Following our latest article on Aggregating Corporate Data on Carbon Offsetting, we’re excited to zoom into the corporates’ retirement data even further. This article begins a series of snapshots highlighting data on the buyers of credits. As we unveil ways to analyze firms, we will crystallize the snapshots into a comprehensive rating of corporates’ efforts in the carbon offsetting space.

One way to evaluate companies is to look at the value of price of offsets they have retired. We arrived at these numbers by summing up the prices of projects purchased by a company and weighing them against the number of credits purchased from each project. We used our price estimates for retired credits (these values can change as data available is updated and prices change).

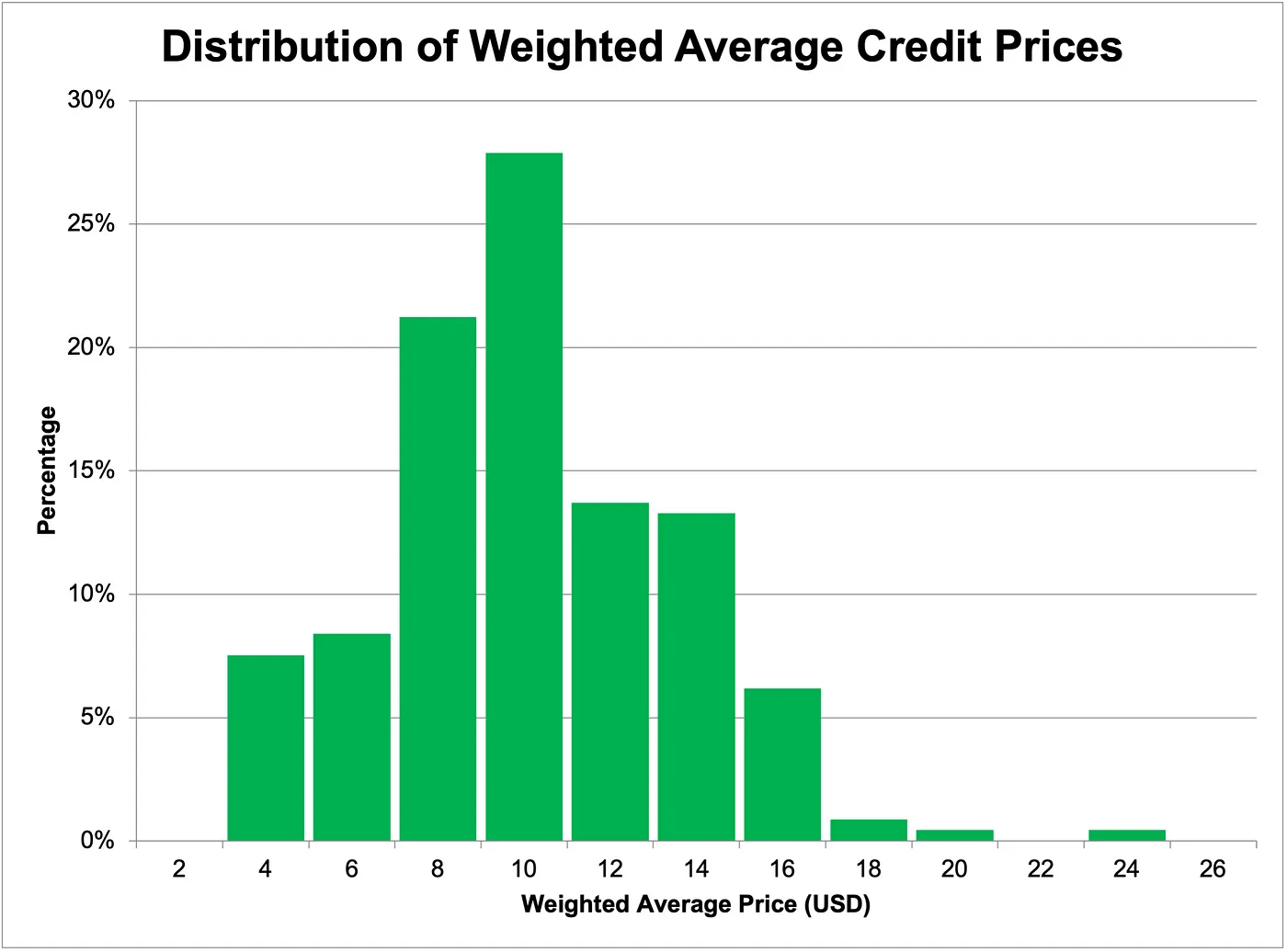

For this analysis, we have limited the sample to companies listed on our dashboard that have retired more than 20,000 carbon credits — this ends up being over 200 corporates. We matched over 250 million retired credits, whose offset price ranges from $2.17 to $23.36 (see the distribution of prices on the graph below), with an average of $9.24 per credit and 3,825,185 retired credits. The price estimates for credits come from our pricing model, which powers individual projects’ prices, as well as our price indices. To be clear, the data shows the current estimate of credits, if they were purchased today.

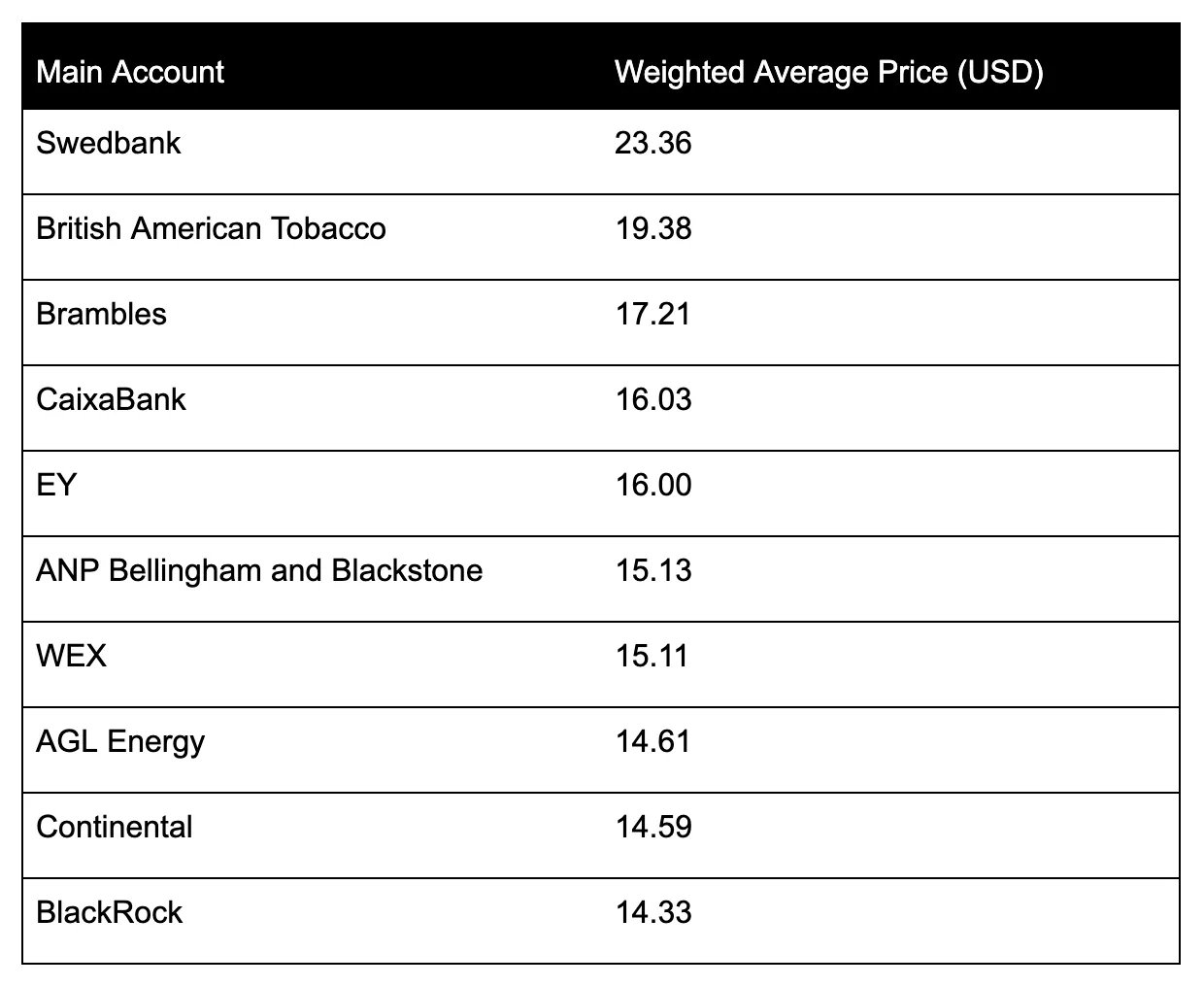

We have identified top 10 companies based on the average weighted price of purchased credits (see the table below). An average retiree among this list is in the financial services industry and had purchased forestry carbon credits (which tend to be more expensive compared to other project types and hence drive up the average price). Most of the retired credits come from the Verra registry. For example, Swedbank have on average retired credits worth $23.36, while BlackRock have chosen credits at $14.33 on average.

As we continue the corporate data snapshots, we’ll introduce further methods of evaluating retirements. Next week, we’ll show the companies that retire credits with the most recent vintages. We’ve reached out to a number of corporates to verify the data we have for them. If you’d like to get in touch, please reach out to hello@alliedoffsets.com to help us understand your company’s retirements.