November 2025 delivered a mixed month for the carbon removal market: offtakes slowed sharply, yet capital investment, issuances, and retirements all climbed. Biomass-based pathways dominated activity across supply and demand, while policy developments in Europe continued to shape long-term market expectations.

- Offtake: 196,450 credits across 4 deals (MoM -56%).

- Investment: $133 Million (MoM +101%).

- Issuance: 111,482 credits (MoM + 25%).

- Retirements: 51,190 credits (MoM +184%).

In short, offtake activity cooled, while issuance and retirements rose - though retirements still remain below issuance.

Offtake

Total volume: 196,450 credits | Deals: 4

- Frontier × Reverion signed an offtake for 96,000 credits via BECCS.

- Frontier × Graphyte signed a pre-purchase for 450 credits via biomass direct storage.

- Boeing × Charm Industrial agreed an offtake for 100,000 credits from biomass-derived bio-oil sequestration.

IMC × Sirona Technologies purchased DAC (volume undisclosed)

November was quiet versus October, with only four announced tech-CDR offtakes. Deal mix skewed toward biomass-based removals.

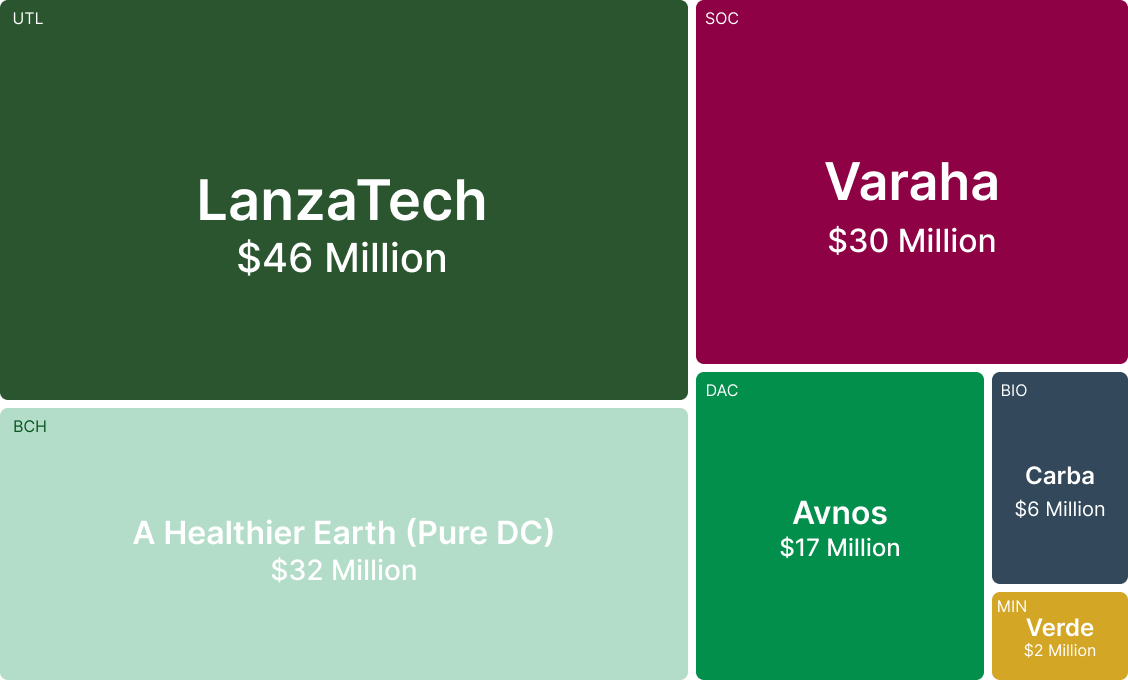

Investment

Total capital: $133 Million (MoM +101%).

Issuance

Total issued: 111,482 credits (MoM + 25%)

Pathway mix: ~100% biomass-based CDR this month.

Top issuer: Net-Zero Richardton (Gevo) BECCS.

This month saw an increase in issuance by 25% MoM, Issuance growth reflects biomass pipeline momentum; tech issuance outside biomass-based CDR remains thin.

Retirements

Total retired: 51,190 credits (MoM +184%).

Retirements / Issuance ratio: 46%, retirements still lagging new supply.

Policy

- Germany’s 2026 federal budget was approved with a multi-year €476M commitment to CDR (2026–2033), including funding for scaling projects and purchasing removals

- SBTi draft Corporate Net-Zero Standard (V2) proposes a clearer CDR framework focused on long-term residual emissions, but stops short of mandating specific CDR volumes.

Learn more about CDR pathways and market mechanics in our CDR FAQ here.