CDR is a high capex industry with novel technology that yet has no obvious product to market to buyers. This makes an awkward funding proposition for investors – yet their cash is crucial to funding the industry.

Luckily, AlliedOffsets has been tracking investments in the space to show you where the money is going, and we’ve put together a few stats and graphs to give you a brief overview of what is going on in investors' heads within the industry.

Overview

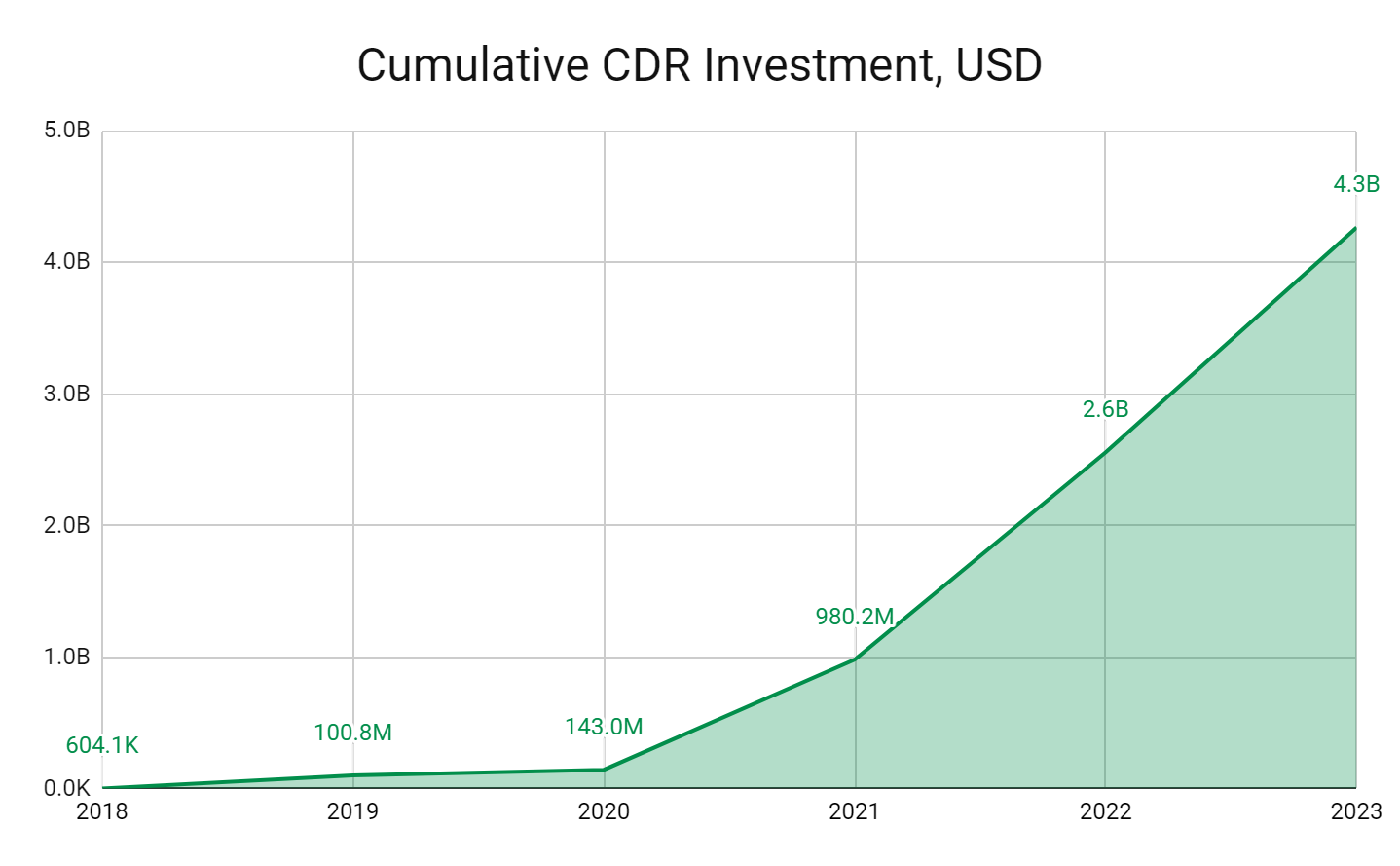

Overall there has been a total $4.3b invested into CDR across 90 investments (not including funding by governments). 2023 was another big year for CDR with $1.7b invested, following an increasing year on year funding into the sector as can be seen in figure 1 below.

CDR also bucks the trend in the climate tech investment space in 2023 as it shows a 6% increase in CDR investment as opposed to an overall 30% decrease in all climate tech investments according to Sightline (formerly Climate Tech VC). This is exciting, but important to note that CDR still has a long way to go, only consisting of 5.3% of all climate tech investments in 2023.

Largest CDR Investments

Some of the largest investments were made last year with the 3rd largest in 1PointFive a DAC company getting $550m, (note this was project financed) and 4th in Svante a CC company with $318m, which account for 15% and 9% of total CDR investment. These investments are only marginally dwarfed by the largest investment in CDR, Climeworks’ $650m investment in 2022 and 2nd largest in Solugen, a UTL company that garnered $592m in their series C in 2021.

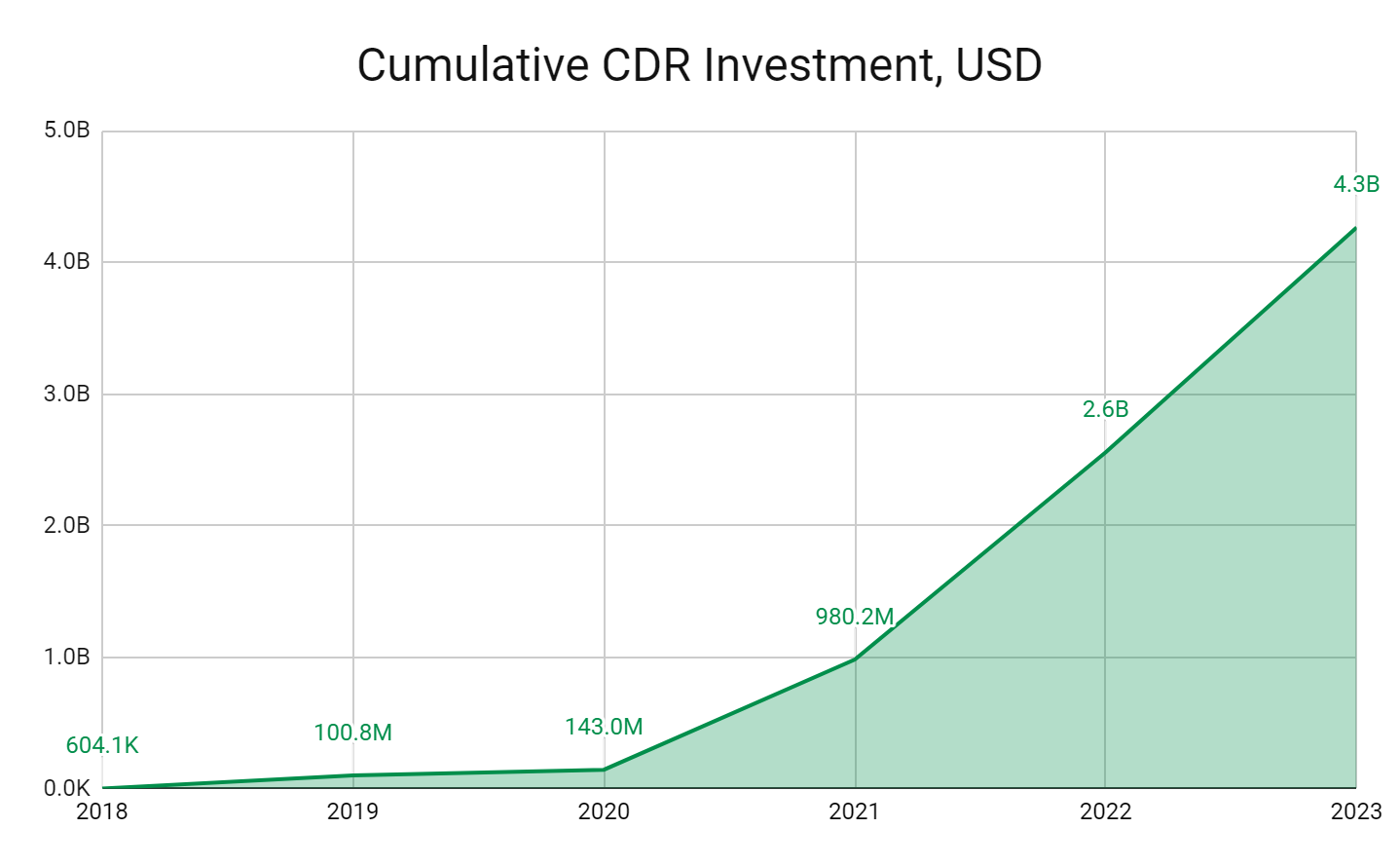

The most active investors as seen in figure 2 are Lowercarbon Capital and the Grantham Foundation, each of which have participated in 18 (known) funding rounds for CDR companies. Lowercarbon Capital, especially, have seen success in their investments, with $100m investment into the likes of Charm Industrial, the largest non-biochar deliverer of CDR credits having delivered approximately 6500 credits to date, and $53m into Heirloom, which Microsoft purchased 315k credits this year, and the 4th largest single purchase of credits in the market accounting for 4.2% of all credits purchased.

CDR Methodologies Leading the Way

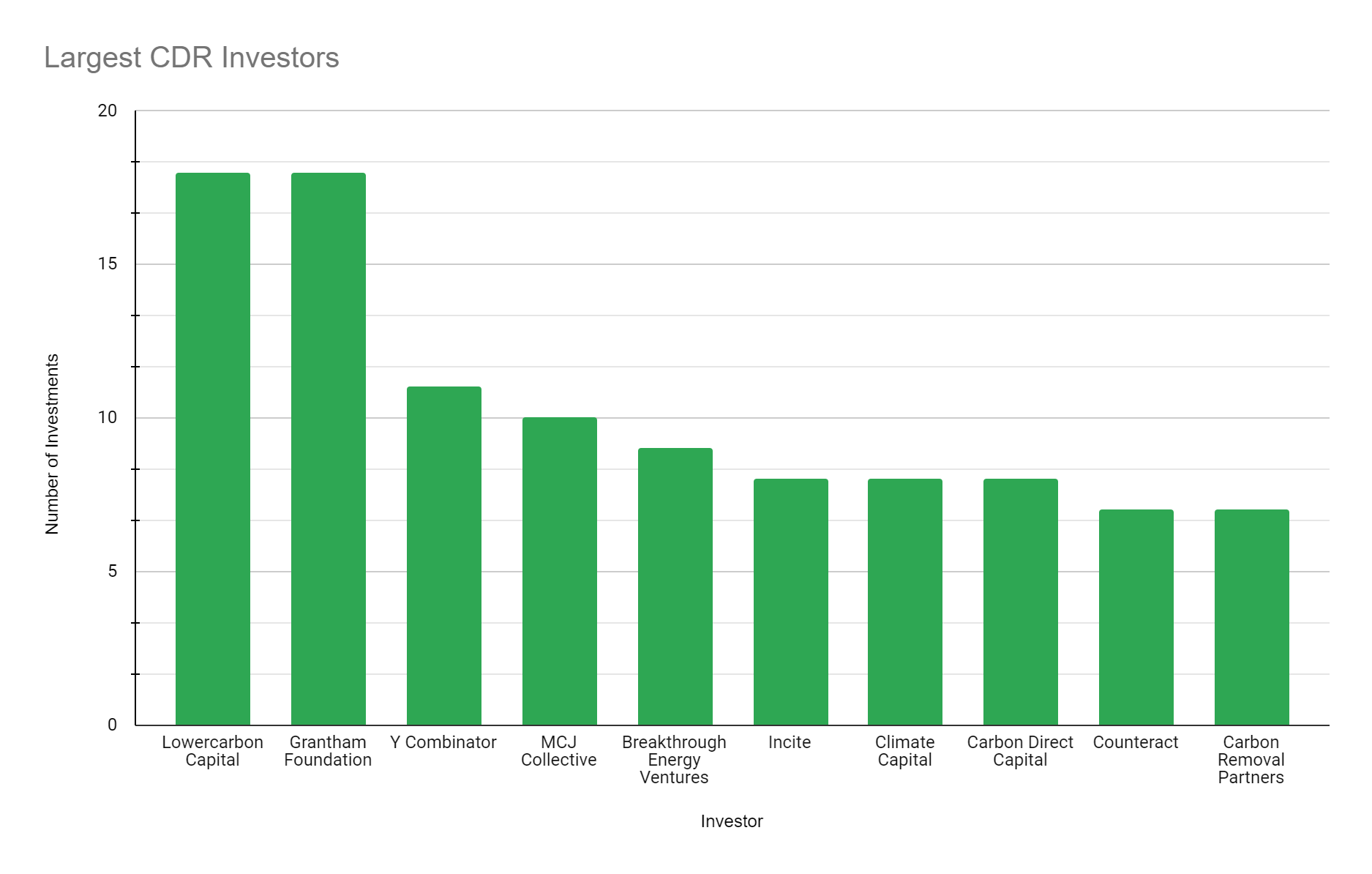

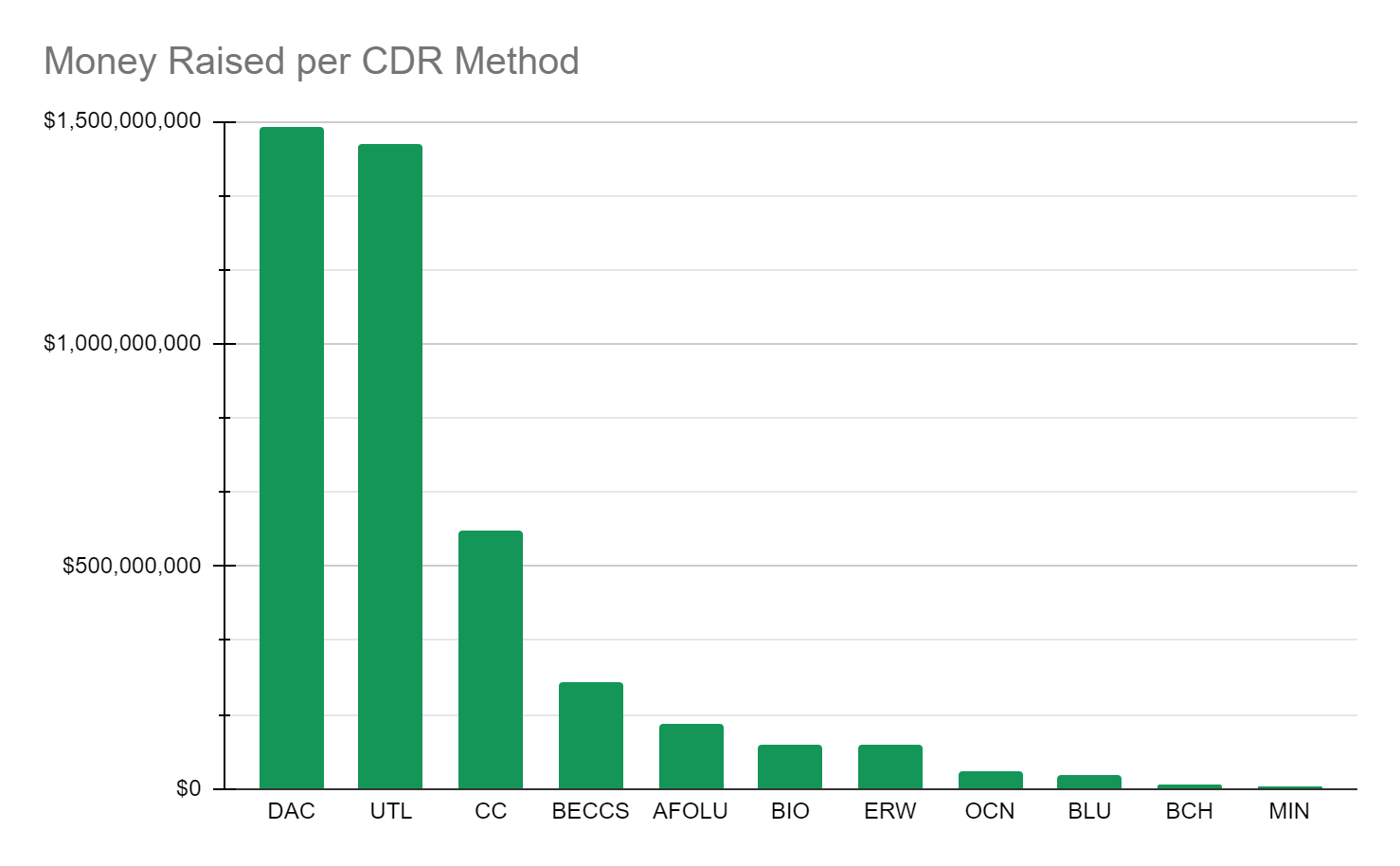

When it comes to the various types of CDR, DAC and UTL are the winners, with $1.49 and $1.45b invested each methodology, making up ⅔ of investment into CDR overall The spread can be seen in figure 3 below:

This split is interesting because out of approximately 620 CDR companies within CDR, there are 200 UTL companies and 87 DAC companies, however each have 38 and 18 separate investments respectively, showing that the number of DAC investments per company are much larger. The distribution of funding per company is top heavy where as you can expect top 2 companies of each methodology (DAC & UTL) represent the majority of investment within the methodology; Climeworks and 1PointFive combined comprising 70% of all DAC investments, and Soulgen with a total of 41% of all UTL investments.

If you are interested in learning more, please get in touch and we’ll be happy to give you a demo of our dashboard. Otherwise, check out our CDR 2023 Landscape report here for more insights!