The Carbon Removal (CDR) market is entering a more mature phase

The CDR market has grown from approximately 40 thousand to 43 million credits purchased between 2020 and 2025, a 1,000x explosion in demand. The typical project lifecycle – moving from pilots to securing long-term offtakes and subsequently raising development capital – has proven advantageous for many developers. At the same time, buyer scrutiny is increasing, and the market is still dominated by a few buyers.

While there are roughly 1,000 companies globally claiming to offer CDR, only around 250 have offtake agreements or spot sales. Supply has diversified over the past five years across both pathways and geographies. In the last couple of years, 30 companies have exited the market, signaling a gradual transition toward a more mature and disciplined CDR ecosystem.

In this blog, we explore what’s happening as the CDR market matures, with exits, consolidation, and strategic partnerships on the rise. This analysis builds on insights and data we recently shared with The Wall Street Journal on emerging consolidation trends across the carbon removal market.

Carbon removal companies are exiting the market

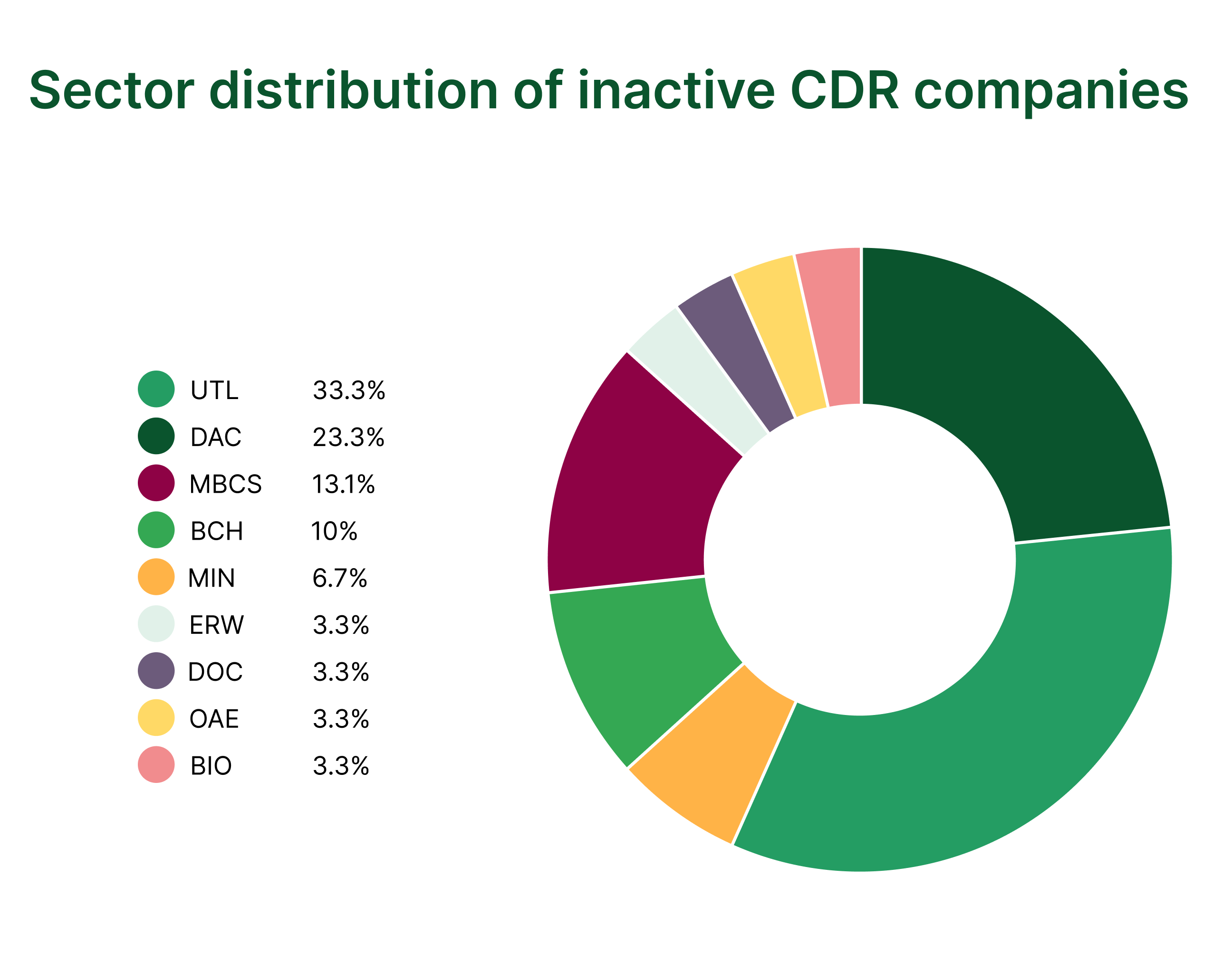

30 CDR companies have become inactive over the past three years (since AlliedOffsets began tracking the CDR market). The majority of these exits were concentrated in utilization, DAC, and marine biomass CDR pathways.

Evidence points to underestimated capital requirements, longer-than-expected lead times, and, most critically, the inability to secure large, bankable offtake agreements as the dominant factors behind the majority of these closures. Of the 30 companies that exited, 25 failed to secure investments or purchases of credits prior to becoming inactive.

That wasn’t the case with all firms, however. Six companies (Brilliant Planet, Noya, Holy Grail, Running Tide, Blue Skies Minerals and Alkali Earth) had secured pre-purchase agreements or raised capital, but ultimately failed to convert this momentum into business success. Within this group, five companies had raised capital, four had secured pre-purchase agreements, and three had secured both pre-purchases and investment. Notably, the often-cited “chicken-and-egg” problem – where developers need capital to scale but investors require proof of viability – was not the primary constraint in these cases. In fact, five of these companies (Brilliant Planet, Noya, Holy Grail, Running Tide and Blue skies MInerals) cumulatively raised approximately $42 million and still ceased operations.

The companies were mostly small, with team sizes of under 10 employees based on information from their LinkedIn profiles. The companies that became inactive were predominantly launched between 2020 and 2023.

Acquisitions and strategic absorption

We are also seeing companies increasingly acquiring smaller startups as consolidation begins to emerge in the carbon removal sector. Recent days have highlighted this trend. In a notable deal, Terradot acquired fellow enhanced rock weathering developer Eion, integrating its assets and contracts to build scale amid tightening capital conditions.

Similarly, Occidental Petroleum’s subsidiary, Oxy Low Carbon Ventures, acquired DAC startup Holocene, marking a strategic expansion of its carbon removal capabilities following its earlier acquisitions in the space. Larger companies have also made moves across the value chain: Baker Hughes acquired Mosaic Materials, while SLB Capturi acquired Aker Carbon Capture, which provides technology to several DAC and BECCS companies. Schroders also acquired a $610 million stake in a UK offshore wind farm from Ørsted; while not a carbon removal deal directly, part of the asset’s output supports BECCS operations.

Beyond acquisitions, strategic partnerships with established players are also helping to scale the sector. Deep Sky, for example, is a Canadian project developer that has formed strategic partnerships to host and scale technologies from Airhive, Phlair, Mission Zero, Skytree, CarbonCapture Inc., and Equatic.

Similarly, AtmosClear (Fidelis) selected ExxonMobil to provide services to transport and store 680,000 tonnes of biogenic CO2 annually from AtmosClear’s Louisiana-based BECCS facility, with the potential to expand volumes over time.

What recent VCM and CDR activity signals about market maturity

Recent consolidation trends closely mirror broader developments in VCM and CDR activity. The market is increasingly characterized by fewer but larger transactions (Microsoft's whale purchases). Over the next four to five years, it will become clearer whether other companies follow Microsoft’s approach and begin investing at similar scale. If that happens, Microsoft will have achieved its broader objective of helping catalyze climate action by accelerating demand for high-quality carbon removal.

At the same time, there is an emerging bias toward biomass-based removal pathways, with activity heavily skewed toward BECCS, bio-other, and biochar. These methods benefit from lower prices, more established MRV frameworks, and a faster path to issuance compared with many emerging technologies.

What this means for the next phase of CDR

Early-stage developers without secured offtakes and capital-intensive technologies lacking strategic partners or integrated storage are most exposed in the current market environment.

By contrast, platforms with long-term, secured offtakes, developers vertically integrated with storage providers or buyers, and companies aligned with compliance markets are best positioned to benefit.

Consolidation does not signal a slowdown in the carbon removal market; rather, it reflects increasing market discipline and early signs of maturity. Buyers are now shifting focus from signing new agreements to delivery and execution. The true test of the market will be whether a meaningful share of these offtakes successfully reach issuance by 2030. If that happens, confidence will increase substantially, and we could see another step-change in offtake activity. Patience, at this stage, is key.

Looking ahead, the market is likely to see fewer new suppliers entering, increased partnerships and strategic integrations, and a clearer demarcation between early-stage pilots and R&D projects versus scaled commercial developers.

Explore The Wall Street Journal’s coverage of carbon removal market consolidation here