It’s been a bumpy start to the year for the voluntary carbon market (VCM), with a stream of negative headlines leading to high-profile soul searching from some of the industry’s biggest players. Forestry credits have been especially maligned, with one firm even having its registry account suspended following an unflattering expose.

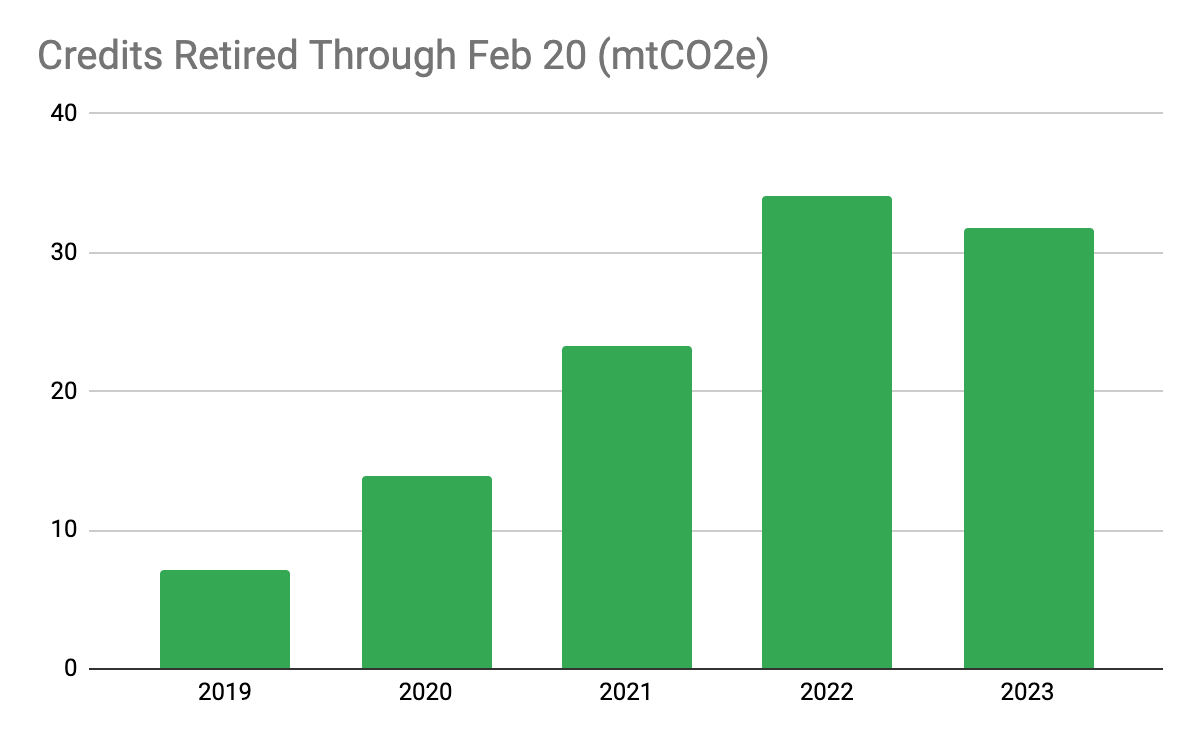

Despite the gloomy narrative, however, retirement activity has generally kept pace with last year’s numbers: retirements are down just 6% vs. same time period last year. As of February 20th, retirements in the market have reached nearly 32m; at this point in 2022, retirements had been 34m.

Forestry retirements are actually up by 21% overall, and Verra’s forestry projects have retired 26% more than through start of 2023.

The two American registries, ACR and CAR, are off to an especially hot start, with projects registered with them retiring over 4m tCO2e already. In 2022, projects from the two had retired a total of 11m out of 205m credits retired in the market.

At the start of 2023, we projected the market to grow by 20% in 2023, with the 95% confidence interval showing a growth of -8% to 53%. As of today, we’re lowering the projection to an expected growth of 12%, with a lowered 95% confidence interval showing -13% to 41% growth in 2023.

The relative robustness of retirement activity may be due to falling prices in the market: as credits get less expensive, they may be more appealing to buyers. There are also a number of retirements made in the start of the year for the previous year’s emissions, meaning that many companies had committed to offsetting their emissions prior to the negative media coverage.

Subscribers to our data can view the latest data in more details by signing into their dashboard; those who haven’t subscribed can see a demo of the platform here.