Carbon market pricing data can vary significantly depending on the source of the data. It's not uncommon for companies that are looking to purchase carbon credits to notice that pricing data from brokers, market places and other information providers will most likely differ significantly.

For example, a broker might offer credits for $9 per ton, while other platforms, including AlliedOffsets, estimate the same credits at $7. At first glance, this might appear to signal an inaccuracy. However, in our case, our estimates are based on broker data we receive and process, and given that prices vary between brokers, the estimates are often more indicative of market trends rather than anomalies.

Challenges arise, however, when we have limited data for specific projects. In these cases, we leverage broader, high-level data from similar projects or regions to form a benchmark. This allows us to test our estimates against generalised market trends, providing a more holistic view of where a project's price might land. However, even with these checks, the reliability of the estimate can fluctuate based on the depth and quality of the data we have at hand.

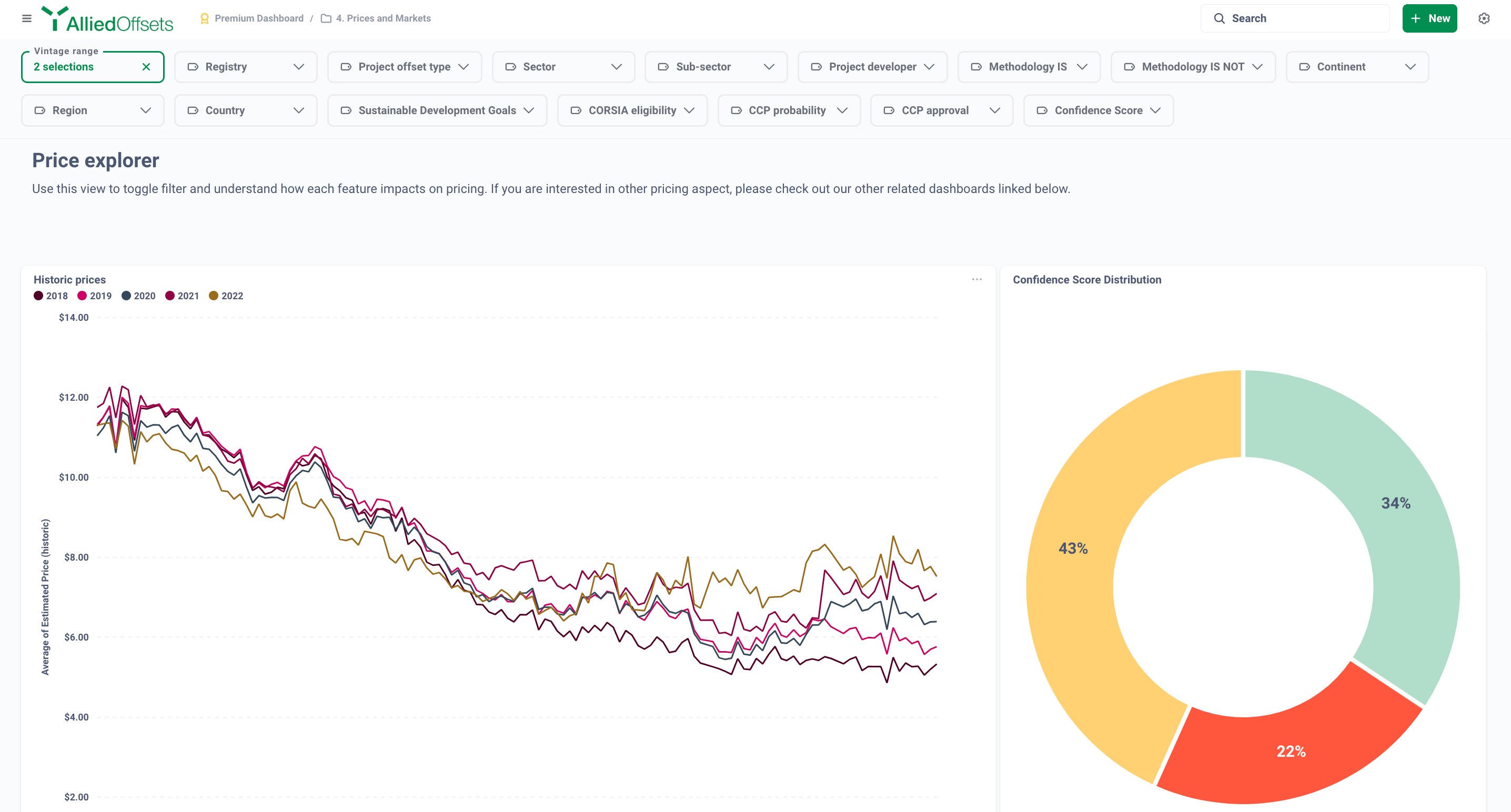

This is why we’ve introduced confidence scores. These scores offer a transparent way to understand how much trust you can place in a particular estimate, clearly categorising them as High, Medium, or Limited confidence based on the potency of the underlying data.

Why Do Pricing Discrepancies Happen in the VCM ?

The carbon market is dynamic, with price variations stemming from multiple sources. Here's why discrepancies are common:

- Broker Price Variation: Different brokers can offer significantly different prices for the same carbon credit, depending on their individual data sources, transaction timings, and market conditions.

- Data Availability: The more brokers and data points we have for a given project, the more reliable the price estimate will be. However, some projects may have fewer brokers reporting prices in the market, leading to a wider range of estimates.

- Market Timing: Carbon markets are constantly shifting. A price estimate that was accurate yesterday may no longer reflect the current market today; this is especially true when projects are spotlighted in the media or receive positive or negative sentiment.

Given these factors, it's clear why price estimates can vary widely. To bridge this gap and provide greater transparency, we've introduced confidence scores for all pricing estimates in our system.

The Role of Confidence Scores

A confidence score categorises the reliability of our price estimates based on the quality and quantity of available data. It helps you understand whether the estimate should be trusted as a reflection of the market or whether you should approach it with caution.

We classify confidence levels into three categories:

- High Confidence: The estimate is highly reliable, with consistent data from multiple brokers.

- Medium Confidence: The estimate is moderately reliable. It’s based on available data, but there may be some variation in pricing or slightly less data.

- Limited Confidence: The estimate is less reliable, often due to limited data or a high degree of variation in the broker prices we’ve collected.

These confidence scores allow you to assess how much weight to give the price estimate you're seeing.

How the VCM Pricing Confidence Score Is Calculated

Our confidence scores are the result of a careful and data-driven methodology. Below is a simplified version of how we determine the confidence level for each project’s pricing estimate.

1. Data Collection

We start by collecting data from multiple brokers and comparing the prices they offer for the same project. Alongside broker prices, we gather:

- Credit-Level Data: Specific attributes tied to the credit itself, such as vintage, quantity of credits, compliance eligibility, and more.

- Project-Level Data: The characteristics of the carbon project, including its sector, region, and methodology.

Overall, our model evaluates a wide range of project and credit feature categories—such as country, registry, CCB status, CORSIA eligibility, and compliance eligibility—alongside key numeric factors like vintage and annual emission reductions to estimate pricing.

For more detailed information, please refer to our Pricing Model Overview.

2. Price Dispersion Analysis

We analyse the variation, or dispersion, in broker prices for each project. A low price dispersion indicates that brokers are largely in agreement about the project’s value, which increases our confidence in the estimate. Higher price dispersion means that brokers are reporting widely different prices, which reduces our confidence score.

3. Leveraging High-Level Data for Limited Information

When we have limited direct data on a project, we expand our scope by looking at high-level data from similar projects, regions, or project types. By comparing the project to broader market trends, we can offer a well-informed estimate even when broker data is sparse. However, this approach often results in a Limited Confidence score, as the estimate is less direct.

4. Assigning the Confidence Level

After evaluating data quantity, price dispersion, and any high-level testing, we categorise the estimate into one of three confidence levels:

- High Confidence: Based on a large amount of consistent data.

- Medium Confidence: Somewhat reliable, with moderate data and price agreement.

- Limited Confidence: Based on limited or highly varied data, indicating the estimate may be less accurate.

Why Confidence Scores Matter

By introducing confidence scores, we aim to provide greater transparency to how you assess price estimates. Here’s why they matter:

- Transparency: Users can now see not only the price estimate but also how reliable it is, making it easier to interpret pricing variations.

- Informed Decision-Making: users can make more educated decisions about when and where to purchase carbon credits, based on the confidence score

- Model Refinement: The confidence scores help users identify which areas need more data or refinement, improving the overall accuracy of our pricing models over time.

What’s Next?

As we continue to gather more data and refine our pricing models, we expect the accuracy of our estimates—and the reliability of the confidence scores—to improve.

Carbon pricing is complex but with the introduction of confidence scores, we’re aiming to provide a clear way for you to evaluate the reliability of our estimates. Whether you’re a buyer or seller of carbon credits, knowing how much confidence to place in an estimate can make all the difference in your decision-making process.

Explore the confidence scores on our platform today, and see how they can help you make more informed choices.