AlliedOffsets forecasting for the voluntary carbon market is now live on our dashboard. Specific forecasting scenarios and filtering capabilities are now available for customers on our dashboard. Here users can play around with the filters and update the country, sectors and growth scenario (including low, medium and high).

Over the coming weeks, we’ll share country-specific outputs from our forecast model on our blog. Today we are sharing some examples from Kenya.

Join our LinkedIn Live event with our Policy Lead, Fundi, to hear more about carbon market developments and forecasting for Kenya. Tune in on Friday at 11 AM next week!

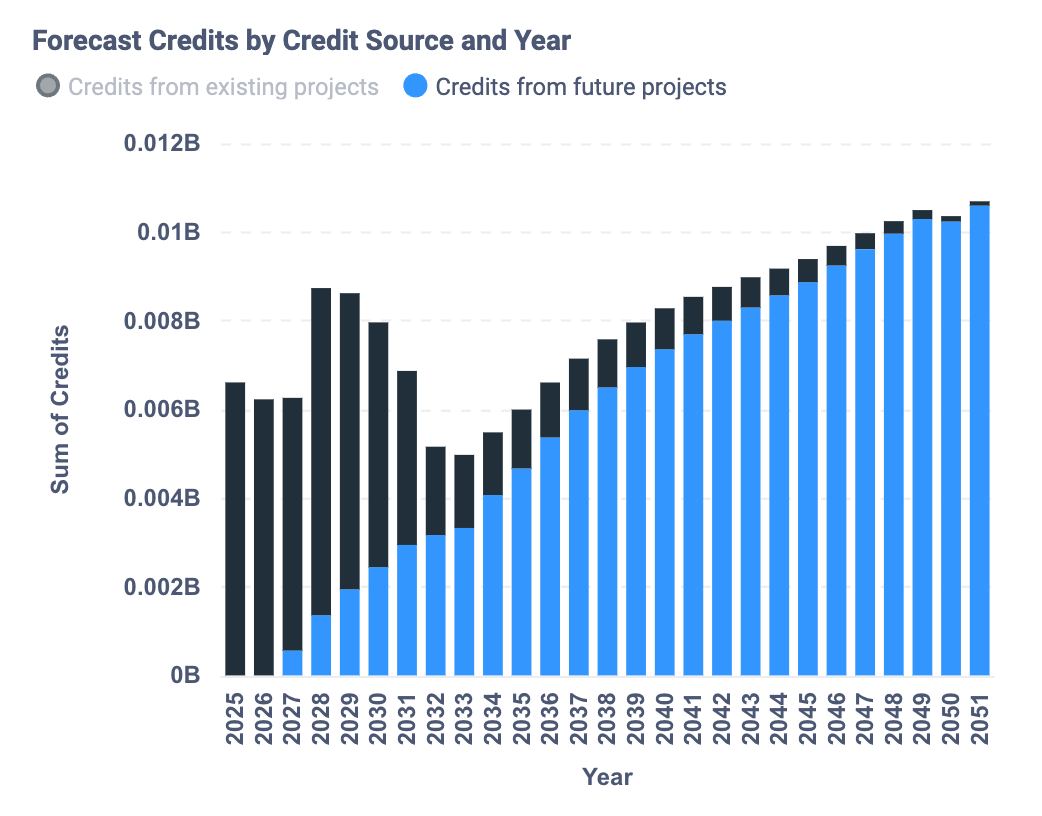

Forecast Credits by Credit Source and Year - Medium Growth Scenario

Forecasted Carbon Credit Supply by Source (Existing Vs. Future Projects)

Using Willingness to Pay to Predict Market Prices Per Sector

For commodities like carbon credits, prices vary widely. Our model estimates sector-specific price premiums and discounts, allowing us to use a single market-clearing price when generating outputs. Currently, the market-clearing price is $3-4, derived from the AO500 Index.

When prices are low, as they are today, high-cost projects struggle to attract enough demand. As prices rise, more buyers are expected to pay for higher-priced credits as the premium will not be as far off from the market averages.

Our model shows the expected market prices for each project type annually. If there’s no price point in a given year, it’s because we predict insufficient demand at the required price for a particular project type to emerge. For existing credits, prices will remain steady in such cases.

Forecasted Carbon Credit Prices by Sector (2025-2050)

We see a big potential in Kenya for revenue projections from future projects

Forecasted Revenue from Carbon Credit Projects by Source (2025-2050)

Join our LinkedIn Live event with our Policy Lead, Fundi, to hear more about carbon market developments and forecasting for Kenya. Tune in on Friday 6th of June at 11 AM!