Earlier this month, ICVCM released a clear indication of what project methodologies are likely to be approved first for core carbon principle (CCP) labels.

The announcement came as part of a wider update on ICVCM work. To date, the organization has categorized methodologies into three buckets: internal assessment, multi-stakeholder assessment, and very unlikely.

The interpretation is that methodologies included in the internal assessment portion of the CCP labeling process are likely to be approved for CCP labels first. In this blog, we look at how projects in these methodologies fare in terms of retirements, which firms are most aligned with CCP to date, and which ones are least aligned. Next week, we’ll look at the very unlikely methodologies, and those excluded by registries.

Analyzing Retirements: CCP Internal Assessment Methodologies

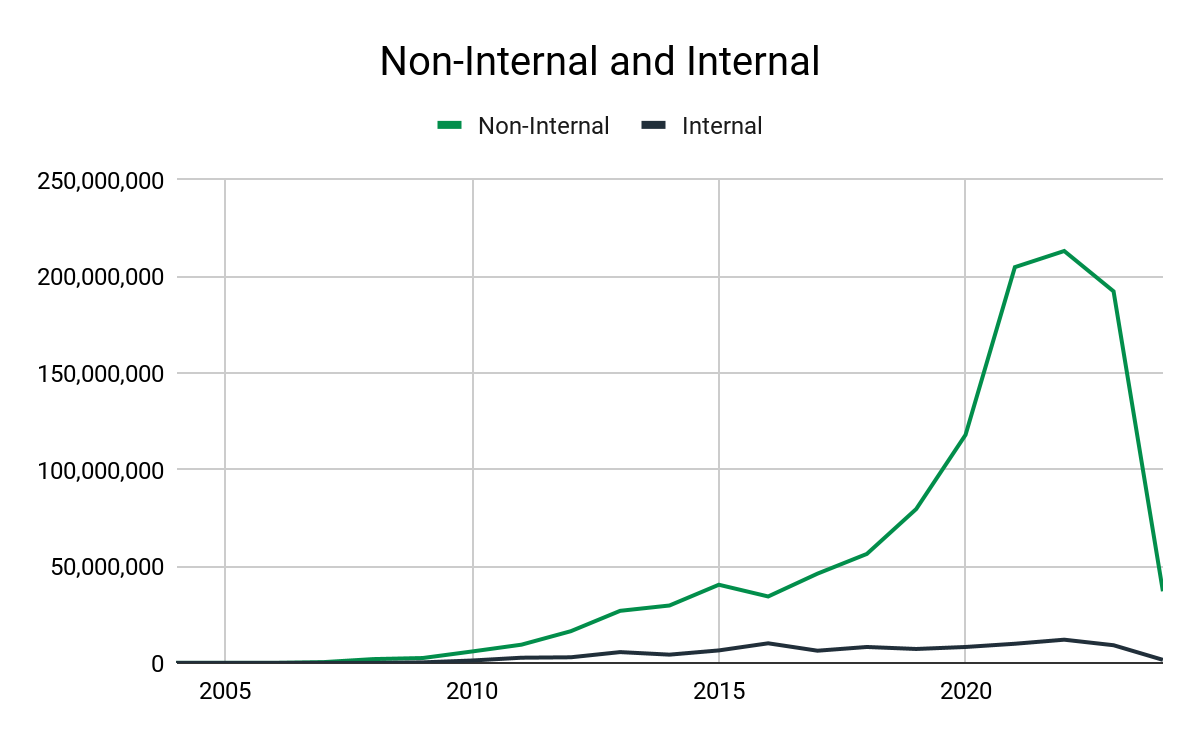

Overall, 9% of retirements have come from CCP internal assessment methodologies. The share of CCP internal credits has vacillated from as high as 30% in 2016, to only 5% in 2023.

That’s not to say that the credits are scarce: there is over 1b tCO2e available from projects in CCP internal assessment methodologies. However, the credits tend to come from older vintages, with 3/4 of the credits being 2012 or older vintages.

Top Companies Leading in CCP Internal Assessment Credits

Of the 12,000 companies whose retirements we track in the VCM, 348 have retired exclusively with CCP internal assessment credits. The top ten companies by number of retirements are listed below – these companies have the least adjustment to make when it comes to altering their offsetting strategy for CCP labels, assuming internal assessment means the methodologies will be approved.

On the flip side are companies that have retired with exclusively non-CCP internal assessment credits – the top ten companies by retirements are below.

These companies are likely to need the most adjustment in a CCP-labeled regime. This doesn’t mean that the projects they are retiring from will not get CCP labels, just that there is greater uncertainty than for those firms that have already aligned with CCP internal assessments.

For more data and insights on CCPs, stay tuned for next week’s blog. Explorer subscribers to our platform can examine CCP activity by logging into their dashboard, and those interested in a demo can book a meeting here.