As companies’ offsetting efforts are increasingly scrutinized, we are highlighting one component of what makes a good retirement: offsetting with credits of a recent vintage.

After zooming in on companies’ carbon purchases value last week, we analyze our data on companies’ offsetting and focus on another dimension of corporate carbon offsetting. In this post, we compare the average retirement dates and vintages of credits chosen by corporate buyers, showing, on average, how recent corporates’ offsets are.

While there are no official guidelines regarding credit vintage choice, a small difference between the two shows a continuous offsetting commitment and matching recently identified residual emissions with recent carbon credits. The market tends to value recent vintages more, as reflected by carbon credit pricing, and 57% of the market has a preference for capping vintages.

To examine the issue, we gathered data on all corporate retirements above 20,000 credits. Among those, we limited the sample to the companies that have retired carbon credits over the last 3 years, based on the most recent retirement data from our dashboard, which ended up being 160 entities.

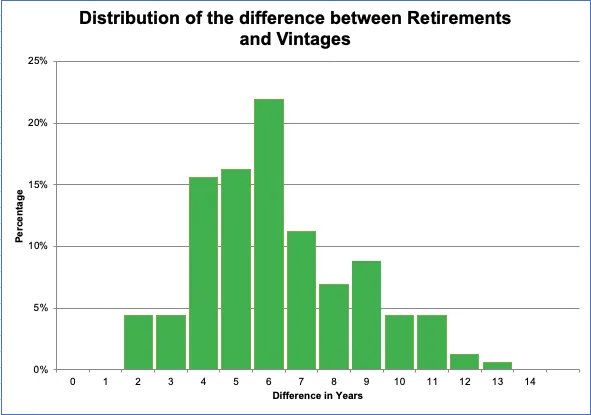

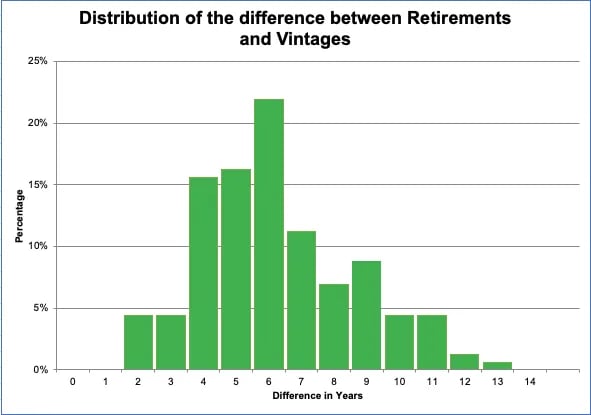

We found the average difference to be around 5.5 years, as shown by the histogram above. The company with the biggest difference between average retirement date and vintage at 12.5 years, meaning that a company retiring credits today would be doing so with 2010 vintage offsets.

We also identified 10 companies with the smallest difference between credit vintage and retirement date. JP Morgan Chase has the smallest time delay at 1.6 years, as seen in the table below. There seems to be no correlation among the companies in terms of industry. Note that, as credits are typically issued the year after the emissions reduction / avoidance activity takes place, it’s rare to find companies retiring with credits of the same year.

Next week, we’ll start including corporate emissions data in our analysis. We’ve reached out to a number of corporates to verify the data we have for them. If you’d like to get in touch, please reach out to carbon@alliedcrowds.com to help us understand your company’s retirements.