Explore AlliedOffsets’ latest project due diligence tool and example outputs.

As in any market, making informed decisions is critical for investors, project developers, and corporate buyers in the voluntary carbon market.

AlliedOffsets’ new Project Due Diligence Tool, will help users overcome some of the market uncertainties and support better decision making. This new tool provides a detailed, multi-dimensional view of project risks, performance metrics, and market reception to help stakeholders make smarter decisions.

Below we explore four key features of this new tool:

1. Project Delivery Risk

Understanding a project’s ability to meet its credit-generation targets is essential for assessing its reliability and long-term viability. This section of the tool evaluates:

- Credit Generation Track Record

How well is the project performing against its expected delivery? Are there observable risks impacting its credit issuance?

- Overestimation Risks

The tool highlights critical metrics such as:

- Ecoptima ratings

- Fractions of non-renewable biomass (fNRB) for cookstove projects

- Comparisons between project-specific and country-level deforestation baselines for REDD projects

- Scientific assessments from leading institutions like Max Planck Institute's Net Zero Lab

- These insights enable users to spot potential overestimations, ensuring realistic expectations for project outcomes.

- Reversal Risk and Buffer Details

Here we provide an overview and insights on project reversals and buffer adequacy.

2. Carbon Project Geospatial Performance

Harnessing satellite data and other geospatial analytics, this section offers a unique perspective on a project’s environmental impact and resilience:

- Annual Forest Loss: Track forest cover changes year-over-year.

- EVI (Enhanced Vegetation Index): Evaluate vegetation health over time.

- Annual Burned Area & Fire Risk: Assess fire activity trends and associated risks.

These geospatial indicators provide a data-driven view of how well projects align with their stated environmental goals.

3. Project Market Risk

A project’s market perception and financial viability are critical aspects of due diligence. In this section, the tool explores:

- Price Risk: How competitive are the project’s credit prices relative to market trends?

- Demand Risk: Are the credits quickly retired? Do they align with compliance eligibility standards?

- Project Ratings

Gain insights from leading ratings agencies, including:

- BeZero

- Sylvera

- Renoster

- CCP Likelihood

- Supply Risk

- Quarterly issuance trends for the project’s sub-sector

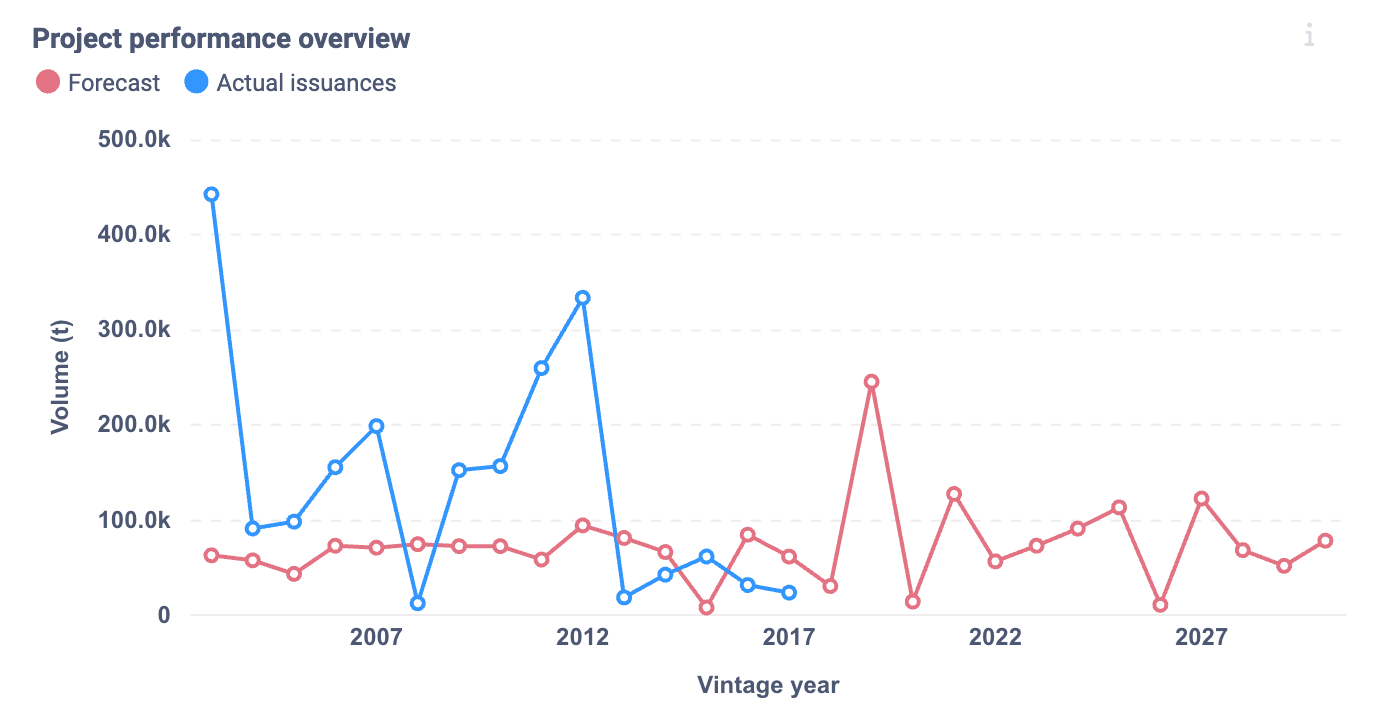

- The project’s share of its projected issuances

4. Project Origination: Country-Level Insights

A project’s success can be tied to the regulatory and economic environment of its host country.

Our tool offers a comprehensive overview of country-level data, including:

Regulatory Support

- Is there an enforceable climate framework law?

- Does the country provide clear Article 6 definitions?

- Have LoAs been awarded for the project?

Country Project Activity Overview

- Compare retirement and liquidity trends between the country and global averages.

Investment Risks

- OECD risk classifications

- Political risk scores

The VCM Due Diligence Tool is your ultimate resource for navigating project complexities, mitigating risks, and unlocking new opportunities in the carbon market. Want to take a closer look? Speak to our team to set up a free trial of the tool!

Coming Soon: News Alerts Function

Stay ahead of market developments with real-time news alerts for your projects of interest. But more on this soon… 👀