This week, the big news in the voluntary carbon market is the provisional launch of the VCMI’s Code of Practice, aiming to guide companies in how to best offset emissions to minimize the chance of greenwashing.

The Code is admirable in its goals, as it encourages companies to be transparent about what emissions they are offsetting, how many tons, and with which projects. If successful, this will help demystify the market and make clearer which projects are associated with which firms. But what about the hundreds of millions of tons of carbon that have been retired over the past ~13 years?

To help answer this question, we have aggregated data from 10 registries, nearly 20,000 projects, and over 250,000 retirement transactions. The aim is to turn messy, human-input data into consolidated, actionable insights that can help the market understand what credits have been offset by which firms.

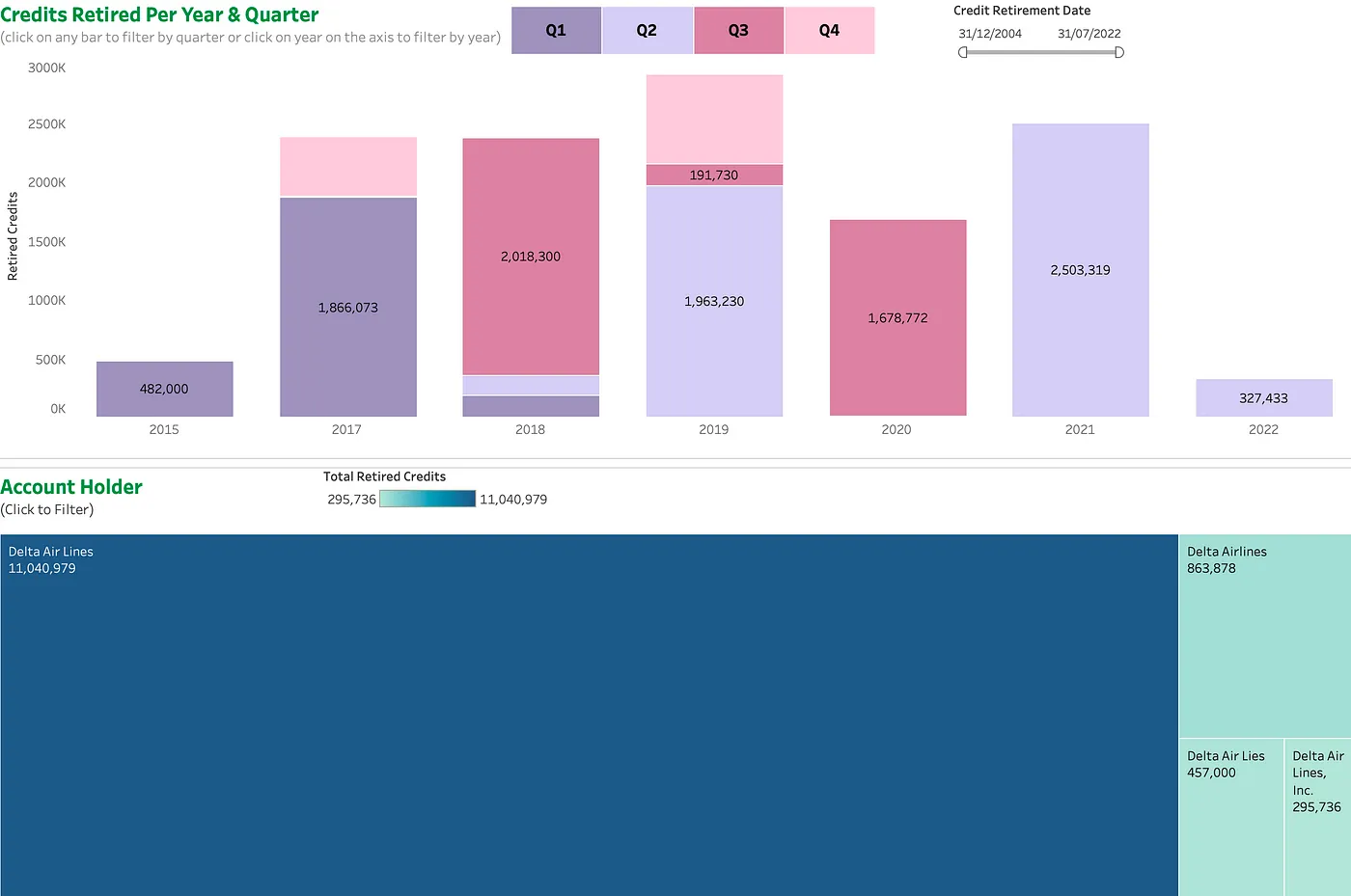

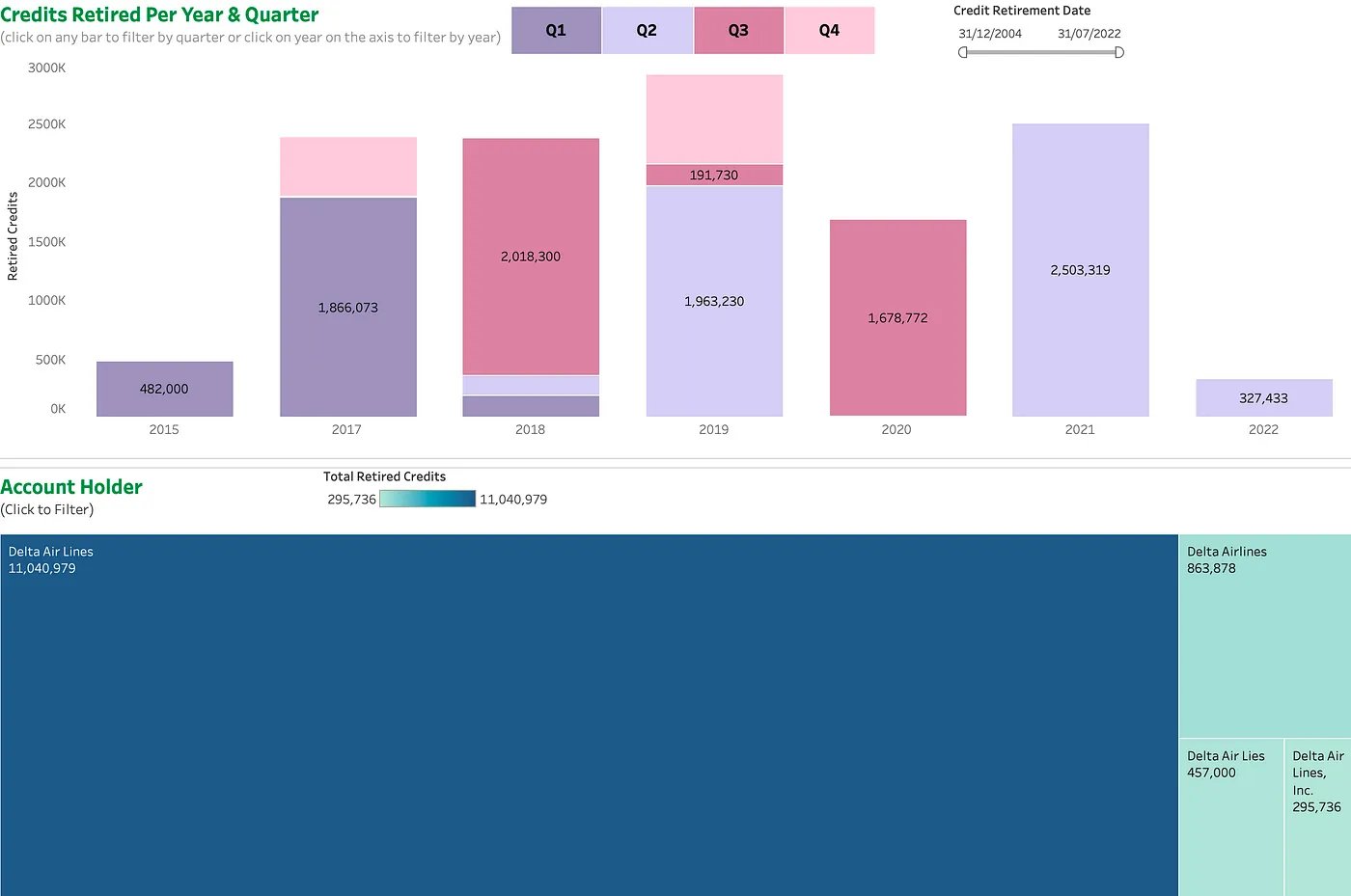

This may seem like a trifle, but it isn’t: companies have been extremely inconsistent in labelling retirements, even when a retirement is not conducted through a broker. For example, Delta Airlines has four accounts that have offset ~300,000 or more credits over the past 7 years: Delta Air Lines, Delta Airlines, Delta Air Lines, Inc., and (the unfortunately-named) Delta Air Lies.

This doesn’t include 16 other account names we’ve associated with Delta Airlines, which have collectively retired millions of tons of carbon. Simply stated, without consolidating this data, it’s impossible to compare corporate claims with retirement activity.

In order to help solve this issue, we’ve been working to aggregate data across thousands of retirements in order to create a definitive list of transactions for each company with a significant track record of retiring credits. To date, we’ve done this for over 600 companies, representing over 200m tCO2e in retirements (just over 25% of total credits retired since 2009).

At this stage, we’re working closely with some of these firms in order to fill gaps in the data available via the registries. This means both appropriately tagging transactions that have taken place via a broker, as well as identifying which anonymous transactions should be attributed to which company. For example, while EasyJet claims retirements via EcoAct of the Bale Mountains forestry project in Ethiopia, there is no mention of either EcoAct or EasyJet on the Verra retirement page for the project. We’re now actively tagging these transactions to reflect the companies’ stated activities.

Behind the scenes, we’ve found this to be a difficult task to automate. Given the number of total offsetting transactions across the registries, there are many entries that seem relevant, but aren’t. For instance, retirements made by Delta Energy tend to be picked up by fuzzy matching as an entry for Delta Airlines. But, by manually tagging thousands of transactions, we’ve created a training set that will allow us to run basic NLP to more accurately tag retirements going forward. In other words, as new retirements take place, we’ll be able to associate them with the appropriate company.

All this will make it easier to understand what firms are retiring which credits, and how they stack up against an increasing number of codes and best practice guidelines for carbon offsetting.

We’ll share more in the coming days, but in the meantime, if you’re a company that wants to verify your emissions reductions as they compare to your stated goals, please reach out to hello@alliedoffsets.com.