Disclaimer:

The below analysis is based on publicly available and company-provided data. Given the dynamic nature of this fast-moving space, as well as the existence of undisclosed data and closely-held deployment plans, please regard this information as a thorough snapshot in time, if not an exhaustive representation of the entirety of the sector and its stakeholders.

Roughly $1.5b has been invested in direct air capture (DAC) firms – which represents a third of all investment that has been invested into carbon dioxide removal (CDR). And the funding rate is increasing: in 2023, DAC investment hit $700m of $1.7b invested this past year into CDR as a whole.

The investment is catalyzing a shift from the lab to the field: DAC firms are increasingly breaking ground on pilot facilities. The pioneers are shifting operations from pilot to commercial scale. With more companies announcing purchases, investment, and new facilities on a near-daily basis, it’s more important than ever to keep track of activity in the nascent sector.

AlliedOffsets and Direct Air Capture Coalition have conducted desk research and surveyed firms to create a map of all the DAC plants as of the start of 2024, identifying 93 DAC facilities announced worldwide by their DAC regeneration method, location, capacity and CO2 utilisation type. Their geographic spread can be seen below, and the mapping tool can be accessed here!

The map includes a number of key metrics, including:

- Facility status

- Operational year

- Regeneration method

- Tons captured per year

Whilst the map is not exhaustive – given the fast growth of the market, finding and keeping facilities up to date is a sisyphean task – it provides perhaps the most comprehensive overview of the state of DAC facilities to date. We encourage companies to submit data updates via this form. Still, given the breadth of the data, we wanted to provide a brief analysis of the data shown on the map.

Overview of Data

53 DAC plants (combined pilots and commercial facilities) are expected to be operational by the end of 2024, with a combined capacity of 59 ktCO2/ye. By 2030, companies anticipate 93 facilities to be operational, with a combined capacity of 6.4-11.4 MtCO2/ye.

The median removal rate of DAC facilities is 100 tCO2/ye, as many plants are still in their pilot phase. 2024 and 2025 are likely to be big years for DAC. There is an anticipated 7.8x increase in global capacity from 2023 (7.4 ktCO2/ye) to 2024 (58 ktCO2/ye) due to the operationalisation of some of the world’s first kiloton plants: Heimedal’s Project Bantam (7.0 ktCO2/ye), Airhive’s Alpha Test Site project (1.0 ktCO2/ye), and Climeworks’s aptly named Project Mammoth (36 ktCO2/ye). Until the end of 2024, Climeworks’ Orca, the world’s previously largest and first kilotonne plant of 4.0 ktCO2/ye, accounted for approximately 54% of global DAC capacity since 2021.

2025 should also be a big year for DAC, with the operationalisation of Stratos, a 500 ktCO2/ye plant in Texas by Carbon Engineering and 1PointFive, which, if delivered on time, will increase the industry capacity by 10x. After 2025, it is expected that an additional 27 DAC facilities will become operational, with 5 megaton scale plants having been announced to be operational before the end of 2030. Figure 2 showcases the capacity breakdown of each of the DAC dataset.

Regional Analysis

DAC activity is concentrated in North America and Europe, with 11.5 ktCO2/ye and 44.0 ktCO2/ye projected to be captured by the end of 2024, respectively. 18 plants are operational in North America and 24 in Europe, with the leading countries being the US, UK, and Canada. By 2030, North America is projected to have 41 facilities, and Europe 35. The US is projected to have almost 3x the number of plants it has today. The fact that the majority of large future plants are featured in the US might be attributed to the large VC system, tax credits given to DAC companies by the Inflation Reduction Act, and the grants handed out to DAC companies to set up pilot projects in DAC Hubs across the country.

As the plants start to come online, North America is projected to overtake Europe in the amount of CO2 captured by 2030. By that year, North American facilities anticipate they will capture 4.3x the capacity of Europe: 4.7 MtCO2/ye in North America compared to a capacity of 1.1 MtCO2/ye in Europe.

It is difficult to project that far into the future, and large mega projects sway the analysis. For instance, Project Bison Phase IV, a US plant that aims to capture 5 MtCO2/ye would alone dwarf all other deployments globally.

Looking at activity by company, 43 companies anticipate they will have at least one plant by the end of 2024. The average number of plants to company ratio is 1.6 of those companies and the median time to operationalise a company’s first plant since a company’s founding is three years. AlliedOffsets data shows there are 177 DAC companies in 2024, indicating that we can expect many DAC plants to be announced and operationalised in the near future, changing the shape of the graph below from a gaussian one to an exponential one, as there are so many companies that have not announced a plant.

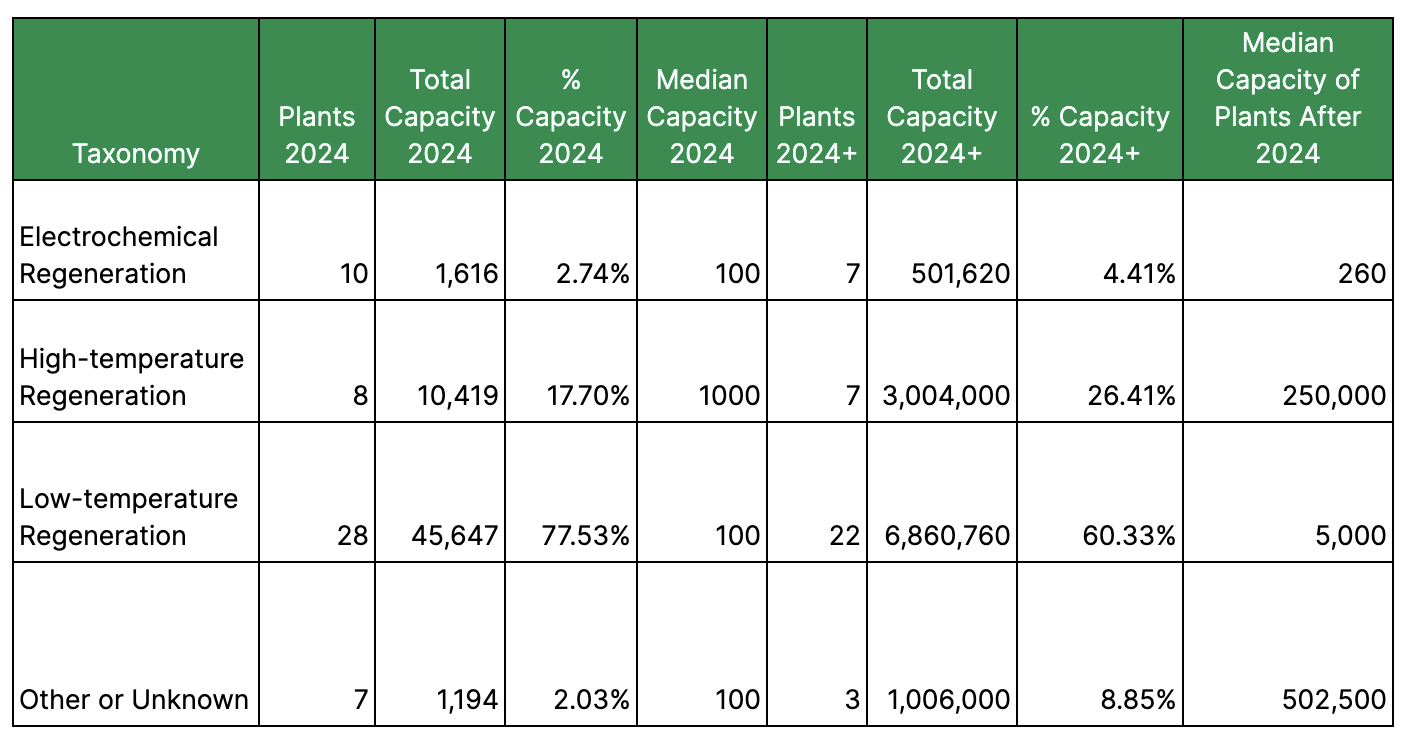

The figure below also showcases the various DAC types and their plant operational dates. The taxonomy AlliedOffsets uses for DAC facilities is based on the regeneration method of that DAC technology, as it can be seen as a way to dissect the industry. This classification was first developed by counteract. The different generations are taken from Exantia’s DAC 3.0 blog. A simplistic explanation of what each regeneration technology is can be found here; the expanded definition of regeneration can be found in the appendix.

- Low Temperature Regeneration (Gen 1): uses materials like amines or structures such as zeolites and metal organic frameworks. These substances attract CO2 and release it at 80-120ºC, often with a vacuum, making use of sources like geothermal or waste heat. Companies like Climeworks, Carbon Capture Inc, and Noya are notable players in this field.

- High Temperature Regeneration (Gen 1): uses strong alkali to capture CO2, releasing it at temperatures up to 900ºC, needing high-grade heat sources like natural gas. While aiding rapid scaling, this reliance on fossil fuels may perpetuate emissions. Alternatives like electric furnaces, nuclear energy, or hydrogen have challenges. Carbon Engineering and Heirloom are among the DAC companies using high-temperature regeneration.

- Electrochemical Regeneration (Gen 2): uses electrochemistry instead of temperature changes to attract and release CO2. Operating on electricity at ambient conditions, they utilise an electrochemical cell to capture CO2 with alkaline agents and release it using acids. They typically require less energy and can run on renewables. Systems like Mission Zero and Carbon Atlantis can store energy, enabling continuous operation even when green energy is unavailable.

- Other or Unknown (Gen 3): There are other DAC approaches that do not exactly fit in these groups. For example, some DAC technologies are leveraging pre-existing sources or alkalinity or acid to either capture or regenerate the CO2. These approaches are often linear compared to the typical looping DAC system.

Low-temperature regeneration potentially accounts for 60% of all DAC capacity by 2030 – that includes 5 MtCO2/ye from the single mega-scale Project Bison facility. The sample size for the other types of DAC is in single digits accounting for a drastic range in median capacity after 2024, showing incompleteness of the data as aforementioned, meaning the capacity data can not be relied upon to make many conclusions.

Among the most interesting data points are the different DAC types within the category other or unknown. Companies here include those that are using moisture swing (Avnos) and electrochemical separation methods (RepAir Carbon). There is also the 1 MtCO2/ye Project Cypress, a collaboration between Climeworks (Low-temperature) and Heirloom (High-temperature). The largest electrochemical regeneration plant and highest capacity planned plant is Project Octopus, a 500 ktCO2/ye facility by Capture6 based in South Korea.

It is important to note that the various DAC plants in this study were classified to the best of our ability at AlliedOffsets so if you are exploring the data or using these numbers and theory just be aware that this is the case.

Conclusion

In summary, the global investment in DAC technology surged in 2023, leading to 93 DAC facilities being announced worldwide and 53 aiming to be operational by the end of 2024. Notable milestones include the operationalization of kiloton-scale plants like Project Bantam and Project Mammoth, leading to a projected 7.8x increase in global capacity from 2023 to the end of 2024. North America and Europe emerge as key regions of DAC activity, with an anticipated shift towards higher capacity in North America by 2030. The taxonomy of DAC technologies highlights diverse regeneration methods such as high temperature, low temperature, and electrochemical regeneration. Looking forward, exponential growth in DAC capacity seems to be on track with the 70% annual increase each year and diverse technologies being used to capture carbon promising significant contributions to climate change mitigation.

You can find the DAC deployments map here and the form to submit any missing facilities here.

AlliedOffsets contains the world’s largest dataset on voluntary carbon markets, including CDR. If you are interested in learning more about our data please reach out!

Appendix

DAC Regeneration methods definitionsThese are https://counteract.vc/thinking/will-one-winner-take-it-all-in-direct-air-capture

Low-Temperature Regeneration: In low temperature regenation solutions, CO₂ is typically captured through chemisorption using a CO2-loving sorbent (such as amines) and/or physisorption using physical lattices into which CO2 molecules fit readily (such as zeolites, metal organic frameworks). The sorbents have a weaker attraction to CO₂ than the strong alkalis used in high temp solutions and accordingly release CO₂ at temperatures of ~80-120ºC, often combined with a vacuum. This allows these approaches to leverage low-grade heat sources such as geothermal energy or waste heat, lowering their carbon intensity. Notable companies in this space include Climeworks, Carbon Capture Inc, and Noya.

High-Temperature Regeneration: High-temperature Regeneration techniques typically use strong alkali to capture CO₂ and then employ calcination technology at up to 900ºC to release it, requiring a source of high-grade heat. Natural gas is the most common choice today due to its low cost and wide availability. This helps with rapid scaling but also risks perpetuating fossil fuel demand and connected emissions (e.g. from methane leaks). Alternatives could include electric furnaces, nuclear energy, or hydrogen, all of which come with some challenges. Carbon Engineering and Heirloom are leading examples of DAC companies using high-temperature Regeneration.

Electrochemical Regeneration: These approaches replace temperature swing desorption with electrochemistry to attract / release CO₂. They operate mainly on electricity at ambient temperature and pressure. An electrochemical cell is typically used to generate an alkaline capture agent used to bind to fresh CO2, alongside an acid, used to outgas CO₂ from the capture material. This method often requires less total energy than temperature swing approaches and can be powered by renewable sources. These systems often have the capacity to load match by storing acids and bases when cheap green energy is available, allowing them to continue operating when it is not. Examples include Mission Zero and Carbon Atlantis.

Electrochemical Separation: These approaches use electrochemistry to both absorb and release CO₂. Air is passed through electrochemical cell stacks where membranes or redox active molecules are used to separate CO2.. This way the process is entirely powered by electricity and does not require heat. Repair and Verdox are examples of DAC employing electrochemical separation.

Direct Water Capture: Direct Ocean Capture (DOC) companies that capture CO₂ from the ocean, rather than the air. DOC encompasses a whole family of approaches, too many to cover comprehensively here (well categorised by NOAA). DOC faces different challenges to DAC, such as the requirement to pump and handle significant quantities of saltwater, potentially hazardous byproducts, and challenges with measuring CO₂ capture in an open system.

Other: There are other DAC approaches that do not exactly fit in these groups. For example, some DAC technologies are leveraging pre-existing sources or alkalinity or acid to either capture or regenerate the CO₂. These approaches are often linear compared to the typical looping DAC system.