Carbon pricing schemes have been introduced across an increasingly large number of jurisdictions in the last few years as both their effectiveness in challenging greenhouse gases from polluting industries and the urgency of climate change become more apparent. It’s estimated that as of this year, a quarter of global emissions are covered by some kind of scheme.

As the carbon markets’ leading data and analytics provider, AlliedOffsets is continually expanding the type and breadth of ancillary sustainability information about the thousands of companies active in the voluntary carbon market. The most recent of these additions is a metric for the financial implications of a carbon tax on some of the world’s largest companies.

How carbon tax sensitivity and investment risk were calculated

Using market capitalization and earnings data from CMC, and 2019 Scope 1 and 2 emissions data from the AlliedOffsets repository of corporate sustainability documents, we have explored how sensitive companies’ earnings would be to a potential carbon tax of $100. At the time of writing, the price of an EU ETS allowance is €76.27.

This work on P/E ratios, fractions of earnings, and carbon debt are produced using a highly flexible set of calculations. The measure of central tendency for emissions, the cost of carbon, and the period of earnings can all be adjusted. Indeed, we welcome feedback on the data and assumptions used in order to make this a maximally useful tool for all those responsible for both the emissions performance and the financial health of these companies.

These metrics offer a standardized assessment of how efficiently some of the world’s largest and most valuable publicly-listed companies generate earnings relative to their carbon footprint. This allows for the comparison of decarbonisation and risk between similar businesses. In our assessment of over 1,000 companies, hundreds underwent enormous inflation of price-to-earnings ratios after carbon liabilities were factored in; 45 changed by over 100%. A tax on emissions could cause significant market disruption as these companies’ shares become worse value and overpriced, presenting a significant investment risk for shareholders.

Carbon debt over 5 years as share of market cap & carbon liability share of earnings

The sectors most at financial risk from the introduction of a carbon tax

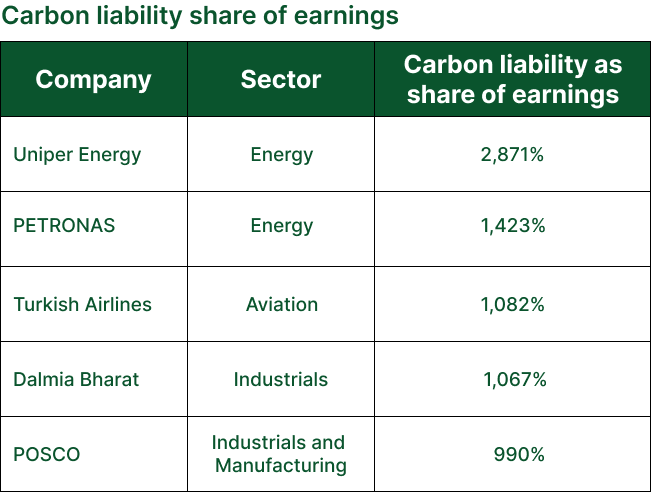

The calculations for both carbon liability as share of earnings (trailing twelve months) and five years of carbon debt as share of market cap are revealing but not surprising. Energy companies operating in fossil fuel extraction and distribution are by far the most sensitive to a carbon price, due to the size of their carbon liabilities relative to their earnings. While the top five tables are dominated by Energy companies, companies in the Aviation and Industrials and Manufacturing sectors also rank very highly.

This raises serious questions about the feasibility of companies accounting for their historic responsibility for GHG emissions and associated climate change. The size of their carbon debt over just a few years would render many companies bankrupt, with the entire market value of 22 companies each wiped out by the cost of paying for five years of historic liability. Of the 52 companies that yielded losses after paying the price of just one year’s worth of emissions, 21% were in Energy, 19% were in Materials and Chemicals, and 17% were in Industrials and Manufacturing.

When looking at just the aviation industry, the worst affected company was also one of the oldest; KLM-Air France has a carbon debt of over 200% of its market capitalization. This sector will be under particular pressure given the upcoming transition to mandatory participation in Phase 2 of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). CORSIA-eligible units are estimated to be worth around $25 when this phase begins in 2027.

Technology and Financial Services: the least financially sensitive sectors to a carbon tax

Technology and Telecommunications, and Financial Services companies fared much better, with many in these sectors having a liability as share of market capitalization of around 1%. In the race to not only reduce but actively remove atmospheric GHG, these are the companies that can most afford to account for their emissions by buying carbon dioxide removal (CDR) credits, which can cost hundreds of dollars per ton. This very much reflects the existing trend in CDR offtakes and retirements in the VCM; in the last 12 months, Technology and Telecommunications companies were responsible for 95% of engineered removals by transaction volume.

As long as the increasing use of data centers, which will likely drive up Scope 1 and 2 emissions, do not outpace the profits generated by these companies, these sectors will likely continue to be relatively well protected against the impact of possible carbon tax obligations.

Why are these outputs important?

While some companies are already obliged to publish these emissions intensity ratios for regulatory compliance, like the UK's Streamlined Energy and Carbon Reporting (SECR), voluntary reporting offers the benefit of showing investors and other stakeholders that the company is proactive on an often forgotten factor. As the number of greenhouse gas (GHG) pricing schemes grows year on year, with 75 in 2024 and 80 in 2025, reality is not so far away from the questions posed by this exercise.

This exercise shows that the profound impact of a carbon price on share prices, dividends, and overall financial stability could reshape the entire investment landscape. In this scenario, it would become clear that some companies are not only ill-prepared for the transition to a low-carbon economy, but that their existence in their current forms are financially incompatible with it.

Whilst it is important that the outcomes of these calculations are read as indicators, not statements, they are still valuable in highlighting the enormous exposure that some companies have to the cost of carbon. Corporate emissions pose a risk to both earnings and the operating environment in a way that may be under considered by both boards and shareholders. On the flip side of this, policy-makers have a powerful decarbonisation tool at their disposal - although it is doubtful that they would decide on such a high carbon price off the starting block.

How can AlliedOffsets support companies or investors manage this risk?

AlliedOffsets track corporate emissions, carbon market involvement and carbon policy developments by country; data which can all be used to inform risk strategies. The impact of a carbon price on financial performance is an area of ongoing development that can offer early warning signs for corporations and investors, as well as signal opportunities for improvement and growth.

Conclusion

In sum, our analysis shows that energy and aviation companies face the greatest financial exposure to a potential carbon tax, whilst technology and financial services remain relatively insulated. For investors, this highlights both the risks tied to high-emitting industries and the opportunities in sectors better positioned for a low-carbon transition. As carbon taxes are introduced globally, understanding these sensitivities will be key to managing investment risks.