Until prices fell slightly in the past month or so, the price of carbon offsets had risen rapidly in the previous year.

This rise has been fueled by several factors: increasing pressure on corporates to set out a path to carbon neutrality or net zero to achieve Paris climate goals; increased liquidity in the carbon markets, with more money chasing a finite number of credits; and decentralized finance initiatives Klima and Toucan setting an effective price floor for Verra credits.

Anecdotally, credits are scarce — developers are rushing to issue new credits, but supply is not keeping up with demand at the moment. Increasingly, projects are holding mini-auctions, asking buyers to submit their best bid for price and volume.

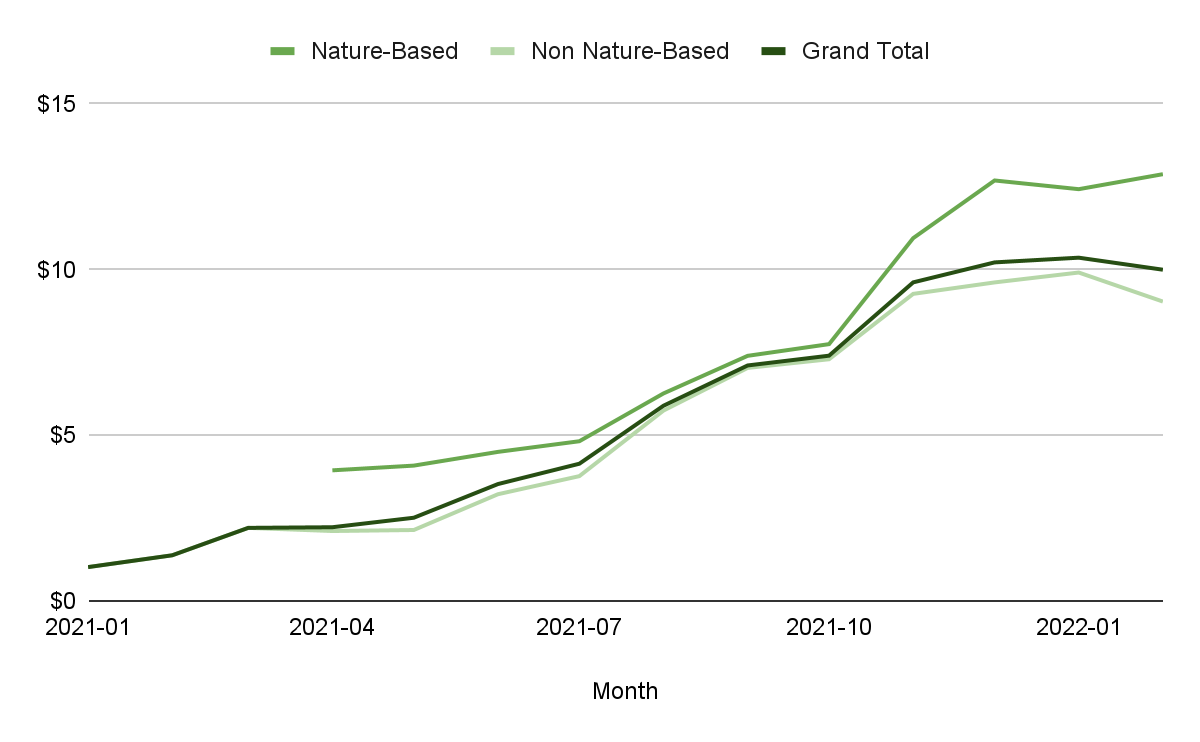

Wholesale Index Prices, January 2021 to February 2022

This chart shows the overall increase in wholesale index prices of carbon credits from January 2021 to February 2022; this data comes from index providers like CBL, AirCarbon, and Platts.

However, prices are not up in all segments of the market. We have looked into our data to find the price increase of resellers, which we collect and update from publicly-available sources (like Gold Standard Marketplace or SouthPole Market).

There, the picture is different. While the wholesale prices have increased from $4.14 to $9.99 between July 2021 and February 2022 — a 141% increase — prices on reseller sites have not had nearly the same bump, rising from $19.38 in July 2021 to $26.19 in February 2022 — a 35% increase.

With the prices continuing to falter in the last month, and an increasingly morose picture for carbon with the conflict in Ukraine pushing up energy prices, it’s highly uncertain how prices will move next.

For the latest, subscribe to our Premium Dashboard — demo here!