credits lose relevance and new projects take a larger role, supply and demand begin to align more closely. From the late 2020s onward, supply volumes grow steadily year on year, reflecting the increasing role of new supply in meeting rising demand.

Our medium scenario, compared to other models in the market, is fairly conservative. By 2040, we anticipate the market to reach only ~1b tons of credits in demand. Relative to CO2 projections, 1b tons is very likely to be less than 5% of global emissions.

What drives demand growth?

AlliedOffsets' forecast outputs suggest that demand grows steadily across all scenarios after year 2037.

In our medium growth scenario, annual demand reaches around 920 million tons of CO2 by 2035, while in the high scenario it rises to 1.3 billion tons of CO2 over the same time period.

Demand Scenarios for Carbon Credits: High, Medium and low

This growth is driven by several factors:

- Decarbonisation targets: Many companies are unlikely to meet SBTi and other net zero commitments through abatement alone. Offsetting part of their surplus emissions enables them to remain ‘on track’ toward their goals.

- Future compliance: Some companies, particularly in aviation, are already purchasing credits in preparation for schemes such as CORSIA.

Where will new supply come from?

AlliedOffsets forecasts show that while existing projects dominate supply today, their contribution plateaus over time. By the 2030s, the majority of volumes are expected to come from new projects. This underlines the importance of continued investment in project pipelines.

Why this matters?

AlliedOffsets’ carbon market forecasts provide market participants with a clearer view of how supply and demand may evolve, insights that can directly inform decision-making.

Forecasting for the carbon market can support:

- Buyers of credits needing a price projection for the market.

- Project developers looking to understand how demand and price for credits will evolve in the future, and what competing supply of credits may look like.

- Regulators, policymakers, and negotiators needing to understand volumes of credits under various scenarios.

By modelling a range of scenarios, the forecasts offer an evidence-based foundation for strategic planning. The model helps stakeholders navigate uncertainty, ensuring they’re able to make informed choices as the market evolves from oversupply to lasting growth.

Looking ahead

AlliedOffsets projections indicate that the carbon market is set to shift over the coming decades. In the short term, activity continues to be shaped by an oversupply of older credits, but further down the line growth will be driven by rising demand and the development of new projects.

By the 2040s, demand is projected to surpass 2 billion tons. Meeting this scale will depend on sustained investment in project pipelines and the ability of buyers, developers, and policymakers to plan effectively for future needs.

By modelling supply and demand under varying assumptions, forecasts outline possible market trajectories and highlight the factors likely to shape them.