The Carbon Engineering acquisition by Occidental is yet another sign that the carbon dioxide removal (CDR) industry is maturing.

And while the industry is relatively new, hundreds of millions of dollars have been poured into CDR companies, suggesting more exits are on the horizon.

As part of our revamped CDR offerings, we’ve collected data on over 550 companies around the world that are looking to capture, store, or utilize carbon in some way — you can check out the public dashboard here.

Behind the scenes, we’ve also been looking into data on CDR investors. To date, we’ve collected information on:

- 177 investors

- 112 funded companies

- 367 investments

- $4b in investment activity tracked

Below are some summary statistics that can help to put the Carbon Engineering acquisition in wider context.

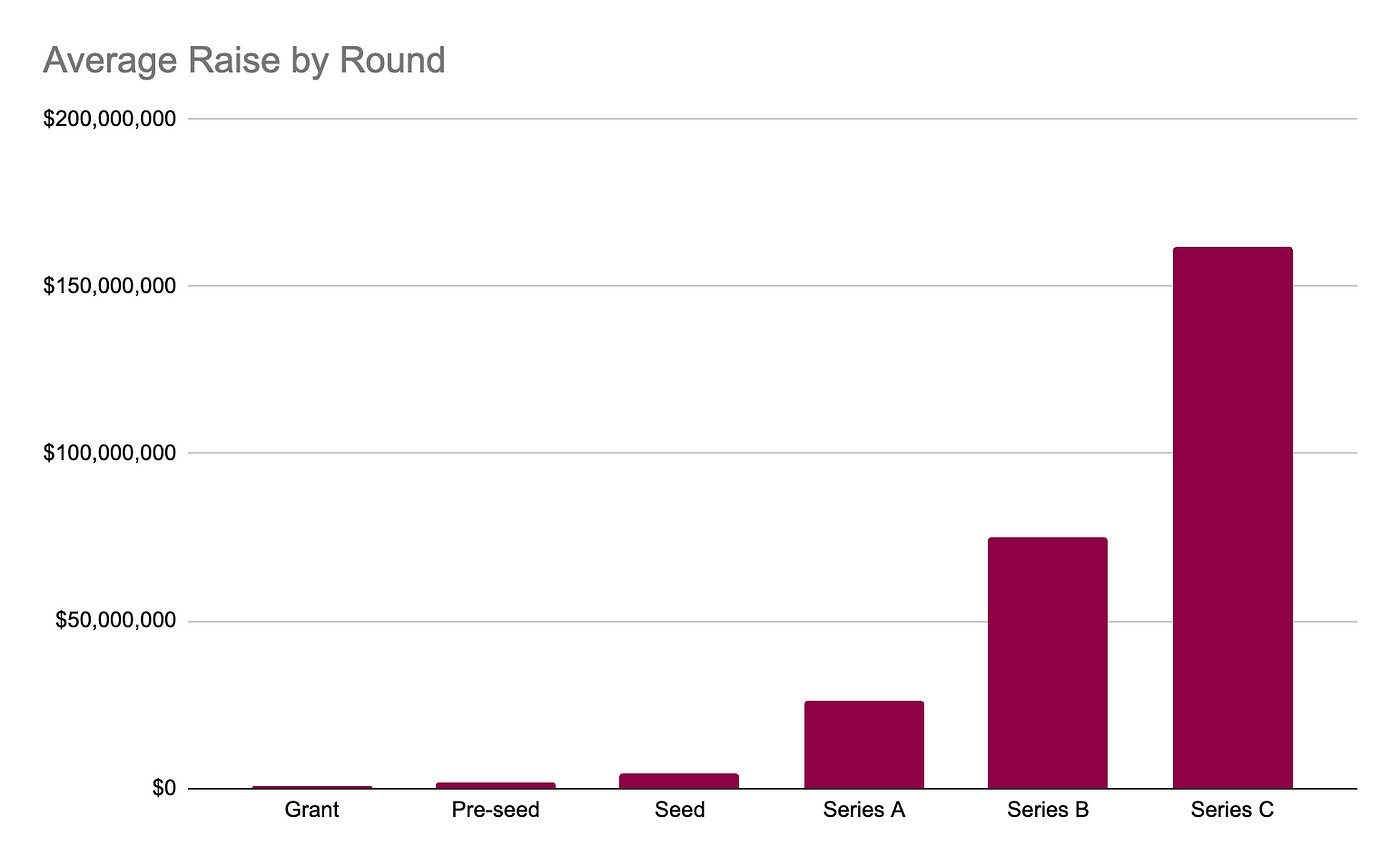

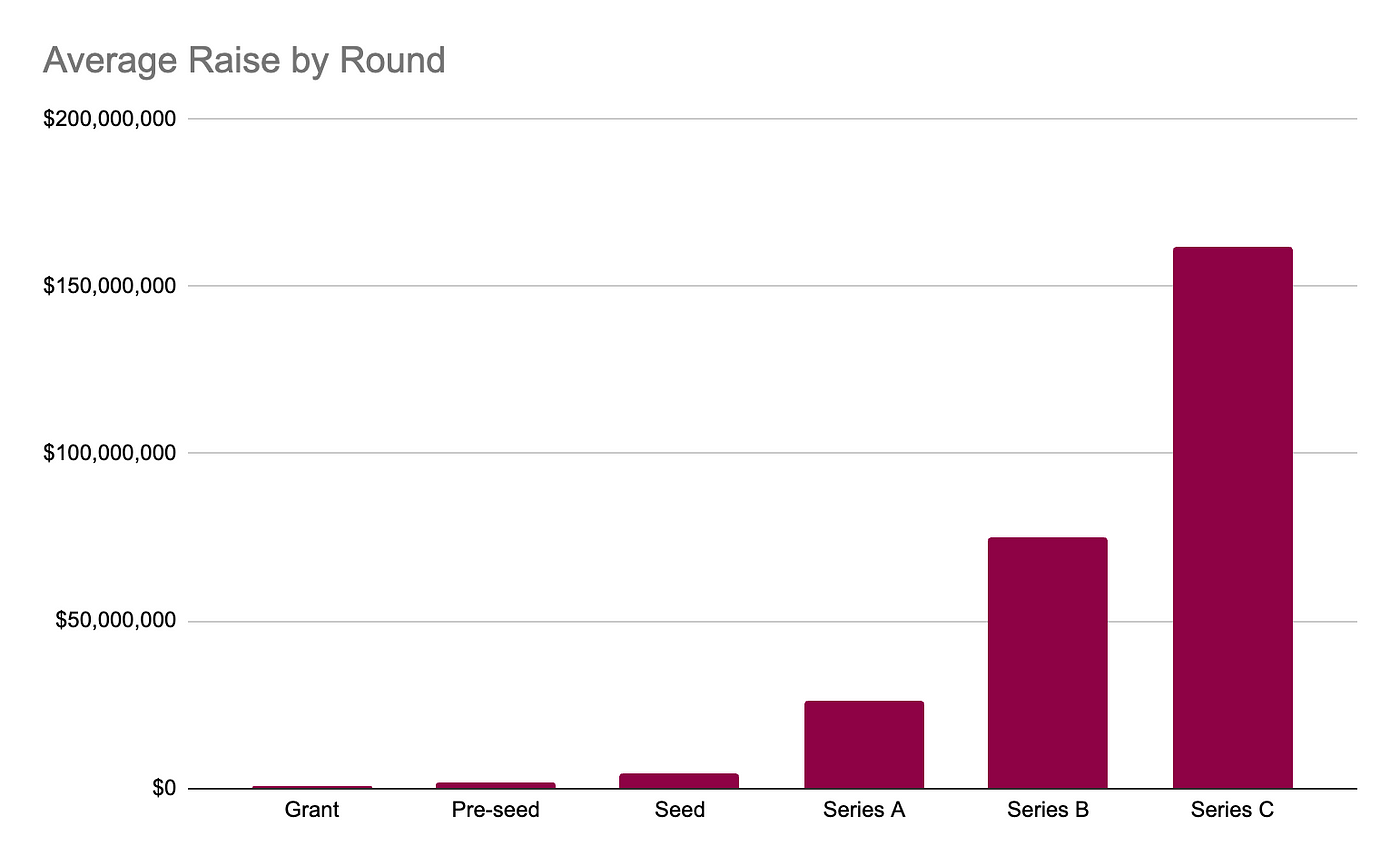

We see larger rounds than average in CDR. The gap widens as companies prove out their models and get further into the funding rounds: this is likely due to CDR being an inherently hardware sector, meaning economies of scale are harder to optimize than in software.

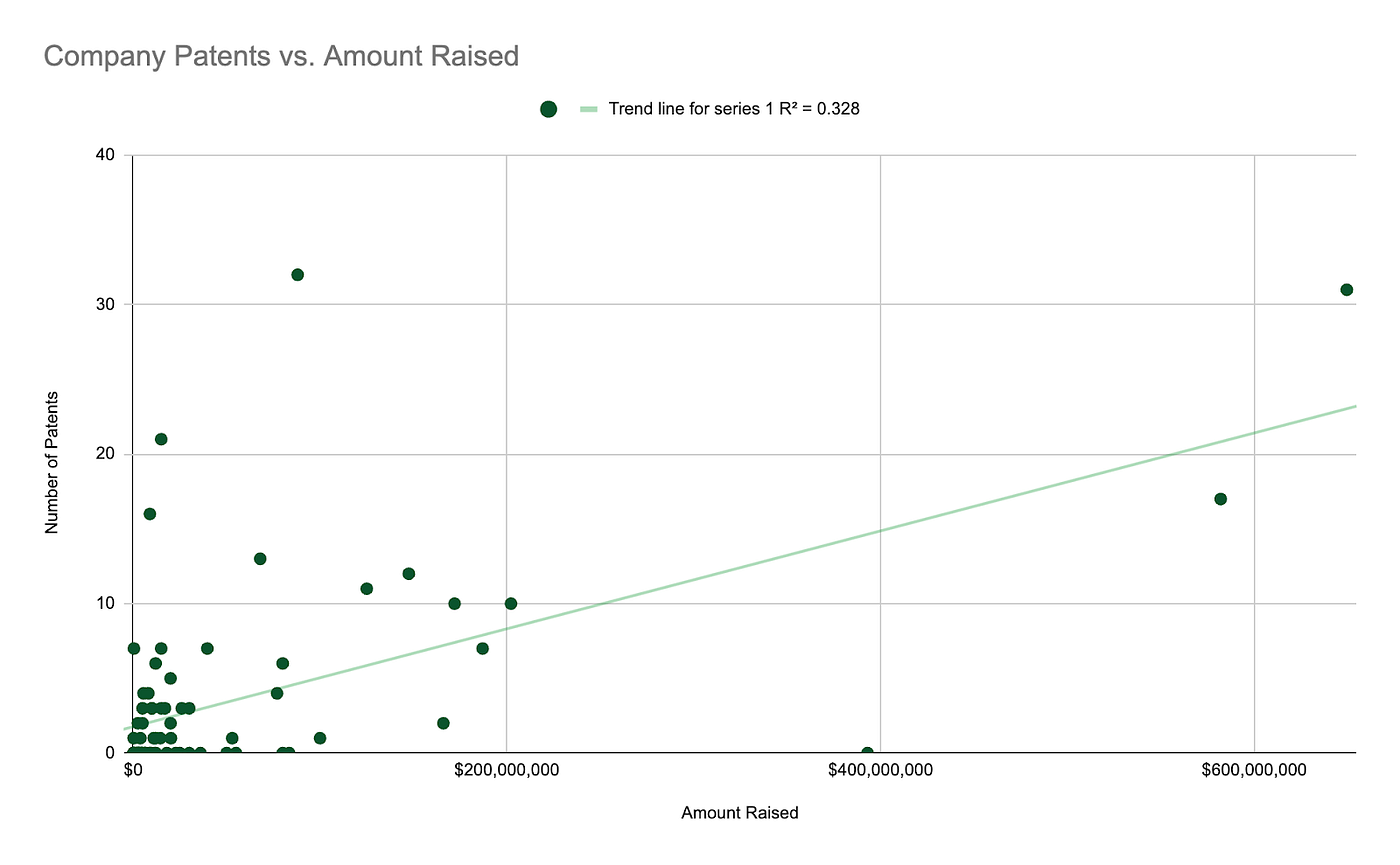

We’ve also collected data on over 2,000 patents that are held by companies engaging in CDR. While the results are still preliminary (and prone to be influenced by outliers, given the relatively small sample size) we see a fairly strong positive correlation of 0.57 between number of patents held and the amount of money raised.

This makes sense — as firms are better able to demonstrate to investors their competitive advantage, they become more attractive to potential funders. Carbon Engineering, by our count, holds 13 patents.

We’ll provide more analysis on CDR investment in the coming weeks, stay tuned!