In our latest newsletter, we shed light on the functionality of our VCM Compliance Tracker and its role in identifying projects and credits within the VCM that also qualify for compliance schemes.

Today, we're thrilled to announce the launch of a sample version of our VCM/Compliance Eligible Credit Tracker.

Before diving into the details, here are some key insights:

Key Insights from Our VCM/Compliance Tracker Tool:

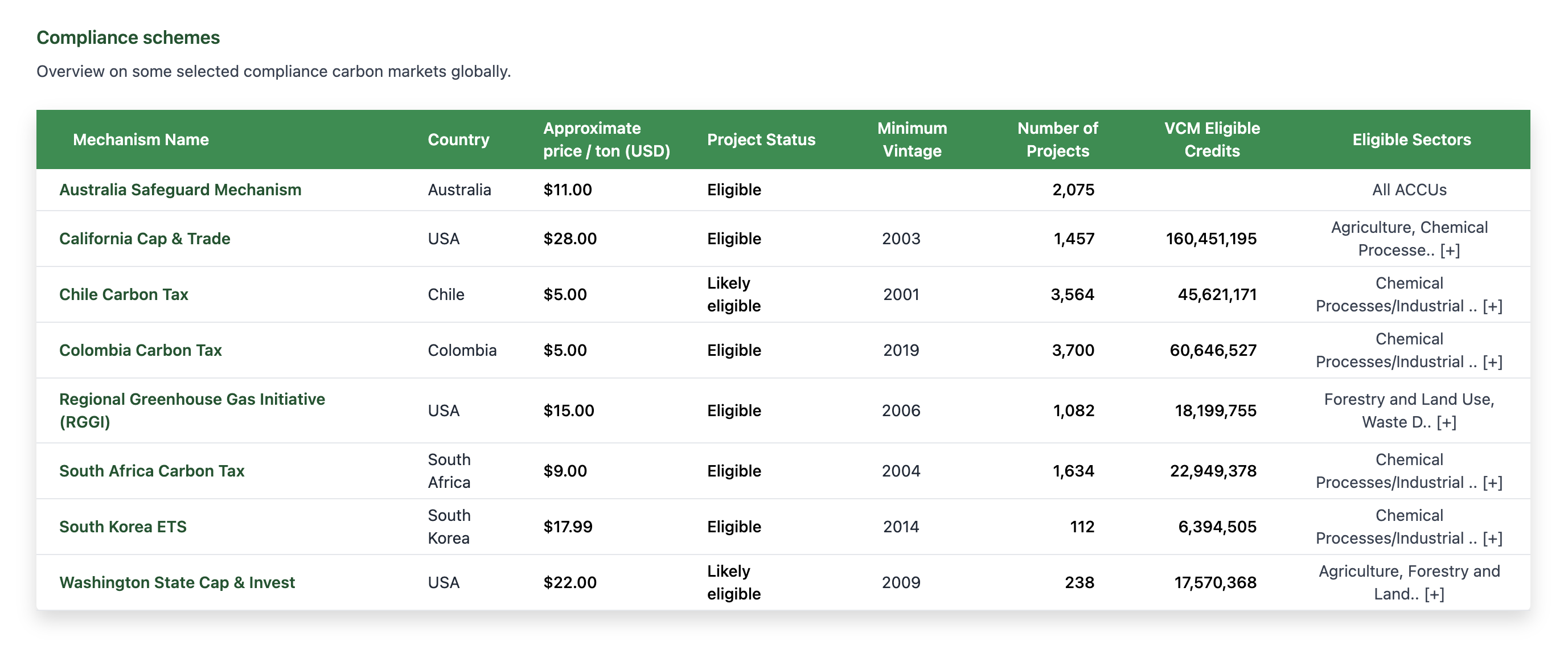

- We have located 13,845 projects across 8 compliance schemes currently listed on the website.

- More than 331 million credits are eligible for at least one or more carbon pricing schemes.

- Among the carbon pricing schemes, Colombia has the highest number of eligible projects currently at 3,693.

- Buyers of the top 5 RGGI cap-and-trade eligible projects by remaining credits include: Disney, Blackrock, ANP Bellingham and Blackstone, PwC and Marsh McLennan

- None of the top 5 Korea-ETS eligible projects by volume of available credits have an estimated offer price of more than $3 / ton. These prices are trending far below the Korean-ETS price ($17.99 / ton).

Q: What is the latest development?

We have developed an open-source tool which identifies voluntary carbon market (VCM) projects and credits eligible for compliance carbon market schemes! Drawing from a sample set of our data across 8 carbon pricing schemes which allow for the use of offsets (including carbon taxes and emissions trading schemes), users can locate the top 5 projects organised by the quantity of remaining credits that we have classified as either currently eligible, or are likely to be eligible for use in the near future.

Q: How does the VCM/Compliance Tracker work?

We have ingested qualitative rules around the use of carbon offsets within carbon pricing schemes, and have run them against our rich dataset of more than 29,000 projects to locate voluntary carbon market projects that are or may be eligible for multiple schemes. This allows for users to identify eligible projects as well as their additional labels e.g CORSIA eligibility, Article 6 readiness (for CDM projects only), CCP readiness and project liquidity scores. Users can also identify the labels we are placing on credits (CORSIA phases, and LOA tags for credits authorised for use under CORSIA, and Article 6 of the Paris Agreement).

Examples of the different parameters we filter for include:

Our tool covers federal level carbon pricing schemes (eg. Australia, Chile, China, South Korea, Singapore, and South Africa), as well as state-level carbon pricing schemes as well including California Cap-and Trade, RGGI, Washington Cap-and-Invest and Queretaro State. We can differentiate between governments which define their own methodologies and protocols beyond the Clean Development Mechanism (China, South Korea), or accept the methodologies of approved standards such as CDM, Verra, Gold Standard or American Carbon Registry for example.

Gain Deeper Insights with The Full VCM Compliance Tracker Tool

The full version of our tool available in the AlliedOffsets Premium Dashboard allows users to search through the full list of projects by sector, registry, country and compliance scheme

The VCM Compliance Credit Tracker is the largest dataset for voluntary carbon credits eligible for use within compliance schemes worldwide. By tracking policy and regulatory updates of more than 12 compliance schemes, as well as the rules around the use of VCM credits to meet emissions reduction obligations, we have assigned labels to credits eligible for one or multiple schemes. Users can filter by jurisdiction (scheme), project location, price, registry and sector among other project-level fields. The Compliance Tracker fits within our larger research of labelling credits and their use for multiple mitigation purposes. This includes assigning labels to VCM credits authorised for use under CORSIA phase I, and Article 6 of the Paris Agreement.

What are some of the use cases of the full tool?

We have developed the dataset for many applications including price discovery and sector-wide reporting. Some queries of the dataset may include:

- Show a list of credits issued between the years of 2018 and 2020, from projects located in Colombia, under the price of $5.

- Show a list of all eligible credits which can be cancelled against Singapore’s carbon tax, based in Papua New Guinea under the price of $6.

- Show a list of all the projects with credits eligible for California ARB Compliance Offset Program, their prices, as well as the brokerages I can purchase the credits from.

- How many pre-2020 vintage credits from CDM projects worldwide are eligible for compliance schemes?

Why have we developed the tool now? Drivers behind the VCM/Compliance Convergence

The VCM/Compliance Convergence is occurring now largely as a response to the EU’s Carbon Border Adjustment Mechanism (CBAM), which aims to prevent carbon leakage by imposing a levy on imports of products with high carbon content. This has prompted countries worldwide to adopt carbon pricing strategies to avoid high costs around exports from their highest emitting industries. For instance, China is expanding its Emissions Trading System (ETS) to include more sectors, such as industries and cement, enhancing its national carbon market where companies can trade emissions allowances and purchase offsets through the CCER scheme. Similarly, countries like Brazil and India, which were active in the Clean Development Mechanism under the Kyoto Protocol, are now integrating the voluntary carbon market within their national carbon market frameworks. These moves signal a global shift towards standardised carbon pricing and trading mechanisms, driven by the need to meet international carbon pricing standards and avoid penalties on exports.

For the projects, this trend presents opportunities and challenges. Projects are likely to see increased demand for credits, as companies seek to offset their emissions not just voluntarily, but also to comply with regulatory requirements. This could lead to a drive of higher standards and verification, aligning voluntary projects more closely with stringent compliance market requirements. It may also lead to increased competition among projects, and a push for higher transparency of trading activity and verification of social impact.

Opportunities and challenges for VCM projects

As compliance demand becomes more important, so too is assessing the level of ambition of ETSs and carbon taxes to allow carbon credit use to meet their obligations. Demand for offsets in the future will always be constrained by

qualitative and geographic limits to projects under schemes. The development of new ETSs and carbon taxes, for example from Indonesia, Turkey, and Vietnam could be an early signal for boosted demand in the near future. Singapore’s rules around the use of offsets to meet up to 5% of taxable emissions from international carbon credits is constrained by both limited supply of eligible projects in Papua New Guinea (as REDD+ projects are currently not accepted under Singapore’s ICC Framework). Increases in carbon tax rates is also expected to increase demand, as South Africa’s treasury proposing a move to triple the carbon tax rate from 190 Rand ($10.05) to 640 Rand ($33.86) per t/CO2e, which could also see increased prices for eligible offsets in the country.

Allowing the use of offsets within compliance markets offers a compelling signal for countries to accelerate their transition to greener technologies outside the scope of carbon pricing schemes, whilst also leveraging the VCM to establish national carbon markets. Voluntary carbon markets are seen as a tool to enhance the long-term competitiveness of domestic industries and broader economies, through financing the development of clean energy and technologies.

In conclusion, our VCM/Compliance Tracker stands as a valuable resource for navigating the complexities of carbon compliance. From locating eligible projects to understanding market trends, our tool offers actionable insights to all market stakeholders.

To learn more about our Compliance Tracker and our other VCM policy products, get in touch with our team!