AlliedOffsets Helps Businesses Reduce Risks and Save Time by Identifying What Factors Are Influencing the Value of Their Portfolio.

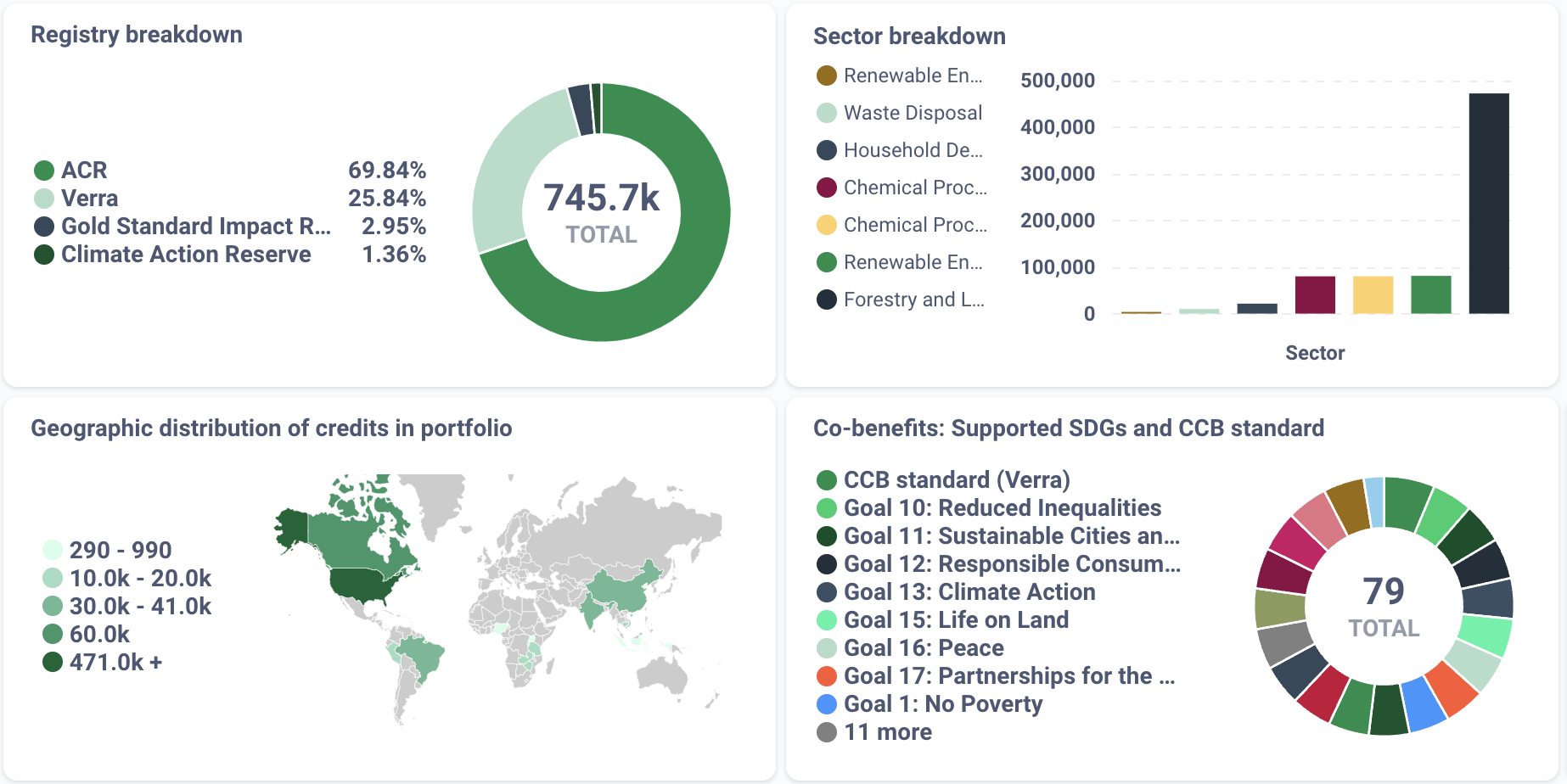

Carbon Credit Portfolio Breakdown by Registry, Sector, Geography, and Co-Benefits

Understanding the full value of your carbon credit portfolio is essential, but tricky for many working in the VCM. Many businesses struggle to grasp how their portfolio's value changes over time, what factors influence these fluctuations, and the potential for future growth. With AlliedOffsets' new Portfolio Monitoring Tool, companies can address these challenges.

What Problems Does the Tool Solve?

Managing a carbon credit portfolio without clear insights can lead to missed opportunities and increased risks. Common challenges include:

- Lack of Visibility: Difficulty in understanding the real-time value of carbon credits.

- Influences: Uncertainty about the factors affecting portfolio performance.

- Forecasting Potential: Limited ability to anticipate future value and profit opportunities.

How Does the Tool Work?

AlliedOffsets' Portfolio Monitoring Tool is designed to provide businesses with a comprehensive view of their carbon credit portfolios. The tool allows users to monitor, assess, and benchmark supply, demand, and prices, all within a unified platform. Here’s how it works:

- Live Portfolio Tracking: Access real-time data on portfolio value and individual credit performance.

- Comprehensive Analysis: Evaluate demand, pricing, and retirement trends within your portfolio.

- Risk and Quality Metrics: Analyze political risks, Article 6 compliance eligibility, and quality ratings.

- Market Connectivity: Access bid and offer prices, confidence scores, and liquidity assessments. Use the live offers function to connect with sellers directly.

Don’t miss out! Join our event for an exclusive live demo and discover how our tool can help you understand your portfolio's value changes over time, and the potential for future growth.

Sign up here!

Features and Benefits of the Portfolio Monitoring Tool

Portfolio Monitoring and Benchmarking

- Track Performance Over Time: Monitor value changes and forecast profit opportunities.

- Sector and Regional Comparisons: Benchmark portfolio performance against other sectors and regions.

Forecasting Options

The tool offers advanced forecasting capabilities to help businesses plan for the future:

- Forecast Supply: Explore low, medium, and high supply scenarios to anticipate market saturation.

- Forecast Demand: Analyze demand drivers from top sectors and regions purchasing your portfolio credits.

- Forecast Profits: Calculate potential profits under varying demand scenarios.

- Custom Scenarios: Benchmark forecasts against custom price and demand assumptions.

Portfolio Performance Growth and Trendline (January 2023 - August 2025)

Top 10 Buyers by Portfolio Volume

How Can Companies Use the Tool?

Businesses can leverage the Portfolio Monitoring Tool to:

- Reduce Risk: Identify and mitigate risks that could impact portfolio value.

- Optimize Strategy: Make informed decisions about credit purchases, sales, and retirements.

- Enhance Transparency: Build stakeholder confidence with data-backed insights into portfolio performance.

- Streamline Operations: Save time by consolidating all portfolio management tasks into one platform.

Develop Your Carbon Credit Strategy

With AlliedOffsets’ Portfolio Monitoring Tool, users can access real-time tracking to advanced forecasting, our solution is tailored to help businesses thrive in the VCM.

Try the tool for free here. Or get in touch with our team to access the full tool and offerings.