Introduction

The ocean represents the largest reservoir of carbon on Earth that is accessible on human timescales, holding more than 50 times as much carbon as the pre-industrial atmosphere and about 20 times as much as all carbon stored in global terrestrial plants and soils.

The ocean is currently taking up about 10 Gt CO2 per year, i.e., a quarter of anthropogenic CO2 emissions, via air-sea gas exchange that responds to rising atmospheric partial pressure of CO2. It may seem logical to try to accelerate this process, moving carbon from the relatively small atmospheric reservoir into the vast ocean reservoir, where the proportional change in total carbon and the potential for large-scale disruption could be smaller. Marine carbon dioxide removal (mCDR) refers to such additional transfer of CO2 from the atmosphere to the ocean by deliberate human activities.

To date, most carbon dioxide removal (CDR) development has focused on land-based solutions. However, the ocean’s potential to capture and store CO2 safely and at scale far exceeds that of terrestrial systems. This highlights the urgent need to harness marine pathways to help counteract the worsening impacts of climate change.

What is Marine-CDR (mCDR)?

Marine-CDR uses ocean-based processes to capture and store carbon dioxide from the atmosphere. mCDR techniques fall into two primary categories:

- Biotic CDR, which includes removing and storing atmospheric CO2 through biological processes such as harnessing photosynthetic fixation through micro - and macro-algae cultivation and terrestrial biomass sinking.

- Abiotic CDR, which influences the chemistry of seawater to increase the net amount of atmospheric CO2 absorbed by the ocean without increasing the acidity. There are two main abiotic marine carbon dioxide removal pathways: ocean alkalinity enhancement (OAE) and direct ocean capture (DOC).

Market Overview: mCDR Momentum

There are currently 56 developers active in marine carbon dioxide removal (mCDR), marking significant growth since 2022.

The distribution of these developers by technology is shown below, with most focusing on Marine Biomass Cultivation/Sinking (MBCS) followed by Ocean Alkalinity Enhancement (OAE), Geographically, most mCDR activity is concentrated in the United States and the UK.

Investment Landscape

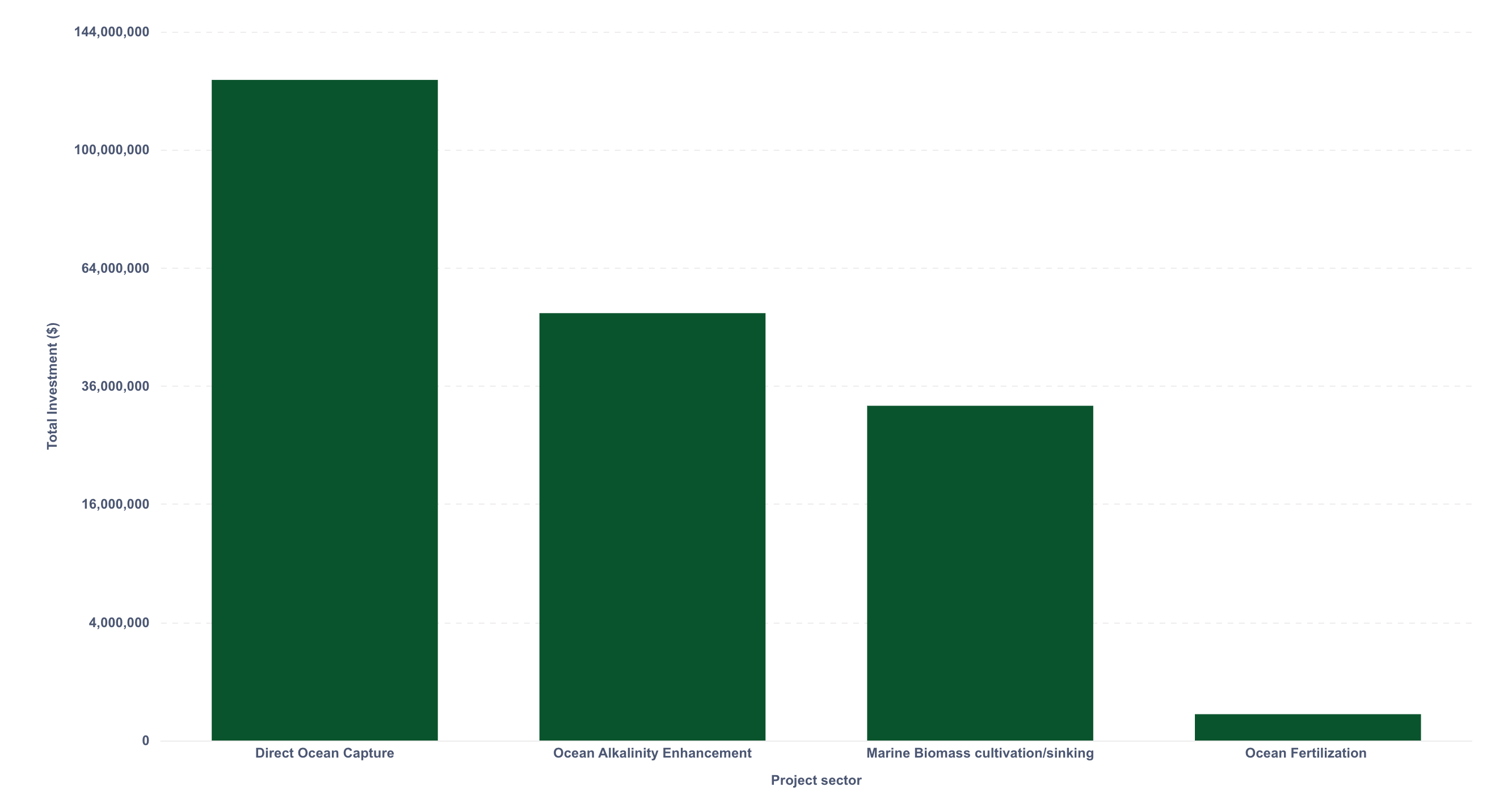

As of 2025, a total of $209 million has been invested in marine carbon dioxide removal (mCDR) projects, with the majority of funding directed toward Direct Ocean Capture (DOC) initiatives.

Over the past five years, investment activity peaked in 2024, marking a significant increase in capital flow into the sector. However, growth has not yet picked up this year. In terms of funding stages, over 70% of all tracked rounds were Series A.

The chart below illustrates the year-over-year investment trends by project sector.

Investment Trend

Investment Split By Type Of mCDR

Offtake Agreements & Buyers

To date, a total of 578k tonnes of CO2 removals have been secured through offtake agreements in the mCDR space. However, only 0.3% of these credits have been formally issued, primarily from Ocean Alkalinity Enhancement (OAE) projects.

The chart below shows the distribution of offtakes by technology, with OAE representing the majority share of contracted volumes. Among developers, Planetary Technologies is currently the top issuer of OAE credits, followed by CREW Carbon, both operating through the Isometric registry.

Offtakes flow to date

The weighted average credit prices across key mCDR technologies are as follows:

Direct Ocean Capture (DOC) > Ocean Alkalinity Enhancement (OAE) > Ocean Carbon Fertilisation (OCF).

Average Price of mCDR

The table and visualizations below highlight the leading suppliers and buyers across the mCDR ecosystem, along with their geographical distribution, prominent buyers such as Frontier and SkiesFifty initiative have emerged as major advocates for mCDR technologies, committing to early offtakes that help bridge the gap between research and commercialisation.

Conclusion

Since 2022, the number of offtake agreements for mCDR projects has shown steady growth, signalling increasing market confidence and early commercial traction.

The United States and United Kingdom remain the leading hubs for mCDR activity, both in terms of project development and investment. Among registries, Isometric has emerged as a key player in issuing and verifying marine-based carbon credits.

While mCDR presents unique opportunities, it also comes with some challenges

- Scientific uncertainty: Ecological impacts of large-scale interventions are not yet fully understood.

- Governance and regulation: The absence of clear international legal frameworks remains a barrier to deployment.

- Public acceptance: Historical controversies highlight the need for transparency and stakeholder engagement.

- Measurement, reporting, and verification (MRV): Robust MRV methods are still under development, limiting confidence in verified removals.