We are launching our monthly Buyer Rating report! Read on for a preview and methodology explanation.

The voluntary carbon market (VCM) has grown in popularity in the last three years, with more retirements taking place than ever before. Companies, individuals, governments, and non-governmental organizations, among others, have increased their efforts in trying to mitigate some effects of climate change by increasing funding carbon finance by purchasing carbon credits towards their social responsibility goals or offsetting purposes.

At AlliedOffsets, we have undergone a review of carbon offset buyers. Each buyer has received a grade that reflects their commitment to offsetting as a complement to their emission reduction strategies and remaining residual emissions. By doing this, we want to shed light on companies who continuously contribute to providing carbon finance using high quality projects.

The buyer ratings take into account two key things about a company: the share of emissions they offset, as well as the profile of the credits they offset with. In order to create a score, therefore, we need two key data points: Scope 1 and 2 emissions for a company, as well as what credits they offset with.

Currently, the list comprises 282 entities from 15 industries. The biggest group is financial services (56 companies), while the smallest included in our list is agriculture, with only one firm represented. We expect the list to grow in the future, as more companies are tagged in credit retirements and share their scope 1 and 2 (and hopefully scope 3) emissions, without which the overall rating and individual grades cannot be compiled.

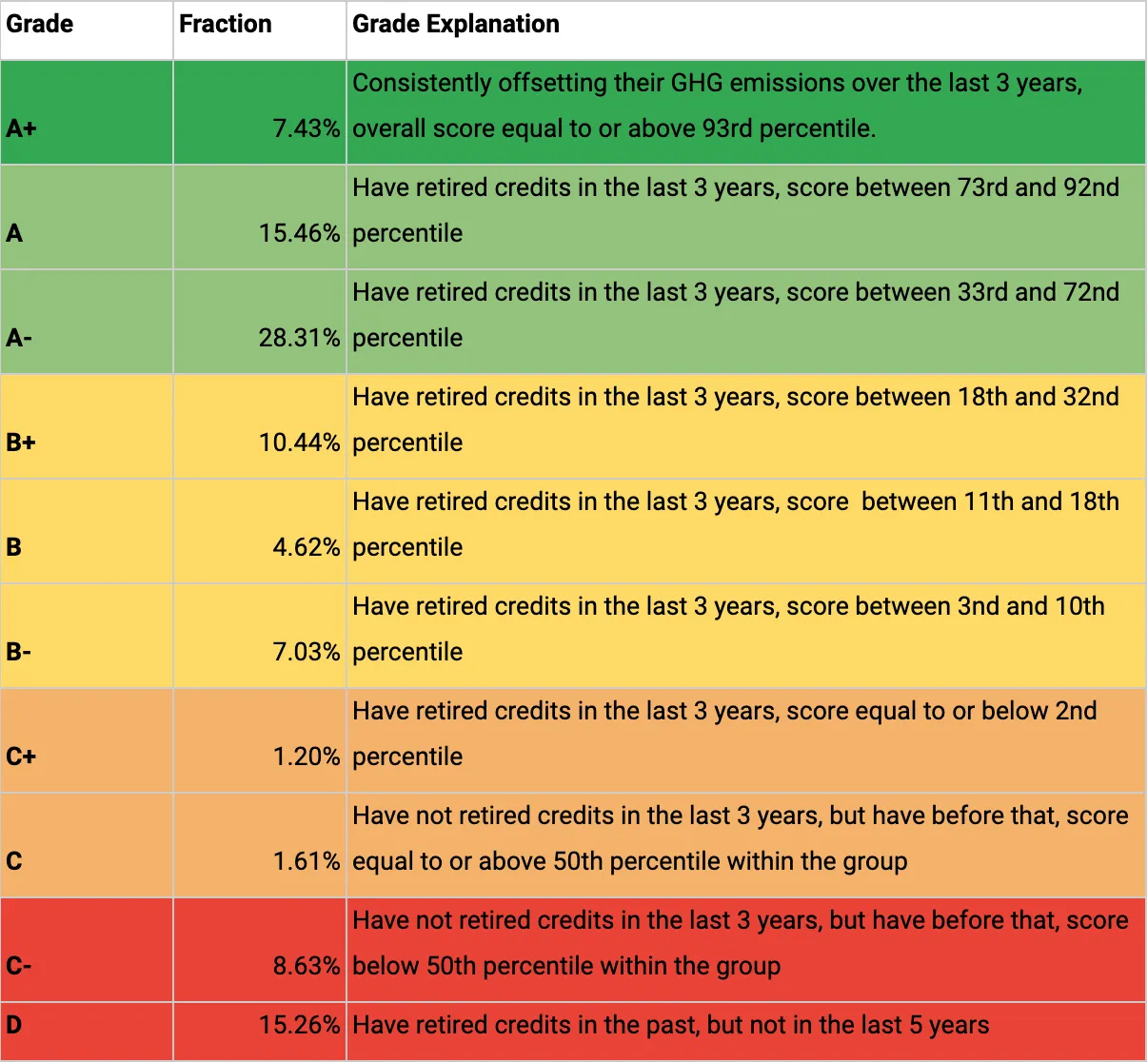

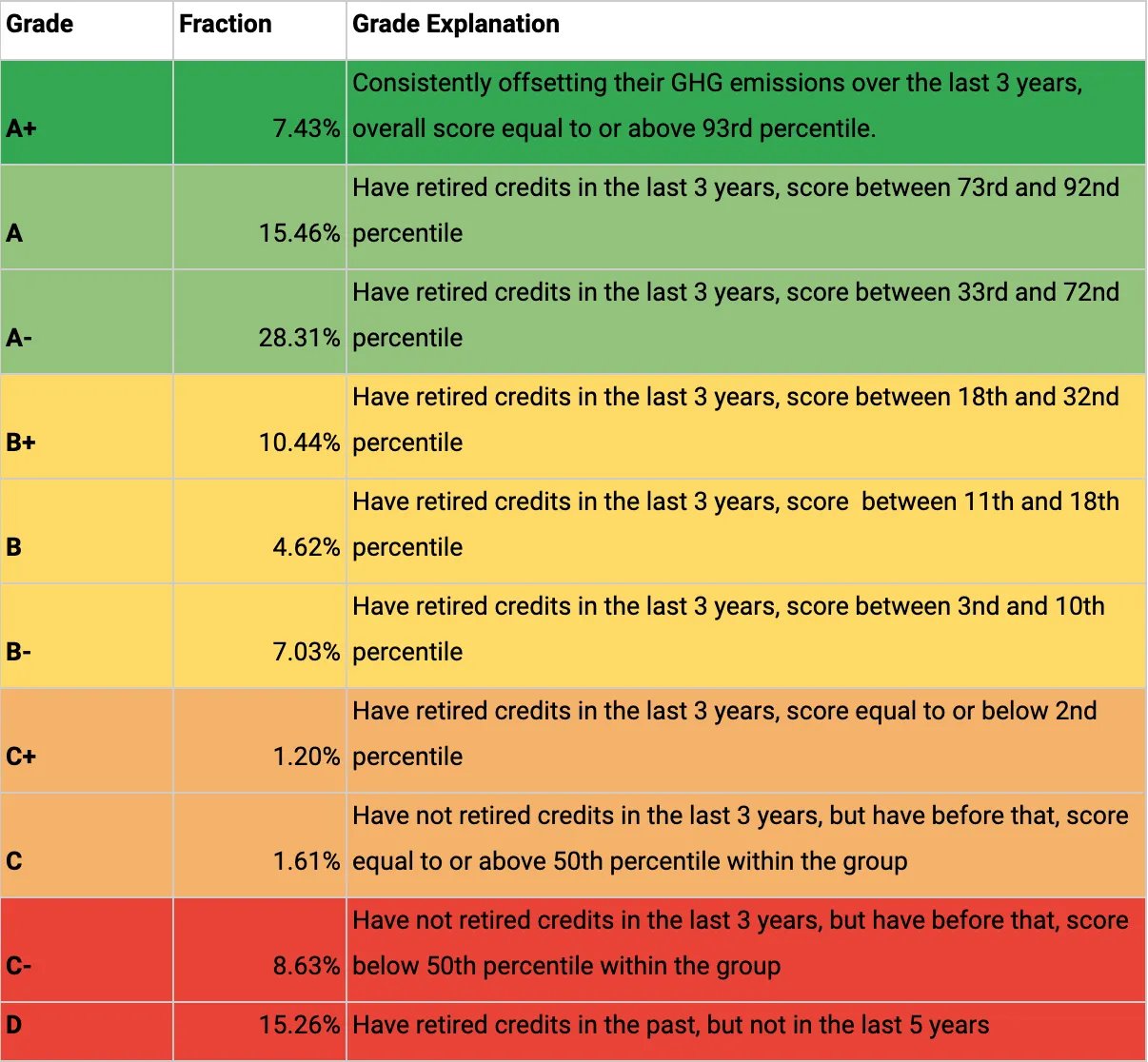

Companies are graded on a scale from A+ (best) to D (worst) with the distribution of grades based on Moody’s and S&P grade spread. Grades from A+ to C+ include companies that have retired carbon credits over the last 3 years and the grades here are calculated based on the distribution within this group, as illustrated the table below.

The full rating with a more detailed methodology explanation and a list of all companies on the list will be sent out and published shortly. The ratings will be updated on a regular basis, and we will keep track of how companies are doing via a monthly report.

This first instalment outlines the methodology and the distribution of scores for the companies we’ve rated. Future instalments will also highlight how companies’ ratings change, as their emissions and retirements change and will explain any significant changes to the rating.

As always, please visit our demo page to find out more!