We’re excited to announce our latest voluntary carbon market retirement analysis, which highlights key trends of 2022 and makes (unreasonably early) projections for 2023!

Overall, we estimate the value of credits retired — one way to measure market size — hit $1.3b in 2022.

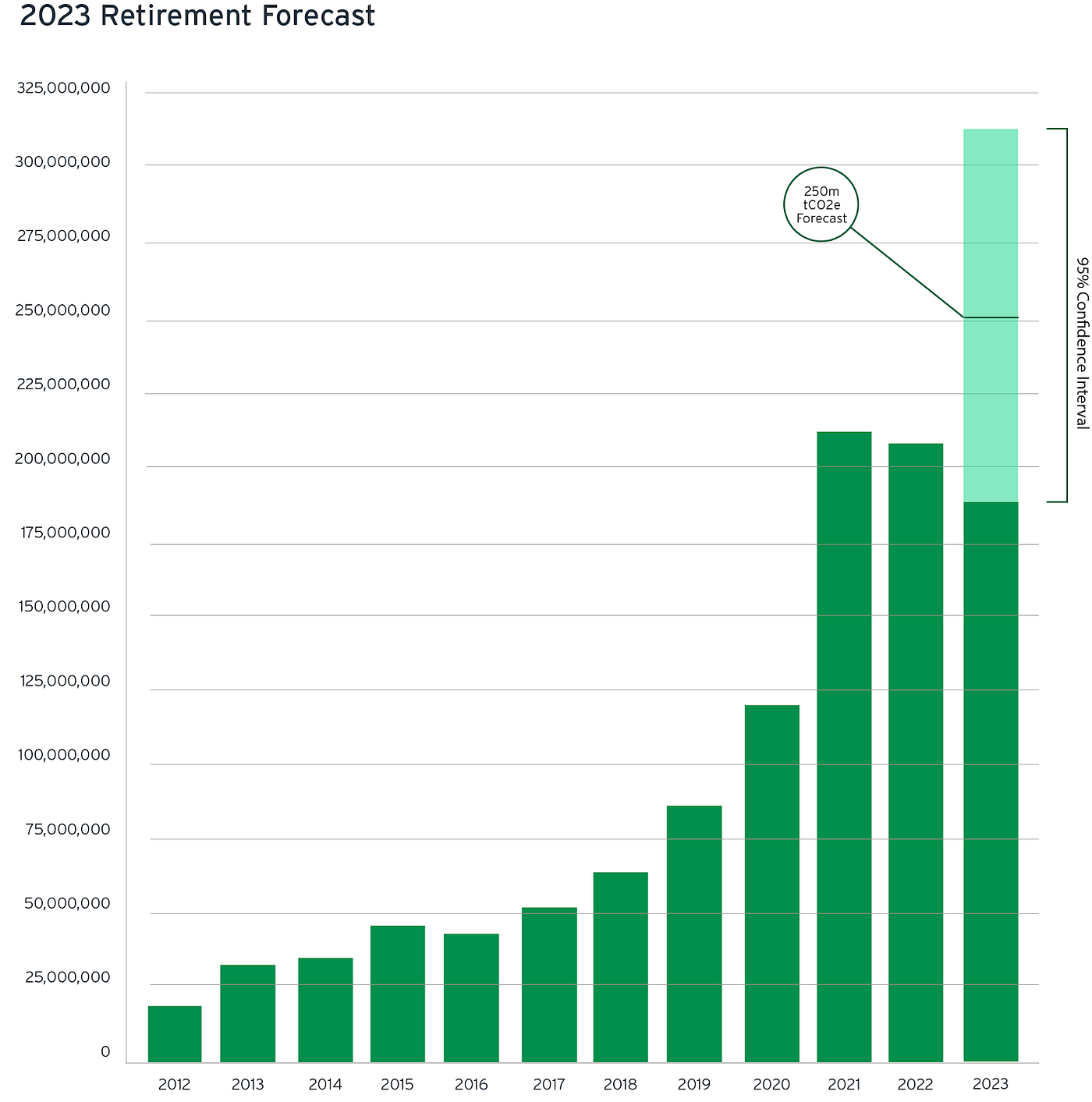

The year finished with 205m credits retired, just under 2021’s 208m credits. Following this year of reduced activity in the voluntary carbon market, we forecast retirements to grow in 2023 by 22%, to 250m.

Given how early it is in the year, the 95% confidence interval for the year is wide: 188m tCO2e to 313m tCO2e. As the year progresses, we will continue to update our analysis. In September, we made a similar projection, which ended up being 4% off the final tally for the year: we hope our 2023 prognostication is just as accurate.

2022 also saw a dip in credits issued, which we again forecast will rebound in 2023.

The year was a mixed bag for those in the VCM: pessimists will look at falling retirement activity, issuances, and prices as signs that the market overheated in 2021 and is failing to live up to lofty expectations. Optimists will point to the fact that when tokenized credits are excluded from the analysis, the market actually grew by ~4% this year — despite a looming recession, high inflation and interest rates, and geopolitical instability caused by the war in Ukraine.

The 40-page report includes analysis of:

- Corporate activity

- Credit prices

- Transaction profiles

- Issuances and retirements by sector

- Vintage and volume of unretired credits

- Top countries

- And much more!

Visit our site to download the report!