Why forecasting matters for the carbon market

The carbon market is not only important to meeting global climate goals, it also provides a major economic opportunity. Understanding how jobs and revenue will grow over time is key for developers, investors, and policy makers planning for the future.

Forecasting allows us to look further than tons removed and focus on the wider impact of carbon offsets, the employment it will create and the economic value it will bring.

By modelling outcomes under low, medium, and high growth scenarios, AlliedOffsets forecasts provide insights into the revenue potential of the carbon market and how many jobs could be created globally - and where they will be concentrated in the future.

Employment Opportunities in the Carbon Market

AlliedOffsets medium growth scenario forecasts 476,239 new jobs will be created in Asia by 2040, making it the leading region for carbon offsets employment growth. Africa follows, with 106,257 jobs forecasted to be created.

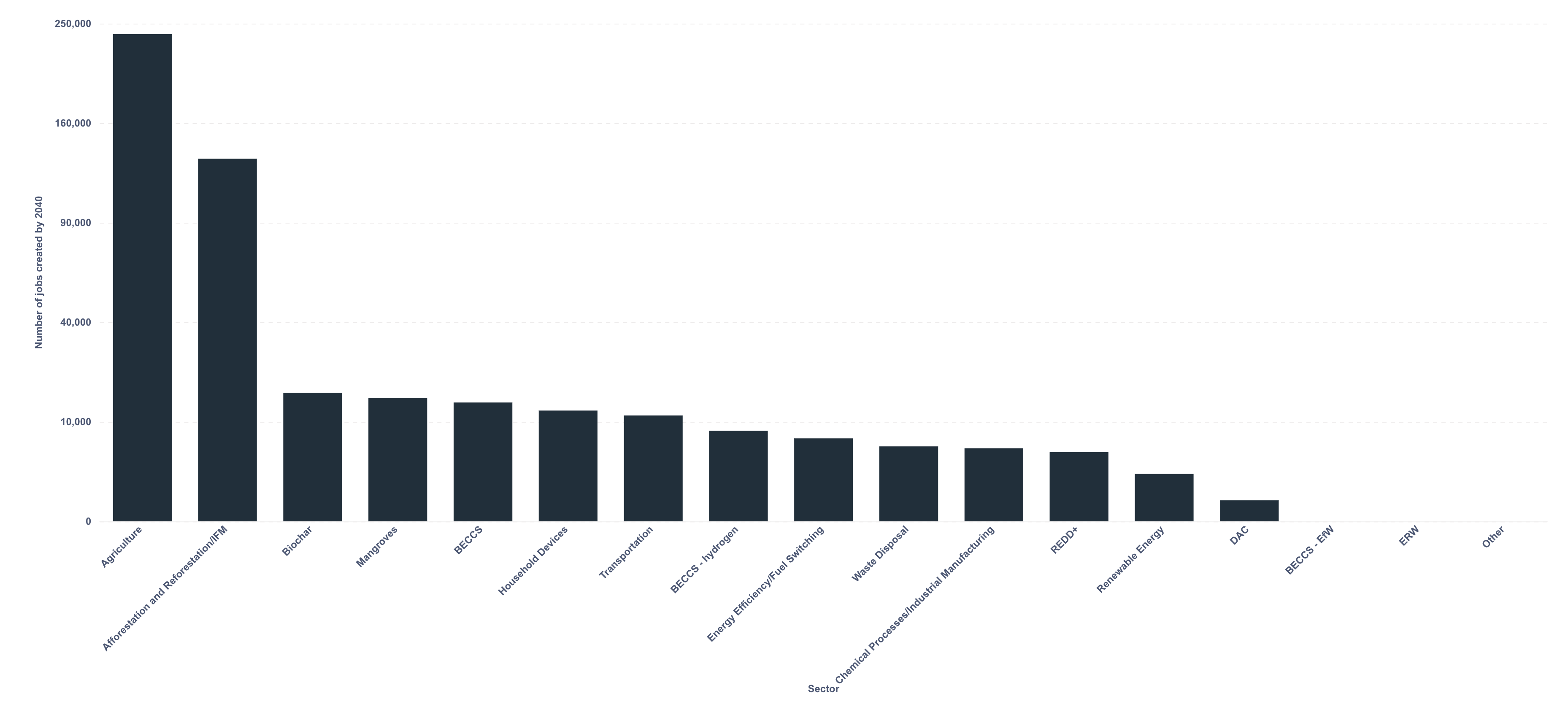

In Asia, the agriculture sector is expected to see the largest boost, with more than 239,661 jobs created, followed by afforestation and reforestation, which is projected to add 132,705 job opportunities by 2040.

Projected job creation by sector (Medium Growth Scenario)

To put this in perspective, our low growth scenario projects only 324,885 new job opportunities worldwide, while a high growth scenario could see more than 1 million new jobs created in Asia alone by 2040, highlighting the role carbon offsets can play in driving economic development.

Revenue Opportunities in the Voluntary Carbon Market

Building on forecasts for supply and demand across different credit types and geographies, the AlliedOffsets forecast model estimates the potential revenue opportunity for the voluntary carbon market globally.

Under the medium growth scenario, AlliedOffsets projects that the carbon market could generate $223.25 billion in revenue by 2040, driven primarily by afforestation and reforestation and agriculture projects.

Projected carbon market revenue by sector (Medium Growth Scenario)

When comparing growth scenarios, revenues remain relatively modest under AlliedOffsets low growth scenario case, around $105 billion by 2040, but rise sharply under the high growth scenario, reaching $503 billion in the same year. These projections show that carbon offsets are not only a climate imperative but also a major factor in unlocking future market value.

Looking ahead: What carbon market forecasts mean for the future

AlliedOffsets carbon market forecasts help market participants link carbon offsets with its broader economic impact, showing not just how much CO2 can be removed, but also the investment and job opportunities. These insights provide buyers, developers, and policymakers with a clearer view of how investment in the carbon market translates into growth.

By 2040, the voluntary carbon market could generate nearly $225 billion and create tens of thousands of job opportunities annually, with agriculture and afforestation and reforestation projects leading the way.