We are thrilled to present our research, which categorises VCM (Voluntary Carbon Market) credits suitable for integration into compliance offset protocols across diverse jurisdictions, as compliance and voluntary carbon markets seamlessly merge.

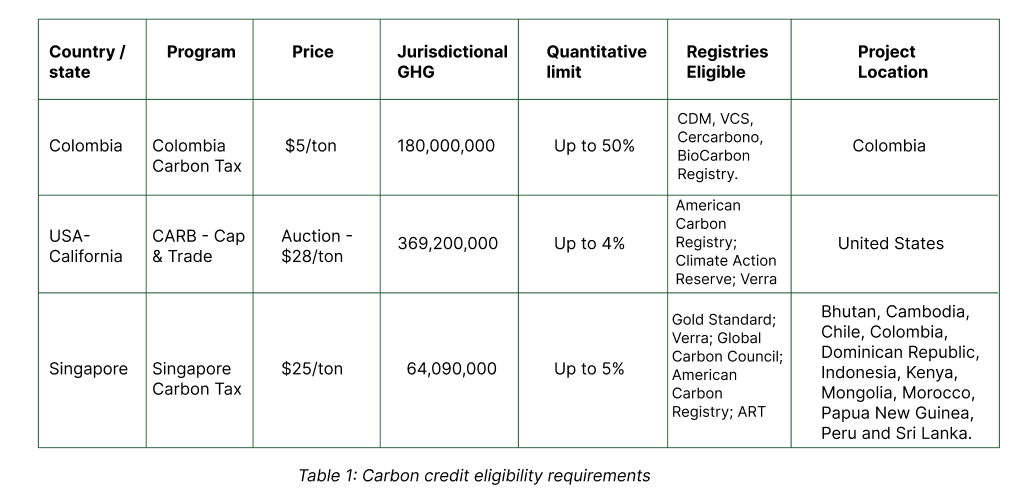

Our efforts encompass the identification of credits from more than 1917 projects, eligible for 11 distinct compliance carbon market schemes including the California (CARB) Compliance Offset Program, the Regional Greenhouse Gas Initiative (RGGI) ETS, Colombia’s carbon tax program, the Korean Offset Program (KOP), South Africa’s Carbon tax scheme (COAS), and others.

The 11 compliance schemes we have covered so far include:*

- Australia Safeguard Mechanism

- Colombia’s carbon tax

- China ETS - CCER

- Japan - Saitama ETS

- Japan - Tokyo CaT

- Kazakhstan ETS

- Singapore’s carbon tax

- South Korea’s ETS (K-ETS)

- South Africa’s carbon tax

- USA, California - CARB Cap & Trade

- USA, Regional Greenhouse Gas Initiative ETS

- USA, Washington - Cap-and-invest program

* As guidance continues to be published, we continue to refine our tagging instructions for eligible projects.

How do compliance offset schemes work?

Carbon pricing schemes, such as Emissions Trading Schemes (ETS) or Cap-and-Trade programs set a cap on the total amount of greenhouse gas emissions allowed within a specified jurisdiction or sector. By allocating or selling a limited number of emissions allowances to entities operating within the covered sectors. Usually set to cover power sectors of the economy, participating entities must procure allowances (either through free allocation or auctions) which can be bought or sold, creating a market among participants. Creating financial incentives for compliance, carbon pricing schemes aim to drive innovation and incentivise companies to adopt clearer technologies and practices.

The integration of carbon credit units into compliance schemes provides jurisdictions with increased flexibility in supporting these schemes. They increase the scope of climate action by encouraging voluntary emissions reductions in more sectors, lower the costs of achieving national emissions targets, and may help stabilise the carbon market. Carbon credit use can also extend to include activities outside the jurisdiction.

Offsets can be sourced from various crediting mechanisms, managed domestically or externally (internationally). Nationally administered mechanisms include California’s Cap-and-trade program, the Korea Offset Program (KOP) and New Zealand’s ETS also generate their own offset credits. Whereas external mechanisms like CDM, Verra, Gold Standard, and ACR generate offsets by overseeing projects that reduce emissions. Some compliance schemes adopt a hybrid model, combining both external and national mechanisms. This mixture includes outsourcing administrative tasks (eg. managing registries and accreditation processes), which allows for carbon accounting and offsetting processes to be streamlined.

The use of carbon credits in compliance schemes is determined by government-led guidance around qualitative and quantitative criteria of projects.

- Sources/registries: Credits must be generated either from projects registered on domestic (China’s CCER scheme) or external mechanisms (Gold Standard, Verra, American Carbon Registry etc.).

- Vintages: Guidance on the vintage or crediting period of credits which will be accepted.

- Methodologies and sectors: Allows jurisdictions to select activities it will accept credits from. Methodologies are either selected by jurisdictions themselves (California, RGGI, South Korea), or they accept methodologies approved by standards (Colombia, South Africa).

- Quantitative limits: Define the percentage of emissions corporations can use carbon offsets to meet compliance requirements. For example, the California Air Resources Board details that obligated companies can use carbon credits to meet up to 4% of their tax obligations, which differs from other jurisdictions such as Singapore (5%) and South Africa (10%). Jurisdictions to incentivise high emitting entities to decarbonisation of high emitting entities supply chains by lowering their Scope 1, 2 and 3 emissions before opting for the use of carbon credits or emissions allowances.

- Qualitative criteria: Allow jurisdictions to determine high environmental integrity of emissions reductions or removals, as well as manage risks around determining project additionality, quantification and verification and permanence of mitigation activities among other factors.

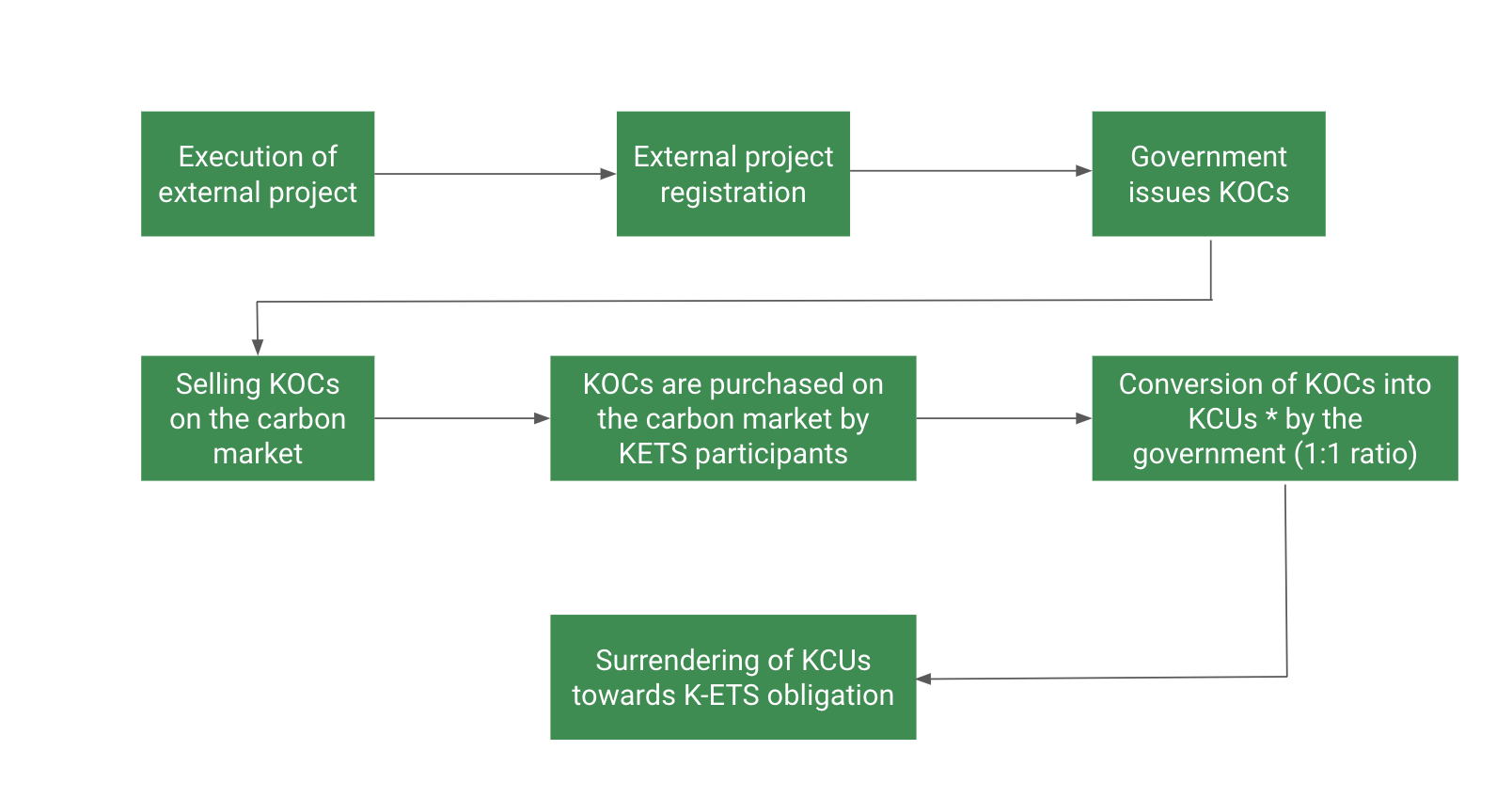

The use of carbon credits in the Korean ETS

The Korean government has set guidelines on the use of internationally generated carbon credits (from “external projects”), within Phase 3 (2021-2026) of the ETS. Credits, following a process of conversion, can be used to meet compliance obligations under the Korean ETS (K-ETS). Certified emissions reductions (CERs) generated under the Clean Development Mechanism (CDM) can be cancelled in exchange for Korean Offset Credits (KOCs), which can be used either for voluntary carbon footprint offsetting, or converted into Korean Credit Units (KCUs) for use under the Korean ETS.

Figure 1 - The Conversion Process of Korean Offset Credits (KOCs) into Korean Credit Units (KCUs) under the Korean ETS

Methodologies

Based on qualitative criteria requirements for each compliance regime, we query credit and project endpoints from the AlliedOffsets API to return projects eligible for inclusion in the scheme. This allows us to return unique project IDs, project developers, estimated offer prices and brokers that sell eligible credits for each regime.

For schemes with well-defined requirements, we've outlined the list of eligible projects. However, in jurisdictions where guidelines are still evolving—like Singapore’s carbon tax scheme (ICC Framework), Mexico’s ETS, Chile’s offset tax scheme, and China’s Certified Emissions Reduction (CCER) scheme — we've tagged credits based on the eligibility criteria outlined in published guidelines.

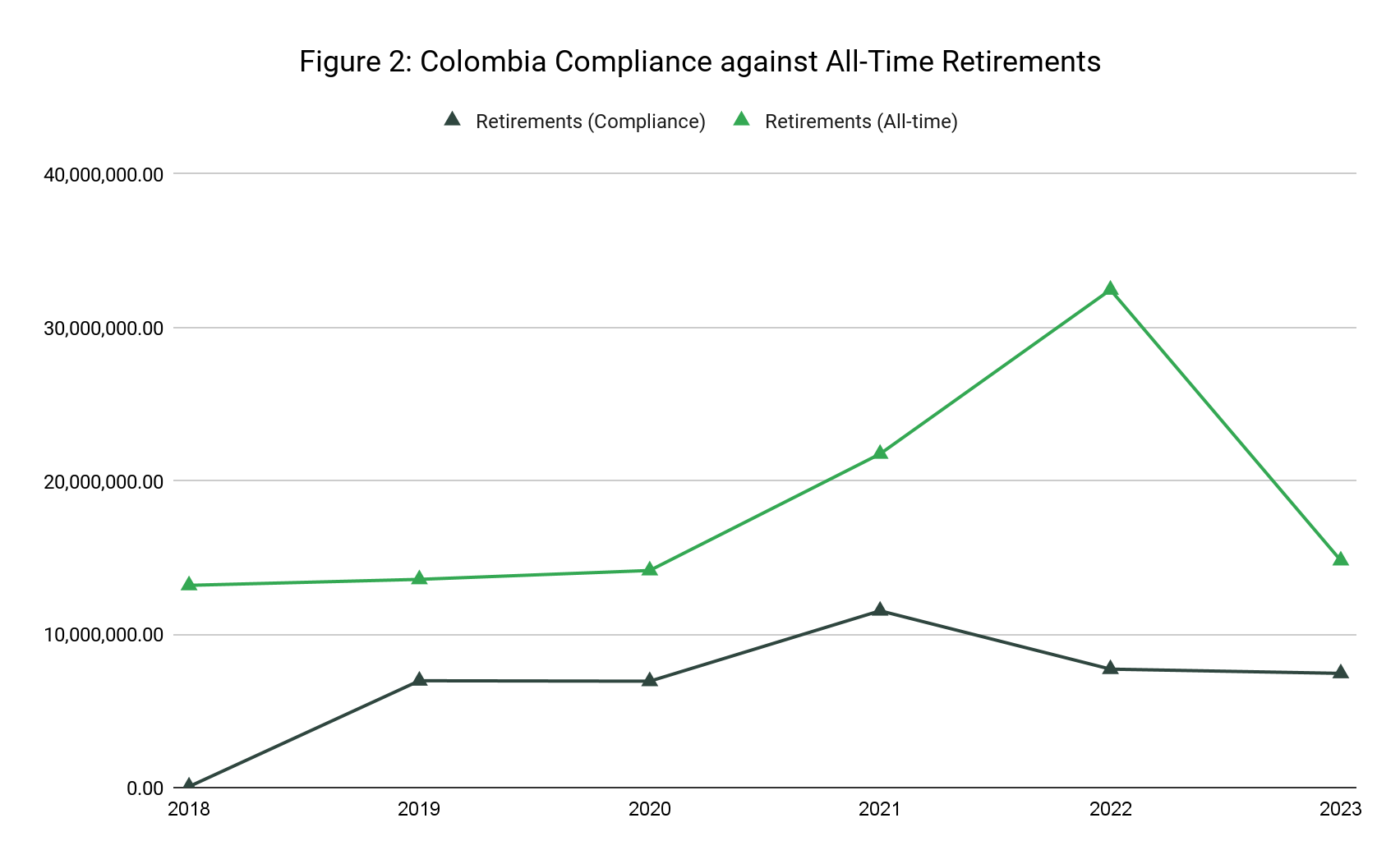

Colombia's Carbon Tax

At present, Colombia’s active carbon tax applies a levy of approximately $5/tCO2 to imports and sales of fuels. Previously allowing obligated entities to meet 100% of their compliance obligations with the use of domestically generated carbon credits, reforms to the tax law in 2022 meant that from January 2023, the limit was revised to 50% of compliance obligations under the scheme. At present the scheme only accepts domestic generated credits, but may accept international offsets in future.

Colombia’s carbon tax can be classified as a primary driver of voluntary carbon credit retirements in the country. According to insights from our AlliedOffsets database:

- 36% of all-time credit retirements in Colombia have been cancelled against the carbon tax.

- Percentage of retirements rose from 23.8% to 50% of retirements in Colombia in the past year (2022 to 2023), following the reform of the tax law in 2022.

- Colombia was the 2nd highest country by retirements of the Top 26 most active jurisdictions in the VCM in 2022.

According to guidance from the Ministry of Environment and Sustainable Development, credits must have been generated in Colombia, hold a minimum five-year vintage, as well demonstrate additionality through the construction of baselines, robust validation, verification. The scheme accepts methodologies approved by projects listed under international standards, and operates similarly to the South African Carbon Offset Programme, which accepts credits selected projects listed under Verra, Gold Standard and the Clean Development Mechanism (CDM).

Implications for the growth potential of carbon markets

The VCM has been expected to grow to $10-$40 billion in value by 2030, in contrast to the compliance market projections of between $200-$500 billion within the same time frame. In our latest VCM Forecast Report, we expect existing corporate buyers may drive demand for up to 1.5 billion metric tons of carbon credits by 2030. Based on the issuance trends of existing and new projects, the supply for credits could reach up to 600 million metric tons by 2030. As many ETS systems mature into their second and third phases, they are beginning to allow rules which allow obligated entities to use domestic and international offsets, subject to qualitative and qualitative criteria, to be used to meet their compliance obligations.

Offset projects are emissions reduction activities generated by crediting mechanisms both domestically and internationally. Protocols are typically selected to extend the scope of the ETS, and increase country climate ambitions.

Market participant implications

- For global climate action – higher quality carbon offsets can complement direct abatement measures and achieve cost-efficient emissions reductions. According to the International Energy Agency (IEA), offsets could provide up to 1.5 Gt/CO2e reductions per year by 2030.

- For buyers and brokers – this represents the prospect of increased carbon market liquidity and diversity, improved credit quality and transparency as well as potential reputational benefits such as making contribution claims towards the achievement of NDCs.

- For project developers – this represents potential for increased demand in credits, enhanced project financing opportunities, and the prospect of higher prices per ton of carbon sequestered.

- For jurisdictions – represents a chance to increase climate ambition, leverage the expertise of global VCM integrity bodies and outsource the administrative costs - including program management, accreditation and management of registries.

As the VCM enters a new phase of growth, we look forward to sharing which credits are eligible for acceptance under multiple jurisdictions, the most compliance-eligible active projects as well as credit prices and active brokers in the space.

Eager to explore the latest insights on compliance-ready projects and credit prices? Or interested in having a conversation about our methodology, AlliedOffsets Policy data and analysis? Reach out to us or schedule a demo at hello@alliedoffsets.com!