From November 11th to 22nd, 197 nations (and the EU) return to the negotiating table in Baku to resume the world’s largest coordination game practical experiment. COP 29, dubbed ‘Finance COP’, is striving finally to fund the climate solutions needed to amend environmental trajectories. From greater ‘green energy finance’ initiatives for emerging countries (crucial to honouring COP28’s commitment to triple global RE investments by 2030) to a more robust loss and damages fund, major players need to open their cheque books for Baku to be successful.

However, it also aims to further political frameworks for carbon markets under Article 6, which crucially need reform to incentivise greater supply of high-quality credits. Done efficiently, this has the potential to improve participation across the Voluntary Carbon Market (VCM). Given the global public purse is already under pressure from growing economic, environmental and security crises, a mechanism that finances carbon-negative initiatives using capital from private polluters is increasingly desirable. Regardless of public opinion on offsets, a debt-free mechanism transferring capital from polluters to abaters is pivotal to achieving climate goals.

Join AlliedOffsets and IETA for drinks at COP29!

We are proud to sponsor IETA's Nightcap drinks event in Baku on the 15th of November at 9pm. We are giving away a few free tickets for the event - get in touch with our team to learn more!

What is preventing private engagement in the VCM?

Research shows that businesses with comprehensive sustainability strategies generate stronger brand loyalty and a greater willingness to spend, and are assumed to create products of higher quality (Sen et al., 2016). This suggests firms benefit from implementing legitimate net-zero strategies.

But there are a range of concerns regarding offsets, from the biodiversity impacts of nature-based projects (see AlliedOffsets Biodiversity Report 2024) to invalidation and reversal risks, slowing participation in the VCM. Arguably the most important variable is integrity - does one carbon credit actually represent one ton of offset emissions? If a firm purchases credits, have emissions actually been offset, or is there a carbon-accountancy error, and consequently a share price-collapsing scandal approaching?

Will COP 29 Address Carbon Credit Quality?

In recent years, media articles have questioned the integrity of carbon credits. In January 2023, the Guardian criticised the quality of Brazilian AFOLU Verra offsets, coining the phrase ‘phantom credits’ i.e. offsets which don’t equate to a ton of removed emissions. In May, the FT reported that Shell had retired phantom credits in its decarbonisation strategy. In July, Science-Based Targets Initiative released a report on scientific evidence supporting the use of offsets in net-zero strategies. They stated there was insufficient data to form a conclusion.

These reports negatively affect perceptions of carbon credits. Rather than viewing them as a mechanism for neutralising emissions whilst increasing capital for green innovators, consumers may see credits as a cheaper alternative to firms decarbonising their operations. Uncertainty surrounding integrity has knock-on effects, causing consumers to grow increasingly distrustful of offsetting strategies that purchase credits. Consequently, firms hesitate to offset.

Baku’s Role in Carbon Market Reform

In 2021, the Taskforce on Scaling Voluntary Carbon Markets surveyed buyers and found 45% viewed quality as a major cause of hesitancy when purchasing credits. The market reflects this hesitation. Fig 1. graphs credit retirement volumes against time (up to Dec 2023) using AlliedOffsets’ corporate retirements data. It shows the annual credit retirements growth rate has trended downwards since its high of 54.01% between 2019-2020, with the volume of annual credit retirements peaking in 2022, before shrinking by 3.32% in 2023.

Figure 1. Volume of annual credit retirements (2004-2023)

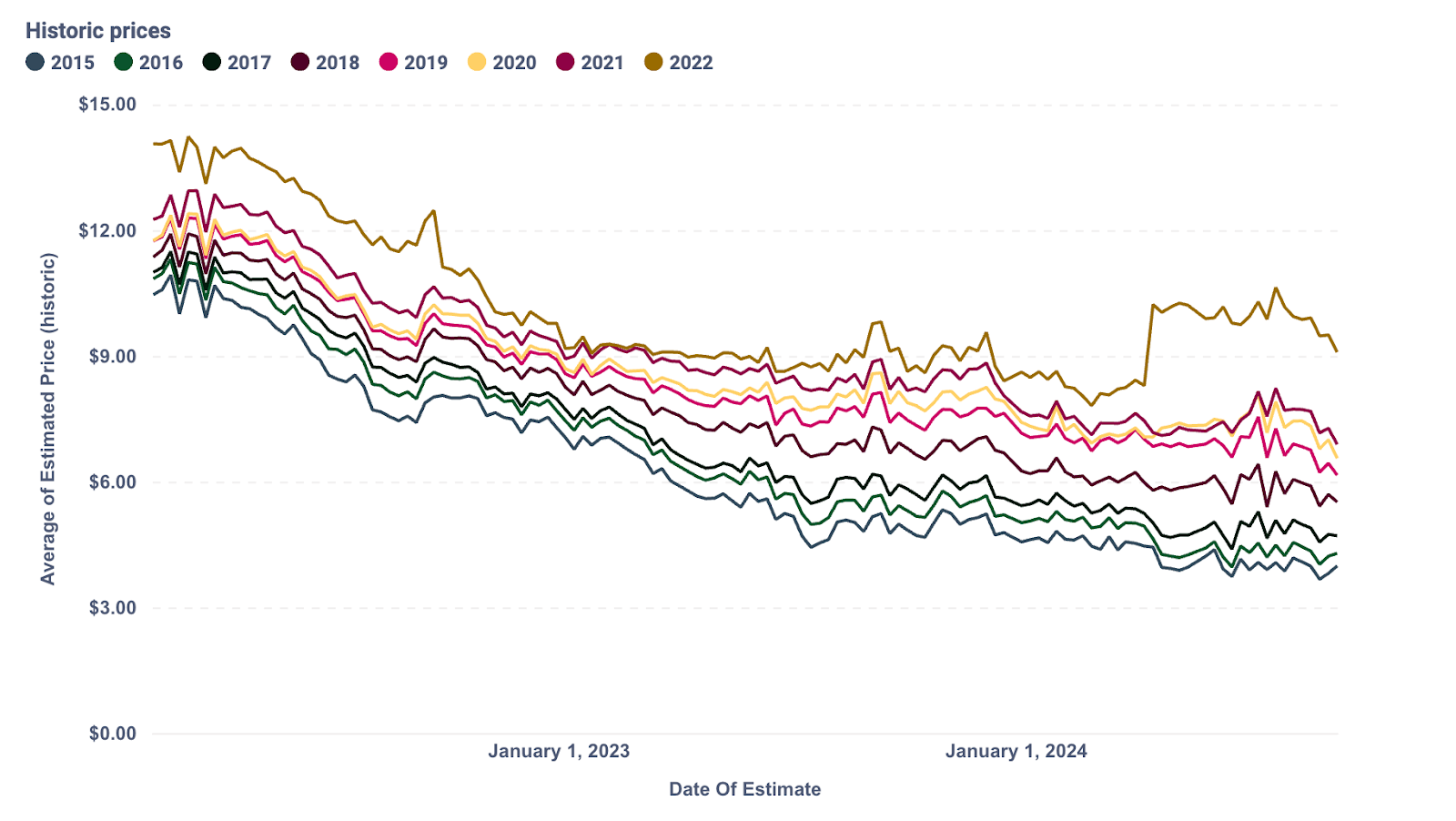

Furthermore, market scepticism regarding integrity is visible when comparing the average price of credits by vintage. Newer vintage credits are considered more legitimate and are assumed to have been created under stricter quality-control measures - whether this is true continues to be debated. AlliedOffsets’ algorithms estimate the average price of a V22 compared to a V15 carbon credit is over $9 and over $4 respectively, shown in Fig 2.

Figure 2. AlliedOffsets’ estimation of the historic average price of each vintage against time (Feb 2022 to present)

What Baku’s COP 29 Could Mean for VCM Integrity

Integrity concerns are most evident in The Guardian’s May 2023 report on a $1bn lawsuit against Delta Air Lines for retiring low-quality credits to claim carbon neutrality. Credit retirements by aviation firms dropped following its publication. Fig.3 graphs this decrease using AlliedOffsets’ corporate retirements data. It shows following the publication, Delta exited the market and participation by aviation firms dropped significantly. Regardless of whether these criticisms are justified, the media’s effect on VCM participation is clear.

Figure 3. Monthly Corporate Retirements of Aviation Firms (Jan 2019 to present)

How Baku Aims to Strengthen Carbon Market Standards

How can Baku improve integrity and bolster confidence in the VCM? Despite the high supply of carbon credits (see Fig 4.), AlliedOffsets’ dataset of over 32,000 projects estimates that 80% of available credits are low quality (see AlliedOffsets’ Quality and Price Trends in the VCM Report), with the majority being pre-V18. This is significant, as many compliance schemes have a baseline vintage requirement to gain eligibility: the Colombian Carbon Tax requires credits to be a maximum of 5-years old; Chile’s Carbon Tax requires 3 years; and CORSIA first phase requires vintages between 2021 and 2026.

Figure 4. Sum of available credits by vintage

One way to increase market integrity is with a greater supply of high-quality credits that adhere to stricter quality-control measures, lowering the likelihood of carbon-accountancy errors. Baku can support this with the implementation of an improved Article 6 framework, promoting greater participation at the national level.

Increased trading from national actors could create a greater premium for Article 6 eligible credits across the market, similar to other schemes where demand outweighs supply.

For example, the average price for a first phase, Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) eligible credit is over $27 (see AlliedOffsets CORSIA: Forecasting Future Demand & Supply Scenarios). Conversely, the average price of a V19 credit, which was the average vintage of all credits retired over the past 12 months, is just over $7.50. Furthermore, the current average price of a credit with a letter of authorisation, eligible for Article 6.2 trading (and has received corresponding adjustment) is also over $27. The premium for high-quality credits eligible for these schemes is clear.

Obviously, higher premiums generate higher returns for eligible carbon projects. Developers seeking to capitalise on these returns are thus incentivised to create high-quality projects, increasing the supply of high-quality credits across the market. Whilst policy is needed requiring private actors to offset more of their hard-to-abate emissions, creating a large supply of high-quality carbon credits is the first step in reducing consumer scepticism and private actor hesitation, and increasing voluntary participation. For ‘Finance COP’ to be successful from the VCM’s perspective, an expansion of frameworks that motivate national participation and successfully incentivise the creation of high-quality carbon projects is crucial.

Sources

- Utgård, Jakob, and Tarje Gaustad. "Carbon emission reductions and offsets: Consumer perceptions of firm environmental sustainability." Journal of Cleaner Production 470 (2024): 143300.

- Sen, S., Shuili Du, Bhattacharya, C.B. (2016). Corporate Social Responsibility: A Consumer

- Psychology Perspective. Current Opinion in Psychology, Consumer behavior, 10 (August): 70–75.

- Taskforce on Scaling Voluntary Carbon Markets, Public Consultation Report, May 21st, 2021, https://www.iif.com/Portals/1/Files/TSVCM_Public_Consultation.pdf