AlliedOffsets is excited to announce the launch of two new data products for the market: the VCM Activity Tracker and the Project Liquidity Score.

The products will help market participants to understand how the voluntary carbon market is trending overall, and to get a sense of which projects’ credits are the most easily tradable at any given time.

The data can be found on our revamped VCM pricing page, which also makes publicly available a number of additional data points.

The data products continue our company’s commitment to transparency in the VCM, and expand our offering of unique and industry-leading data on VCM pricing.

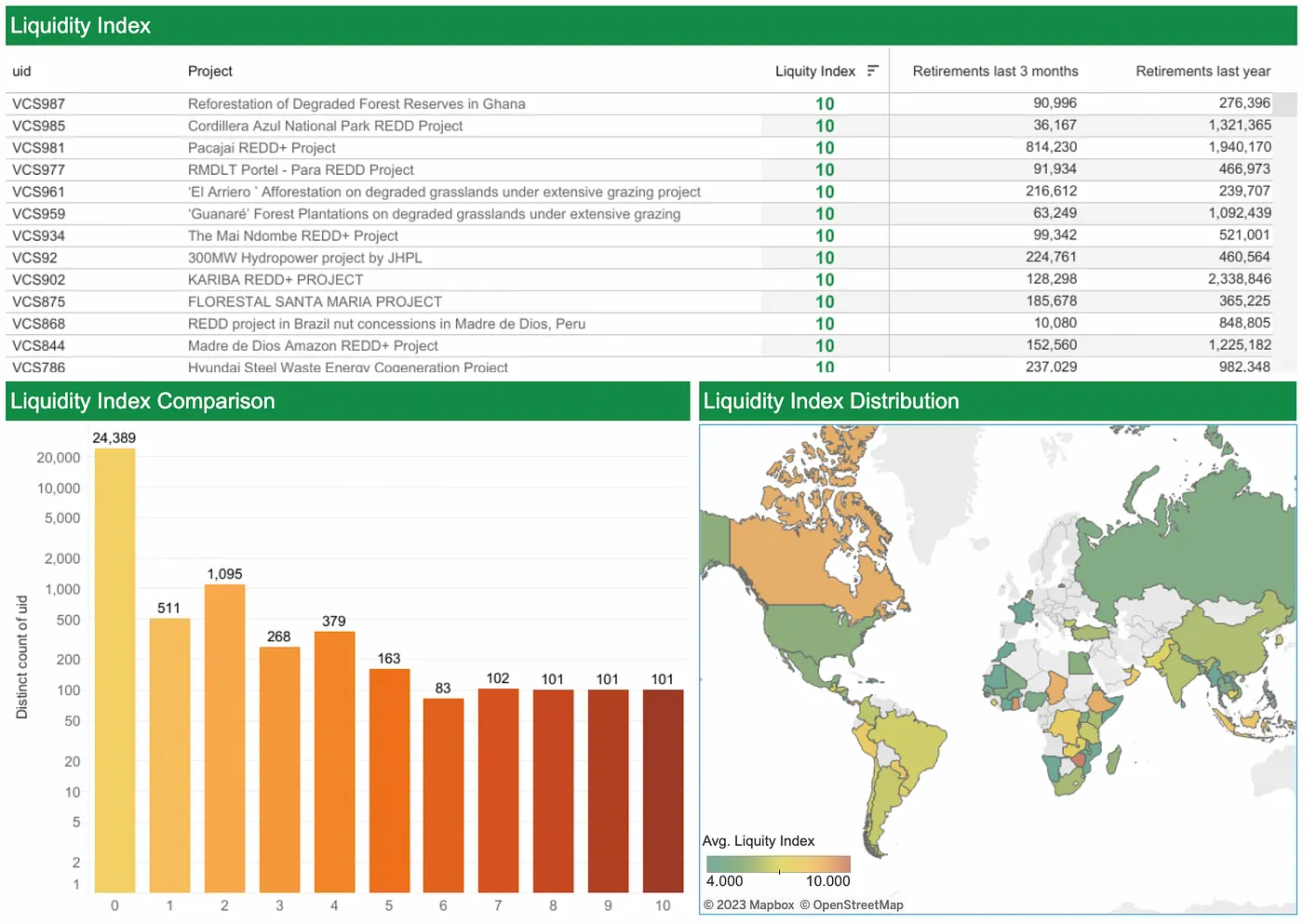

The Liquidity Score allows anyone to get a better understanding of how actively a project’s credits are being traded at a given time. This data comes from information provided by our broker partners, online exchanges, and other actors in the space, as well as fundamental issuance and retirement data.

In short, the more brokers and online resellers have a project in their portfolio (or have traded it), and the more issuances and retirements a project has had recently, the more likely it is that a stakeholder in this space will be able to identify a buyer or seller for the project’s credits. For more information on how the score is calculated, please read Tushar’s blog.

Inspired by brokers’ comments that the market is currently in a rut, the Activity Tracker is a measure of the market overall. Instead of keeping track of individual projects, it aims to provide a view on how active the VCM is, and how the activity compares with previous months. The data comes from publicly available exchange data, as well as trade data provided by broker partners and publicly available sources in the space. You can read more about the Tracker in Maria’s blog.

Simplified versions of the Liquidity Score and the Activity Tracker can be found on our new Pricing page. The page includes:

- AlliedOffsets Indices going back 12 months

- VCM Activity trends, broken down by Exchange and OTC

- Project-level activity numbers

- Sample bids, offers, and transactions in the VCM over the last 10 days

AlliedOffsets clients can access the full versions of both products by logging into their dashboard.

If you have any questions, please contact hello@alliedoffsets.com.