AlliedOffsets is excited to launch its Biochar Price Index! The index can serve as a reference for buyers, intermediaries, and project developers who are interested in the fledgling biochar carbon market.

The voluntary carbon market often lacks price transparency, especially for biochar credits. This is because biochar credits are relatively new and still rare compared to other types of credits. As a result, they appear less frequently in brokers' portfolios and online marketplaces.

The Biochar Price Index: A Tool for Transparency

In order to encourage transparency in the market, AlliedOffsets has launched the Biochar Price Index, a weekly measurement of prices for biochar credits in the market.

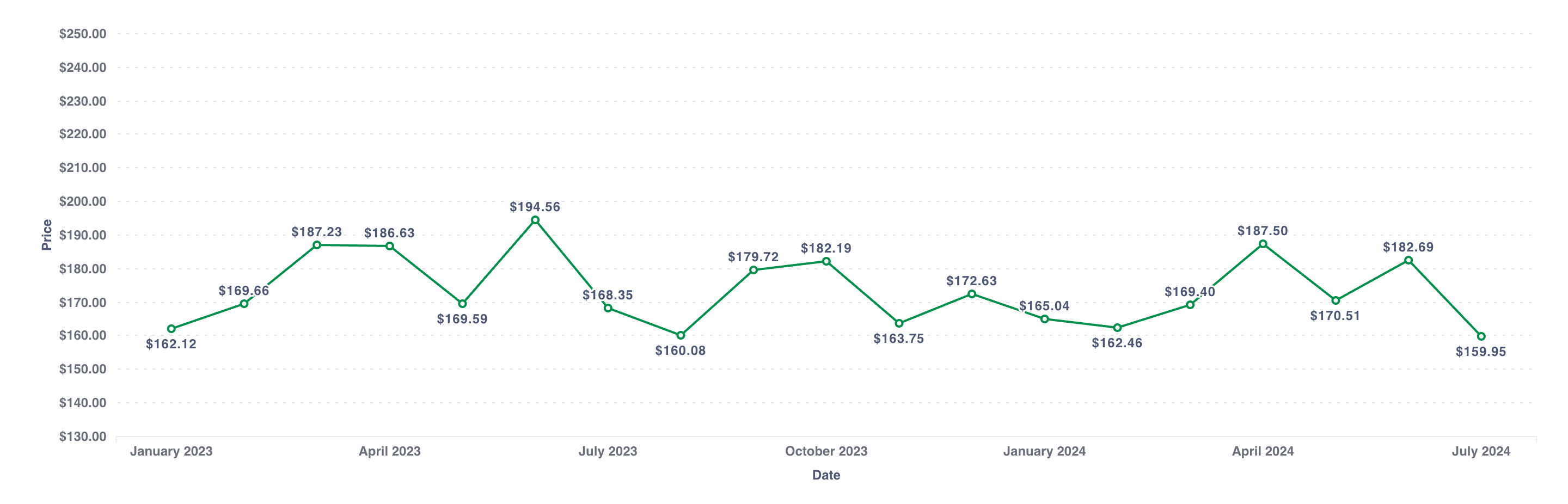

The data below shows the price progression on a monthly basis, with prices falling below $160/ton in July.

Subscribers to our dashboard can view the data on a weekly basis; we also publish the weekly index via Carbon Pulse.

Data Sources for the Biochar Price Index

The index combines two sources of data:

1. Puro Retirements: For the first component, we take a weighted average of the price of credits that are retired on Puro, for projects where the prices are known to us. Prices can come from the Puro CORC listings, which had included public prices until very recently, or from our own data on biochar project prices (this generally comes from disclosed purchases, or survey data).2. CHAR Index: CHAR is a token developed by Toucan, with the underlying assets coming from five biochar projects listed on Puro. We have been tracking this price since April this year, following the token’s launch at the end of February. CHAR has recently seen a large increase in activity, with roughly $80,000 worth of trades coming in the past month.

Future Developments

As biochar credits become more prevalent in the market, we’ll add new sources of data to the index. For now, we hope it’s a useful benchmark for industry stakeholders who are looking to get an up-to-date price of how the credits are priced.