Our latest product, the VCM-Compliance Eligible Credit Tracker allows users to identify voluntary carbon market credits that also qualify for compliance carbon market schemes.

In this third edition of our series on Compliance/VCM convergence, we will be exploring compliance schemes with carbon offset mechanisms. Leveraging a dataset of more than 29,000 projects, our tool makes distinctions between projects which are eligible, or likely eligible to be included in compliance schemes currently - or in the near future.

Overview of South Africa’s Carbon Tax (COAS)

South Africa was the first country in Africa to introduce a carbon tax in 2019 and is currently the 12th largest greenhouse gas emitter in the world. The country experienced a rapid trajectory of carbon emissions between 1990 to 2019 when total GHG emissions (excluding forestry and land use) increased by over 67%. Driven by the energy sector, which accounted for close to 86% of emissions in 2019 and 91% of GHG emission increases since the 1990s, South Africa’s electricity generation mostly relies on coal-fired power plants.

The carbon tax is seen as a key tool to help achieve its Nationally Determined Contributions to the Paris Agreement, which it updated to commit to reducing its GHG emission to 350-420MtCO2e by 2030 and reach carbon neutrality by 2050. The country has outlined its intent to perform corresponding adjustments in accounting for NDC targets.

How the carbon tax works

South Africa introduced an official tax rate of R120 (approx. $7) per ton of CO2e, but the government took the step of increasing it to R134 (about $8) per ton by the end of 2022. A transition phase characterised by generous tax-free thresholds and allowances which was meant to end in 2022. However, the start of the second phase has been extended to January 2026 - which has kept the effective carbon tax rate low, and reduced carbon tax liability for the highest emitting entities.

According to section 13 of the Carbon Tax Act, taxpayers may offset up to 5% of their taxable emissions. Offsets of approved projects (as listed in the Department of Minerals Resources and Energy’s Carbon Offset Administration System (COAS), and guidance can be found under the 2019 Carbon Offset Regulations. Guidance around project approval includes:

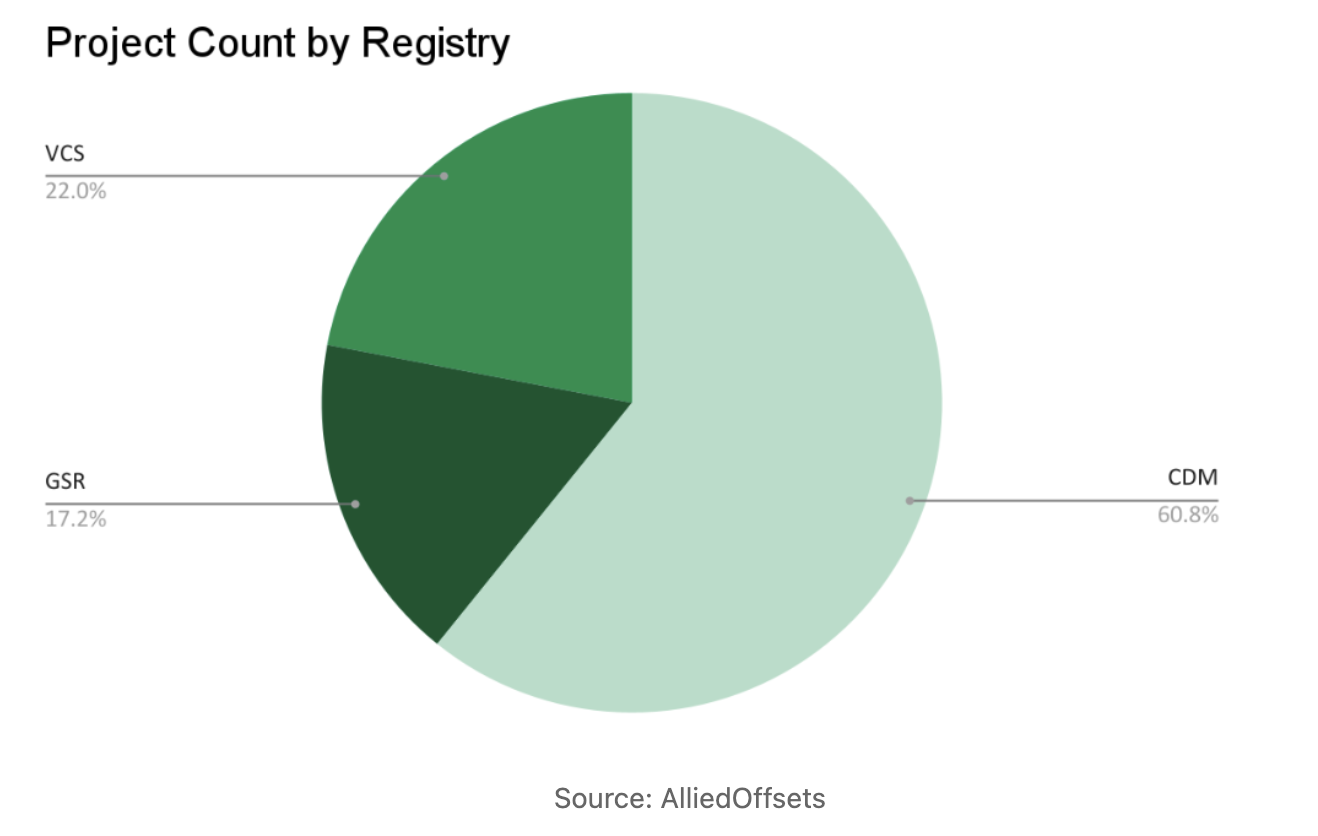

- Approved projects include CDM, VCS, Gold Standard projects, but also leaves space for other standards to be approved by the Minister of Energy or a delegated authority;

- Carbon avoidance, reduction or removal activities must have been carried out on or after 1 June 2019

- Offset activities must have taken place in the Republic of South Africa

Insights from our VCM-Compliance Eligible Credit Tracker

- We located 250 projects with credits eligible for its compliance tax scheme, with cancellation under section 13 of the Carbon Tax Act.

- The country currently has 48 active CDM projects under the Kyoto Protocol, 21 Gold Standard Projects and 33 Verra projects, with 106 inactive projects (96 CDM projects, 10 Gold Standard) and 41 pending projects (8 CDM, 12 Gold Standard and 21 Verra).

South Africa has projects eligible for its carbon tax offset scheme, of which renewable energy projects (22) and energy efficiency or fuel switching projects (12) are the highest by sectoral project count. This differs slightly from the list of 37 registered projects under the government’s website (COAS).

South Africa has projects eligible for its carbon tax offset scheme, of which renewable energy projects (22) and energy efficiency or fuel switching projects (12) are the highest by sectoral project count. This differs slightly from the list of 37 registered projects under the government’s website (COAS).

Out of the 250 eligible projects, Verra’s projects seemed the highest in demand - with the highest recording project (VCS2505) recording 1,022,034 all-time retirements, with the lowest (VCS2433) recording 217,566 all-time retirements.

According to the Taxation Laws Amendment Act 34 of 2019 GG42951 15 January 2020, a taxpayer [must] reduce the amount in respect of the carbon tax for which the taxpayer is liable in respect of a tax period by utilising carbon offsets as prescribed by the minister.

Key features of the South African Carbon Offsett Administration System (COAS):

- All projects (and credits) issued in the registry of one of the listed international standards are listed in the COAS.

- The Carbon Offset Administrator (COA), as outlined by the Carbon Offset Regulations is the main administrative unit for the registry, and forms part of the current Designated National Authority (DNA) branch of the Department of Energy.

Q: How are projects approved for the South African offset scheme?

- Projects must undergo a four-stage process under the development of an international standard. Beyond the development and third-party verification under an international standard, projects are also liable to follow the four processes which govern the Carbon Offset Administration System:

1. Extended Letter of Approval procedure:

- Letter of approval issued to CDM projects before project registration (confirming that the project aligns with South Africa’s Sustainable Development Criteria. Gold Standard/Verra projects do not require a LoA.

- An Extended Letter of Approval (ELoA) is issued to a project before listing credits in the South African Registry. This letter confirms project compliance with South Africa’s Sustainable Development and Carbon Tax Offset Eligibility Criteria.

- All projects require an ELoA.

2. Listing Procedure:

- Listing application requires the project owner to complete an online form and submit supporting documentation: a) an Extended Letter of Approval and b) a Voluntary cancellation certificate from international standard.

- Requests are evaluated by the Carbon Offset Administrator (COA)

- Credits are listed in the Ownership Repository, which is a part of the South African Registry.

3. Transfer of Ownership:

- Listed credits may be transferred to participants through a transfer request. Transfers can only be done by COAS-registered participants.

4. Retirement of credits:

- The South African Revenue Service (SARS) requires submissions of retirement certificates for carbon tax offset purposes

- Only credits listed on the COAS can be retired, and generate a retirement certificate (retirements by request on COAS).

- Credits which are not retired do not expire.

Once projects have been accepted and uploaded to the COAS, project owners may buy credits from other project owners or credit owners. Project owners may also choose to sell or retire their listed carbon credits, whereas buyers may buy, sell and retire credits either as trading stock or for reduction of carbon tax liabilities.

The JSE’s announcement of a partnership with Xpansiv will look to develop South Africa’s secondary carbon market infrastructure, with further information forthcoming.