From Avoidance to Removals

India is not new to the voluntary carbon market (VCM); most of its participation has been in avoidance projects, mainly in the renewable energy segment. Yet, that has the potential to change.

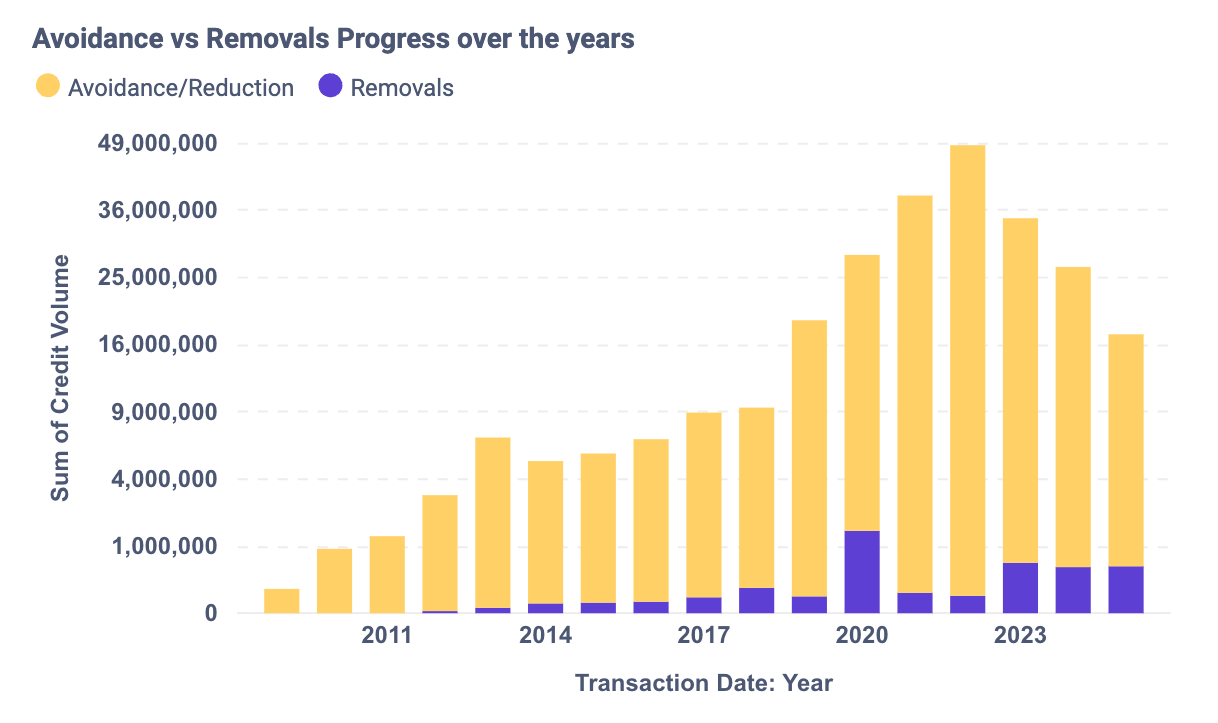

To date, Indian projects have retired about 267 million credits, of which ~98% come from avoidance. The remainder are removals, dominated by nature-based solutions.

Given India’s climate and its abundance of biomass feedstock, the country is well positioned to scale both biochar and enhanced rock weathering (ERW) projects.

Avoidance Vs removals in India’s carbon market, showing 98% avoidance dominance and gradual growth in removals

Project Landscape: 49 CDR Initiatives and Growing Momentum

As of August 2025, there are a total of 49 Carbon Dioxide Removal (CDR) projects in India, of which 34 are technical-removal companies and 15 are nature-based projects.

Project development has been steadily increasing over the past few years, showing a clear upward trend and healthy momentum.

Growth and composition of India’s carbon removal projects, highlighting biochar dominance and rising activity over time

Supply Trends: Issuances, Offtakes, and Investment Flows

- On the supply side, issuances for technical CDR projects have grown steadily, with ~214,000 verified credits issued to date. Most issuances have come from Carboneers, Varaha, and Mash Makes.

- Offtakes total ~114,000 credits, mainly from biochar and ERW, with notable deals from Varaha and Alt Carbon. Overall, the top supplier is Varaha, which offers a portfolio of methodologies, with biochar the predominant one. For a deeper look at current benchmarks, see our Biochar Index on our pricing page.

- Roughly 95% of credits sold by Indian CDR projects are biochar removals, with the remainder from ERW.

- On investment, tracking suggests around $24 million has flowed into Indian CDR companies, with ~80% split between Alt Carbon and Varaha.

Offtakes and issuances of Indian carbon removal credits, led by Varaha and Alt Carbon with rising volumes since 2023

Who’s Buying: International vs Domestic Demand

Among international buyers of Indian CDR (removal) credits, Google is the most visible advocate through its offtake deal with Varaha, followed by Mitsui O.S.K., Frontier, and NextGen CDR.

On the domestic side, Indian companies have mostly retired nature-based removal credits. Top retirees include Sterling, and Delhi International Airport. AlliedOffsets data shows that Indian corporates are starting to enter the removals market, but volumes remain small, and purchases of CDR credits by Indian corporates are still negligible for meeting offset targets.

So far, only Omega Healthcare has purchased technical CDR credits, and in very small quantities, from CarbonCure. The rest have been nature-based.

Buyers of Indian carbon removal credits, led by Google with additional purchases from Mitsui OSK Lines, Frontier, and NextGen

Indian Corporate CDR Retirements

Indian corporate carbon removal retirements, led by Sterling and Wilson Solar, and Delhi International Airport

India Outlook: Toward Durable Removals

Corporates are slowly recognising sustainability in their business models and seeking to decarbonise, and the Indian government has announced a list of 10 sectors identified for the domestic offset mechanism, including removal technologies such as biochar and afforestation.

Although today’s activity is concentrated in biochar, methods such as ERW and DAC are gaining traction among Indian developers, albeit with slow scaling so far.

Taken together, these trends point to rising demand and a gradual shift toward more durable removals.